UniCredit Bank Austria Business Indicator:

Economy remains sluggish but inflation drop points to modest recovery before year end

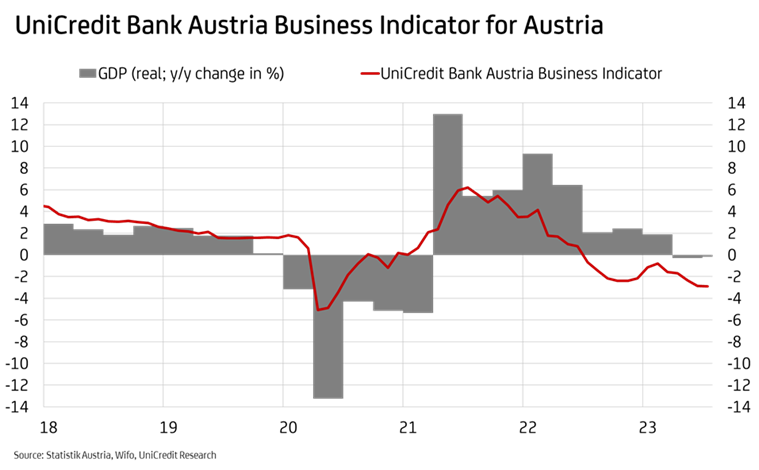

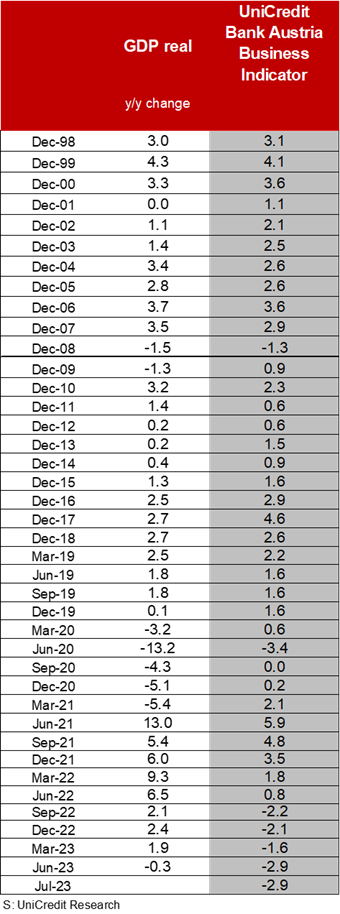

- UniCredit Bank Austria Business Indicator stabilises in July at -2.9 points

- Current data suggests increased likelihood of further GDP decline over summer following slight dip in Q2

- Modest economic growth of 0.7% still anticipated for 2023 thanks to statistical overhang, albeit with significant downside risk

- Sluggish economy putting pressure on labour market: Despite strong performance at start of year, unemployment rate for 2023 set to rise only slightly to 6.4%, driven by construction and industrial sectors

- Decline in inflation from 7.6% on average for 2023 to 3.5% in 2024 to fuel significant real-terms wage increases

The weak period being experienced by the Austrian economy appears to be lengthening. "The UniCredit Bank Austria Business Indicator stabilised in July following the period of continuous deterioration seen since the start of the year. July's figure was unchanged compared to the previous month. At -2.9 points, however, the indicator signals a sustained downturn in the Austrian economy", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Following a weak H1 that saw a slight drop in GDP in Q2, there is no immediate prospect of recovery. The domestic economy is really feeling the strain as we head into H2."

The mood in the services sector deteriorated noticeably at the start of Q3, although consumer pessimism has eased somewhat due among other things to declining inflation. While consumer-oriented services in the leisure and tourism sectors are still benefitting from the catch-up effect, business-related services in particular are increasingly feeling the effects of the economic slowdown in the manufacturing sector.

The downturn in the services sector and declining industrial demand, in particular from abroad, are weighing on the economic mood. While the slowdown in the European investment economy is affecting areas such as mechanical engineering, the more construction-reliant sectors such as timber and building materials, plastic and metal goods manufacturers and parts of the electrical industry are feeling the effects of the slump in the construction economy. Given the altered financing conditions, the construction sector is increasingly bringing up the rear in the Austrian economy.

