UniCredit Bank Austria Purchasing Managers' Index in October:

Industrial activity may have bottomed out

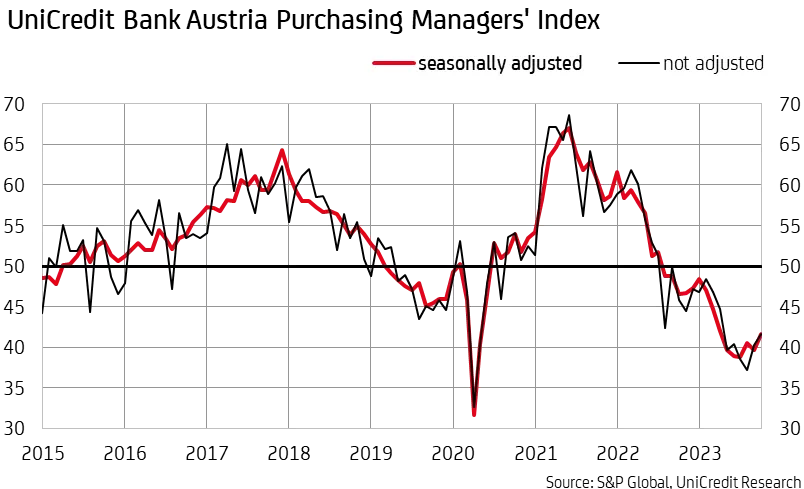

- After deterioration in previous month, UniCredit Bank Austria Purchasing Managers' Index roses slightly in October – achieved best score in last six months at 41.7 points.

- In view of slower decline in new business, domestic businesses reduced output slightly less than in the previous month

- By contrast, decline in employment in manufacturing continued at high pace

- Cost decline slowed in October but average earnings situation improved despite slight drop in output prices

- Easing of decline in purchasing activities signals start of inventory cycle reversal

- Despite indications of end to downwards trend, production expectations among Austrian businesses for the next 12 months declined to lowest level since first pandemic lockdown

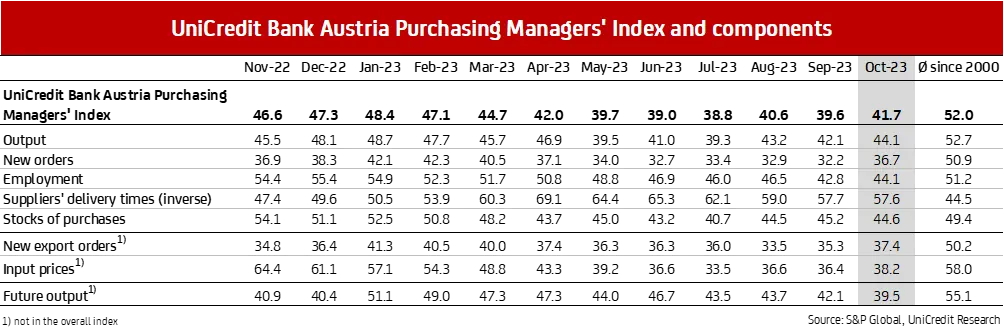

Austria's industrial sector started the fourth quarter of the year with a slight improvement, having sustained the strongest losses since the start of the COVID-19 pandemic in the third quarter. "The UniCredit Bank Austria Purchasing Managers' Index increased to 41.7 points in October. This is the indicator's highest value in six months, but it remains well below the 50-point mark that signals growth in the domestic industrial sector", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "The industrial economy in Austria remains in recession. Production fell in October, new orders declined, prices continued to fall and employment reduced sharply once again. However, the industrial economy has likely bottomed out as the negative trends have slowed. In addition, the significant reduction of inventories in recent months is likely to slowly come to an end, thus reversing the inventory cycle."

Production and orders continue to decline sharply but more moderately than in previous months

The performance of the Austrian industrial sector in October was once again characterised by strong output declines that have now persisted for almost eighteen months. This is the longest contraction period since the survey began in 1998. That said, the pace of production cutbacks has slowed compared to the previous month. The production index rose to 44.1 points, which is the highest level since April of this year.

