UniCredit Bank Austria Purchasing Managers' Index in September:

Continued decline in demand worsening recession in industry

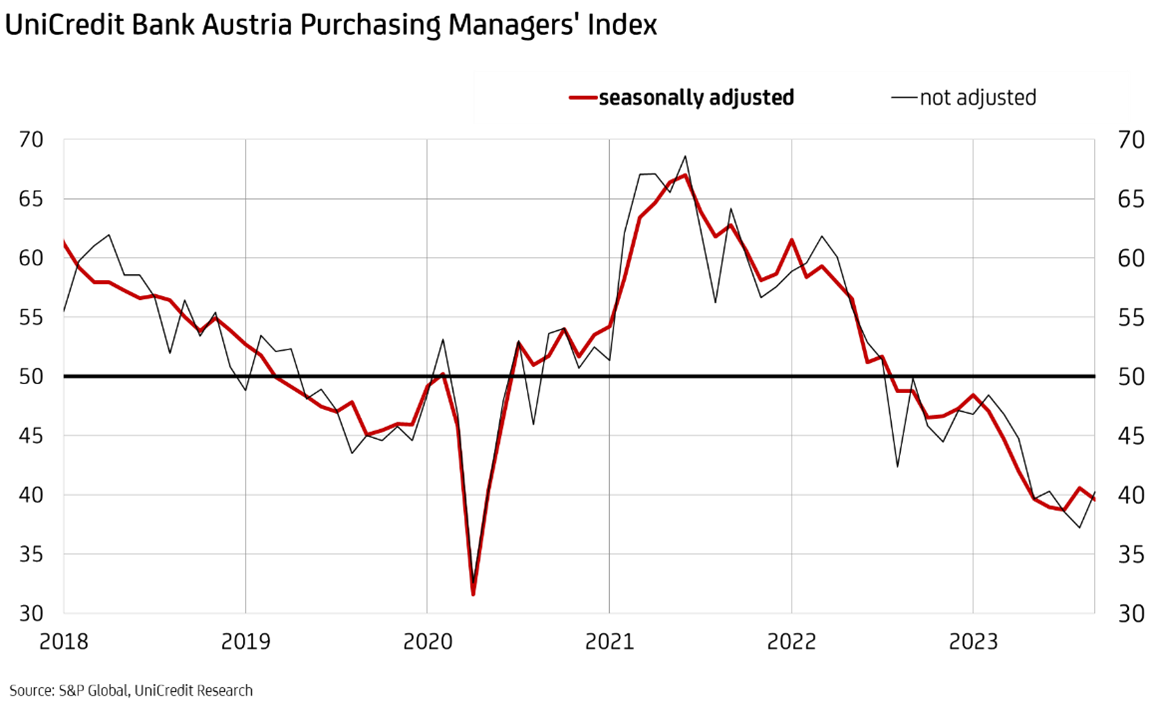

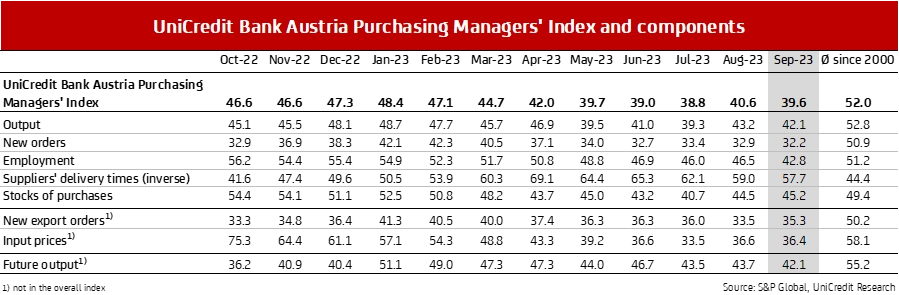

- Following slight improvement in previous month, UniCredit Bank Austria Purchasing Managers' Index falls again in September to 39.6 points, placing it below 50-point growth threshold for fourteenth consecutive month

- Accelerated decline in new business makes domestic companies cut back production more drastically than in previous month

- Biggest decline in employment levels since first pandemic-induced lockdown in spring 2020

- Fall in costs accelerates slightly in September, but slowdown in reduction of output prices improves earnings on average

- Renewed increase in stocks of finished goods despite restraint in purchasing underlines weak order situation

- Expectation index falls to 42.1 points: Austria's industrial businesses expect significant declines in production over next 12 months

The downturn in Austrian industry accelerated again at the beginning of autumn. "Following a slight improvement in the previous month, the UniCredit Bank Austria Purchasing Managers' Index declined slightly in September. At 39.6 points, growth remained very clearly below the threshold of 50 points. The recession in Austrian industry persists", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

"However, certain details of the latest survey data suggest that the industrial economy is likely to reach its lowest point soon. The rate of output decline was significantly lower in September than in early summer. Although the drop in new business continued to increase, the fall in demand from abroad slowed down. Stocks of purchases were reduced far more cautiously than in previous months; the pace of price reductions stabilised in purchasing and even slackened in sales. Nevertheless, job losses in domestic industry gained momentum", stresses UniCredit Bank Austria's chief economist.