"The current UniCredit Bank Austria Business Indicator raises fears of a slight decline in GDP over the summer months — as we saw in Q2. That said, the Austrian economy is unlikely to experience a sharp slump", says Bruckbauer, adding: "We are optimistic that improved framework conditions driven by the noticeable decline in inflation will have a positive impact on economic momentum before year end."

Hopes for recovery rest on consumption

The construction sector will face some particularly tough challenges over the coming months. The price-related reduction in the affordability of residential property, combined with more stringent lending regulations and rising interest rates, have led to significantly fewer orders in structural engineering in particular and dampened the outlook.

The coming months are also likely to be difficult for the export-focused industrial sector. Growth in global trade is expected to slow in H2 2023. This forecast is due in part to the burden placed on the manufacturing sector in particular, and within the sector primarily on consumer goods, as a result of the sizeable and simultaneous interest rate hikes implemented by the central banks. In addition, China's manufacturing sector also remained weak after the economy opened back up at the start of the year, and the prioritisation of demand for goods over consumption of services during the pandemic will continue to take a toll worldwide. For the time being, therefore, hopes of a recovery rest solely on the services sector, which is set to profit from the slowdown in inflation and thus also from real-terms wage increases as of H2 onwards.

However, declining catch-up effects, more expensive consumer loans and the high level of uncertainty, including about how the labour market will develop, mean that the mood among domestic consumers will shift only slowly and is not expected to result in a more positive demand situation until 2024.

"The pace of recovery, based on private consumption, which provides momentum to the services sector in particular, is expected to remain manageable. Given the dampening effect of monetary tightening, recovery will be slow to spread to other sectors of the economy. Thanks to a statistical overhang, we continue to expect modest economic growth of 0.7% for 2023, albeit with significant downside risk. In 2024, the slightly improved framework conditions could prompt somewhat stronger economic growth of 1.2%, with persistent geopolitical challenges continuing to be a burden", says UniCredit Bank Austria Economist Walter Pudschedl.

Turnaround in the domestic labour market

The labour market has deteriorated slightly since the spring. The employment rate was just 6.2% at the start of the year, and by July the seasonally adjusted figure was already 6.5%.

A sluggish economy initially led to an increase in the number of job seekers, especially in the production sector. In the construction sector in particular, the unemployment rate has increased sharply as a result of the sizeable drop in incoming orders since spring. The increase remained less marked in the industrial sector given that companies are retaining skilled workers in the face of a tight supply situation on the labour market. However, unemployment in the services sector has now also increased after something of a delay.

While employment continued to increase in H1 despite the worsening economic situation, the rise in unemployment has now become so strong that, as H2 begins, employment in Austria has not increased on the previous month for the first time in two and a half years.

"The picture in the Austrian labour market is set to worsen in the coming months. Given the positive development at the start of the year, the average unemployment rate for 2023 is expected to be 6.4%, which represents only a slight increase on last year's figure of 6.3%. The increase is expected to be due primarily to developments in the construction sector. Despite accounting for only just over 7% of those in employment, the construction industry will be responsible for around 40% of the increase", says Pudschedl.

Further inflation drop fuels real-terms wage growth

Having sat at an average of 9.6% in H1, inflation dropped to 7.0% in July. It is likely to continue its downwards trend over the coming months, picking up pace from September onwards. While the dampening effect of fuel prices will have run its course by then, the fall in energy prices and in producer prices in the industrial sector are set to put downwards pressure on inflation. Inflation should fall to an average of around 5.5% in H2 2023, dropping below the 5% mark towards the end of the year.

"We expect average inflation for 2023 to be 7.6%, falling to 3.5% in 2024", says Pudschedl, adding: "Lower inflation will prompt real-terms wage growth as early as H2, since the 5.5% increase in consumer prices on the previous year will be offset by wage increases of more than 8% on the previous year. The gap between wage growth and price increases is likely to increase still further in 2024, meaning that the real-terms wage shrinkage caused by the strong price increases of the previous years will then be largely offset."

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at