"The considerable drop in production experienced once again in October was a consequence of the significant slump in new orders within the domestic industrial sector. New business from abroad declined, and domestic orders fell even more strongly. In both cases, however, there was a clear slowdown in the downwards trend compared to previous months", says UniCredit Bank Austria Economist Walter Pudschedl. In step with the decline in new business, orders on hand with Austrian manufacturers fell at a slightly slower pace in October than in September. Delivery times were pulled in significantly at the start of the fourth quarter, continuing a trend that has prevailed since the start of the year. Due to the tense global demand situation and well-filles stocks, underutilised delivery capacity and improved availability of primary materials are likely to have contributed to this picture.

Employment in industrial sector on the decline for six months

In October, domestic businesses responded to the ongoing deterioration in order volumes and the sharp decline in order backlogs by adjusting personnel capacity once again. "At 44.1 points, the employment index now points to a reduction in personnel in domestic manufacturing for the sixth month in a row. In addition, the pace of job cuts has slowed slightly from the 2.5-year high of the previous month", says Pudschedl.

By contrast, the domestic industrial sector continues to report an increase in employment levels compared to the previous year, with a slight increase of around 0.5% expected for 2023 on average. Nevertheless, the average annual increase in employment in the manufacturing sector of just under 10,000 people is likely to be offset by an increase of around 1000 in the number of job seekers. The unemployment rate in the sector will therefore rise to 3.2% on average for 2023, compared with 3.1% in 2022. However, this means that the unemployment rate in the domestic industrial sector will still be only about half as high as in the economy as whole. The economists at UniCredit Bank Austria expect an average unemployment rate of 6.4% in 2023 for the economy as a whole.

Cost pressure continues to ease

The sustained decline in production output and new business also saw purchasing by manufacturers continue to drop in October. The reduction in purchasing activities goes hand in hand with increased efforts to reduce storage costs and optimise working capital owing to higher inventories. The downwards trend did lose momentum, however. The purchasing volume also fell faster than inventories again.

While inventories in stocks of finished goods declined only slightly due to lower demand, stocks of purchases once again declined somewhat more strongly in October than in the previous month. Although the index ratio of stocks of purchases to stocks of finished goods sits squarely in a range that indicates a significant downturn in the industrial sector, the ratio continued to improve in October. This gives an indication that the inventory reduction is ending and that a reversal of the inventory cycle and economic performance is drawing closer.

"The lower demand for primary materials and raw materials has contributed significantly to resolving the supply problems. In addition, cost pressure continued to fall despite rising oil prices. Input prices fell for the eighth month in a row, but the pace of the decline in October was slower than over the summer months. By contrast, output prices fell somewhat more strongly than in the previous month. Despite sluggish demand, domestic businesses appear to have significant price-setting power, with price trends on average resulting in a slight improvement in the earnings situation of domestic businesses", says Pudschedl.

Negative expectations reinforced by uncertainties

Despite a slight increase, the UniCredit Bank Austria Purchasing Managers' Index for the Austrian industrial sector is currently indicating performance below the growth threshold of 50 points for the fifteenth consecutive month. Following a very weak third quarter, however, the industrial economy seems to have reached its lowest point and there are signs of a gradual easing in the coming months. This prospect is underpinned by developments in the key sales markets for the Austrian industrial sector.

"The flash purchasing managers index for the manufacturing industry in the eurozone declined only marginally in October, to 43.0 points. One notable positive factor was the third consecutive improvement in the index in Germany. For the Austrian supplier industry, the renewed decelerated decline in new orders in Germany in particular could prove to be a sign of an imminent turnaround. Nevertheless, we will have to wait at least until the spring of next year for any meaningful recovery", says Bruckbauer.

The components of the current indicator for Austria also point directly to a slight easing in the industrial economy. The ratio of new orders to stocks of finished goods has improved slightly given the recovery of the new orders index from 32.2 to 36.7 points, while the index for stocks of finished goods fell from 50.9 to 49.2 points. Despite this progress, stocks of finished goods are still sufficient to meet the demands of the lower levels of new business, meaning that production and employment levels may well have to be scaled back again in the coming months.

The economic concerns of domestic industrial businesses appear to be consolidating in the face of newly emerging uncertainties caused by the conflict in the Middle East and its possible consequences on global demand and cost developments. The number of domestic businesses anticipating year-on-year production losses has now outstripped the number with improved expectations across nine consecutive months. "Austria's industrial businesses remain very pessimistic in the medium term — the expectation index was at 39.5 points in October, which is the lowest level since the first COVID-19 lockdown in spring 2020", concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at