Developments in the key sales markets are increasing the likelihood that the industrial downturn in Austria will slow down gradually. "At 43.4 points, the provisional Purchasing Managers' Index for the manufacturing industry in the eurozone remained broadly stable in September compared to the previous month, which was accompanied by the second consecutive improvement in the index in Germany. For the Austrian supplier industry, the renewed and significantly decelerated decline in new business both in the eurozone as a whole and in Germany could prove to be a sign that we can expect a turnaround in the coming year", says Bruckbauer.

Accelerated decline in new business, but losses in exports slowing down

Domestic industrial companies once again cut back their production significantly in September. The pace was slower than in early summer, but the output index fell to 42.1 points compared to the previous month. The renewed acceleration of production cutbacks is a consequence of the continued low demand for domestic industrial products.

"The global economic slowdown combined with increased costs, sufficient inventories and modified financing conditions under geopolitically challenging circumstances caused the number of new orders in Austrian industry to fall further still in September. The index for new orders dropped to 32.3 points, meaning that new business declined not only somewhat more sharply than in the previous month, but at the highest rate in almost one and a half years. Having said that, the decline in export business slowed down for the first time this year", says UniCredit Bank Austria economist Walter Pudschedl.

Delivery times continue to fall

September saw domestic companies once again reduce their purchasing activities as a result of low demand. Purchasing volumes declined more sharply than at any time since April 2020, contributing to a sustained easing of supply chain disruptions. "Supplier delivery times decreased in September for the fourteenth month in a row. This reflects not only the largely smooth functioning of supply logistics chains, but now, first and foremost, the dramatic drop in demand from a globally weakening industrial economy", says Pudschedl.

Falling new business and persistently cautious cost management led to a further decline in stocks of purchases in September. However, the pace of stock reduction has now slowed significantly. Despite the restraint in purchasing and the cutbacks in production, there was an increase in the stocks of finished goods due to poor demand and order cancellations — but this increase was only marginal.

Price trends generally improving earnings

"The cost of raw materials and primary materials fell for the seventh month in a row in September. However, due in part to rising energy costs, the decline in purchasing prices accelerated only slightly overall. The fall in producer prices even slowed down", says Pudschedl, adding: "Due to the different price trends in purchasing and selling, the earnings situation of domestic companies actually improved on average in September. Profit margins were secured by passing on the cost reductions to customers in a comparatively more restrained manner."

Price developments in Austria are consequently different from those in the eurozone and in Germany, Austria's biggest trading partner. According to the latest surveys, the fall in costs in the eurozone and Germany slowed significantly in September, but producer prices were still cut more sharply than in the previous month. Companies here perhaps have less price-setting power than those in Austria.

Low demand now clearly impacting the job market

The employment index fell to 42.8 points in September. After four months of relatively moderate job losses in domestic industry, the labour market is now showing clear signs of strain as autumn begins, given the ongoing sluggishness in demand and high cost increases for energy and personnel. While seasonally adjusted employment remains at a high level of about 648,000, the number of job seekers in goods manufacturing has risen since the beginning of the year to nearly 22,000, which constitutes an increase of around 7.5%.

"The unemployment rate in industry rose to a seasonally adjusted 3.3% at the start of autumn, up from just 3.0% at the beginning of the year. Even though the labour market in industry is likely to feel the economic challenges more strongly than other sectors in the coming months, the unemployment rate of 3.3% on average for 2023 will be barely half that of the economy as a whole, following low levels in the first months of the year", says Pudschedl. For the economy as a whole, economists at UniCredit Bank Austria expect the unemployment rate to rise from 6.3% in 2022 to an average of 6.4% in 2023.

No recovery in sight; downturn to decelerate at best

The pessimism in Austrian industry has increased somewhat in the medium-term. "Economic uncertainty, high inflation, higher interest rates and generally lower demand have weighed on the business outlook. The expectation index dropped to 42.1 points, the lowest figure for the current year", says Bruckbauer, adding: "Domestic industry remains mired in recession, which even worsened somewhat at the beginning of autumn. More than a third of businesses are now expecting production to decline over the next 12 months." According to economists at UniCredit Bank Austria, there is no economic turnaround in sight for domestic industry in the remaining months of 2023; at best, the downturn will merely decelerate.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at