UniCredit Bank Austria Business Indicator

Signs of slow bottoming out in the Austrian economy

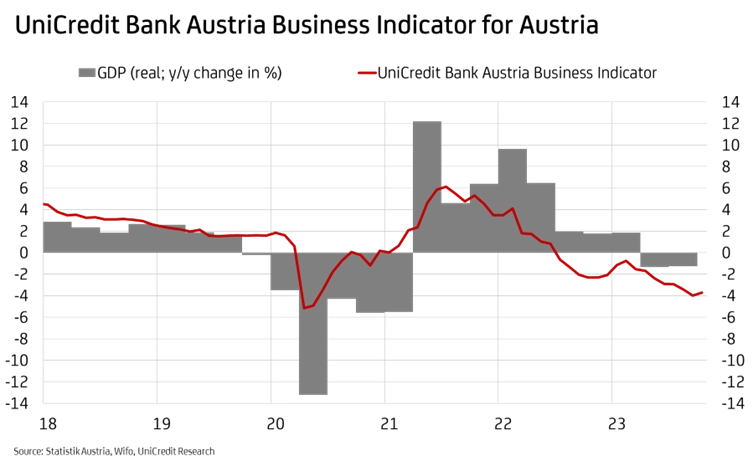

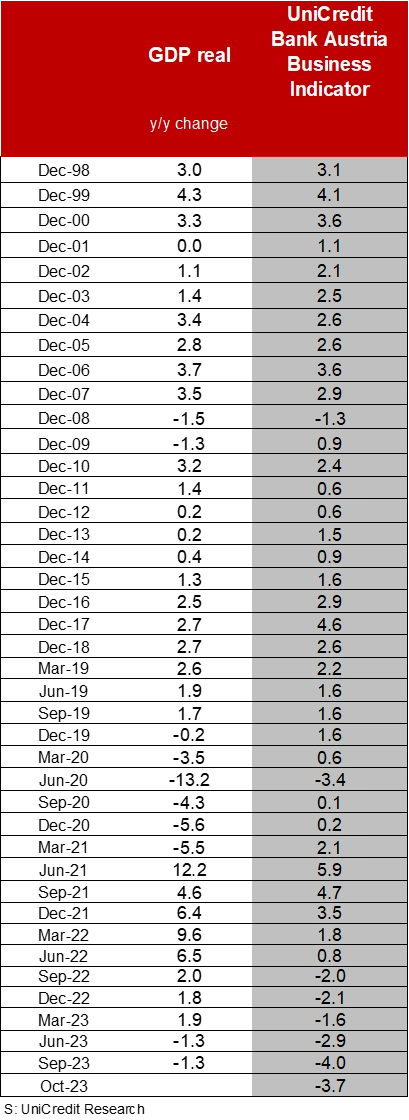

- UniCredit Bank Austria Business Indicator rises to minus 3.7 points in October, signalling end to decline but no turnaround yet

- Austrian economy expected to emerge from recession towards end of 2023, but GDP forecast down to minus 0.5% for year as a whole

- Real wage increases boosting consumption to offer hopes of recovery in 2024, but not without hindrance by restrictive monetary policy

- Economic slowdown fuelling unemployment: average unemployment rate expected to be at least 6.4% in 2023/24

- Inflation expected to fall from average of 7.8% in 2023 to 3.6% in 2024, placing it above eurozone level for 16th consecutive year

- No further interest rate hikes expected in eurozone. Significant drop in inflation making cycle of interest rate cuts increasingly likely from mid-2024 onwards

The economic situation in Austria remains very tense. "The UniCredit Bank Austria Business Indicator points to a marked period of weakness in the Austrian economy at the start of the final quarter of 2023. At minus 3.7 points, this is the second lowest figure of the current year. For the first time since the year began, however, there's been a slight improvement on the previous month, which had actually hit a 40-month low", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "The indicator rising could imply a slow bottoming out in the Austrian economy. The downturn seems to have come to an end now, but that doesn't mean a turnaround is on its way. There are no signs of recovery in the domestic economy just yet."

Headaches in production sector

"Two sectors in particular are currently facing major challenges: industry and construction. Despite a small rise compared to September, economic sentiment in domestic industry is very noticeably below the long-term average", says Bruckbauer. The number of incoming orders has fallen significantly, leading to cuts not only in production but now in staffing too. Rising labour and energy costs combined with the risk of falling behind in international competition are darkening the mood.

This pessimism is currently particularly acute in metal goods production, mechanical engineering and electrical engineering. The prospects of export-based companies are being diminished by the great geopolitical uncertainties, which have caused a slight decline in the indicator for global industrial sentiment weighted by the Austrian share of trade. While the situation in Europe and the US remains challenging in October for the most part, tensions in industry have intensified, especially in the Asian growth markets.

Sentiment in construction has likewise deteriorated. There has been a sharp drop in the number of orders to construct buildings, and housing in particular. While civil engineering can rely on relatively solid growth from public contracts, some construction-related sectors are even seeing a greater number of renovation projects and climate-related investments.

The poor performance in the production sector has now spread to the services sector. The loss of purchasing power due to high inflation is dampening demand and has caused a significant downturn in sales in the retail sector, for example. Nonetheless, sentiment in the services sector began to improve in October — and even made the biggest positive impact on the UniCredit Bank Austria Business Indicator rising. The improvement in consumer sentiment once inflation had shown clear signs of falling has played a crucial role in this.

"Economic sentiment in Austria improved slightly in October. However, pessimism still prevails in all sectors of the economy, and the mood is far below the long-term average in some cases. The Austrian economy shows itself to be particularly weak compared with other countries. Sentiment in all economic sectors is well below the eurozone benchmark. Despite discreet signals that the economy is bottoming out, sentiment in the Austrian economy is still significantly lagging behind that in the eurozone", says UniCredit Bank Austria Economist Walter Pudschedl.

Slow road from recession to modest recovery

Having been in a technical recession between spring and autumn, there is no immediate turnaround for the economy in sight, and it will remain weak as the year draws to a close. There are some early signs that the Austrian economy is slowly bottoming out, however, which point to the recession finishing towards the end of 2023. "Stagnation is the best we can expect for the Austrian economy in the fourth quarter of 2023. Given the downward revision of previous GDP figures and poor performance recently, we should assume a slight decline in GDP in Austria of 0.5% for 2023 as a whole", says Pudschedl, adding: "After two strong years of recovery with economic growth of more than 4%, real economic performance in Austria at the end of 2023 is still around 1.5% above pre-pandemic levels."

"On the assumption that inflation continues to fall, we expect a moderate recovery to begin in 2024 with a slight increase in GDP of less than 1%. Rising real-wage growth as a result of inflation going down should kick-start a moderate recovery at the beginning of 2024, driven by consumption and bolstered by a relatively stable labour market and fiscal measures", Pudschedl continues.

By contrast, restrictive monetary policy will continue to pose a major challenge to investment dynamics in 2024. While the recovery will be led by the services sector, which has been supported by increasing household purchasing power, the situation remains tense in industry and the building trade, and in structural engineering in particular. However, a gradual recovery in the global economy is likely to increasingly boost export-focused industries.

Unemployment on the rise

Although the labour market has been very resilient to economic trends so far this year, the consequences of the continuing economic slowdown can now be seen in the rising number of job seekers in many industries. The seasonally adjusted unemployment rate in Austria rose to 6.6% in October, having been just 6.2% at the start of the year. While growth in the services sector has so far been below average and concentrated in a few sectors such as real estate, housing and certain freelance professions, it is the construction sector that has been significantly impacted. Unemployment has risen sharply in building construction in particular. 2023 has seen the number of job seekers increase significantly in industry too, especially in construction-related areas such as the electrical industry, the wood industry and downstream activities such as furniture manufacturing.

"A slight uptrend in the unemployment rate should continue in the coming months, but the recovery set in motion will not be able to bring about easing in the labour market until the second half of 2024. In terms of an annual average, we expect the unemployment rate to rise to at least 6.4% on average in 2023/24", says Pudschedl.

Inflation continuing to fall but still higher than in the eurozone

At 5.4% in October, inflation in Austria has more than halved since the beginning of the year. "We expect inflation to fall to below 5% by the end of 2023. Following the high figures at the start of the year, however, average inflation is anticipated to be 7.8% in 2023. For 2024, we expect it to go down to 3.6%", says Pudschedl, adding: "This means that inflation will now be higher in Austria than in the eurozone for the sixteenth year in a row. Inflation in Austria has exceeded that in the eurozone since 2008; this will add up to a rate increase of more than ten percentage points by 2024." As for the eurozone, economists at UniCredit Bank Austria expect inflation to decline to an average of 5.6% in 2023 and 2.6% in 2024.

"Given the weak economic data and, first and foremost, the significant drop in inflation, we expect the ECB to ultimately decide against further interest rate hikes. What's more, considering the latest inflation data, we believe that the likelihood of interest rate cuts in the coming year has increased significantly. We continue to expect a cycle of interest rate cuts to begin around the middle of 2024", concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at