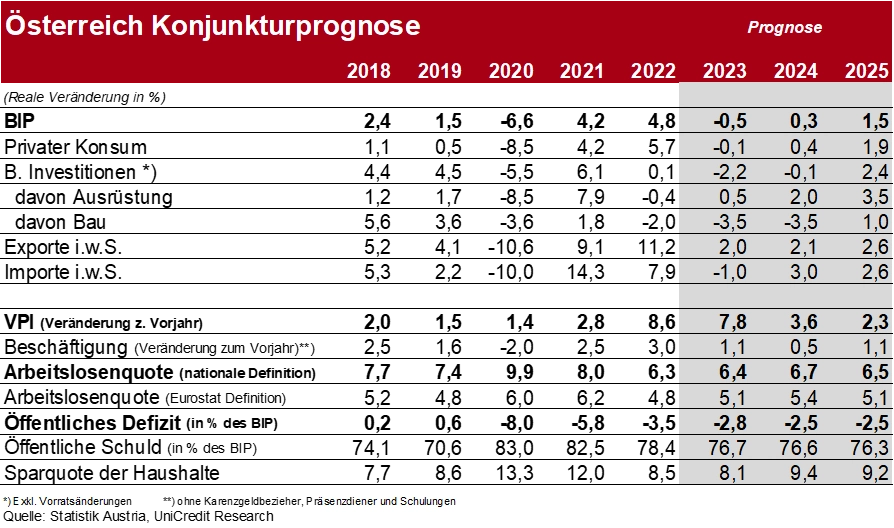

UniCredit Bank Austria Economic Forecast 2024/25:

Prospect of moderate recovery following recession

- Global economy to lose momentum in 2024 due to monetary tightening and ongoing geopolitical tensions, but falling inflation and interest rate turnaround support trend reversal for end of 2024 and 2025

- Stagnation in USA throughout 2024 and only moderate growth in the eurozone; recovery at below-average pace for 2025

- Weaker income development causing Europe and Austria to lag behind USA in economic growth to date

- Key interest rates reached peak: Monetary policy shift expected between mid-2024 and end of 2025 with total interest rate reduction of 225 basis points in USA and 175 basis points in the eurozone

- Falling inflation and increasing purchasing power steering Austrian economy out of recession

- With upturn in consumption and warehouse cycle turnaround, Austrian GDP expected to rise by 0.3% in 2024, with interest rate reversal boosting moderate growth of 1.5% in 2025

- Slow bottoming out in industry: UniCredit Bank Austria Purchasing Managers' Index rises in November for second consecutive month to 42.2 points

- Inflation continues to decline but at slower pace than in eurozone: Expected average inflation of 3.6% in 2024 and 2.3% in 2025

- Economic slowdown impacting labour market, with unemployment rate rising to 6.7% in 2024, but expected to ease to 6.5% in 2025

- Risks for 2024 high: Geopolitics, elections and overly restrictive economic policies

"The global economy is expected to lose further momentum at the beginning of 2024. A combination of monetary policy being tightened, household saving buffers running low, the backlog of tourism, for example, petering out and fiscal policy being less supportive will have an impact. Ongoing geopolitical tensions will also continue to create uncertainty", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, commenting on UniCredit Bank Austria's current economic overview and adding: "After this year's rate of 3.0%, we expect global GDP growth to slow further to 2.7% in 2024 before picking up again slightly to 3.0% in 2025."

The global slowdown in growth is reflected in the decline in the US economy's GDP growth from 2.4% in 2023 to an expected increase of only around 1% in 2024. Moreover, the worsening demographic situation and the difficulties in the bloated real estate sector in China will weigh on global dynamics, while other emerging markets, backed by falling interest rates, will by contrast be more resilient. In this environment, modest growth is expected for the eurozone, supported by the increase in real incomes.

"We expect the eurozone economy to continue to maintain its 2023 growth rate of 0.5% in the coming year, supported by falling inflation and a tentative recovery in global trade later in the year. However, strong headwinds can also be expected in 2024, as the consequences of the ECB's interest rate hikes will become increasingly noticeable precisely when households' savings buffers are largely used up, fiscal policy is tightening and the resilience of the labour market is starting to decline", says Bruckbauer, adding: "Nevertheless, the European economy should gain more momentum in the course of the coming year and achieve average economic growth of 1.2% in 2025."

In contrast to the USA, income development in the eurozone and in Austria has so far significantly lagged behind inflation and, accordingly, consumption has up to now stagnated at 2019 levels, while the USA is experiencing consumption levels far above those seen in 2019. "In Austria, it was not only the development of real income that had a negative impact, but the additional savings made during the pandemic have not yet started to decline. On the contrary, the savings rate continues to remain higher than before the pandemic", says Bruckbauer. In part, households may have viewed the increased savings as partial compensation for their real-terms wealth reduction due to high inflation.

Interest on the way down to neutral levels from mid-2024 onwards

Monetary tightening has peaked and the monetary policy shift is coming closer. "Given the weak economy and the decline in inflation, the next step for central banks in both the USA and the eurozone will be cutting key interest rates. We now expect easing of monetary policy to begin in June 2024 for both economic areas", says Bruckbauer, adding: "Central banks will be very cautious about approaching neutral interest rates. We expect the ECB to cut interest rates quarterly by 25 basis points, bringing the deposit rate down to 3.25% by the end of 2024 and 2.25% by the end of 2025. The Fed is expected to lower the key interest rate to a target range of 3–3.25% by the end of 2025." While the ECB is expected to have lowered key interest rates to neutral levels by then, US interest rates will remain slightly above neutral according to estimates by UniCredit Bank Austria economists.

By the end of 2025, the US Federal Reserve is expected to cut key interest rates by a total of 225 basis points, and the ECB by 175 basis points. With the start of the easing cycle and the reduction in the interest differential, the strength of the US dollar against the euro will somewhat diminish. However, the growth differential between the USA and the eurozone will slow such a trend. At the end of 2024, the exchange rate of the US dollar is expected to be close to 1.13 for one euro and by the end of 2025, close to the fair value at 1.15 per euro.

Eurozone inflation set to fall into central banks' target range by end of 2024

Eurozone inflation has fallen sharply within a year, mainly due to lower energy prices. However, disinflation has widened in recent months, with price pressure easing in all sectors. Prices for core goods and food are providing the strongest impetus for the slowdown in inflation and this trend is likely to continue. Prices for services are also moving in the right direction, although they will remain more stubborn due to the greater impact of wage increases on the costs of companies in the sector.

"We expect overall inflation to be close to the ECB's target of 2% by the end of 2024 and to even fall below that target in 2025. In terms of an annual average, we expect inflation in the eurozone to fall from 5.5% in 2023 to 2.5% in 2024 and 1.8% in 2025", says Bruckbauer.

Increasing purchasing power to end Austrian recession

"The Austrian economy's recession, which began in the spring, is expected to lead to a 0.5% decline in GDP in 2023. We expect a moderate recovery in 2024, supported by a further slowdown in inflation, with a slight increase in GDP of 0.3%, which is expected to accelerate to around 1.5% in 2025", says UniCredit Bank Austria Economist Walter Pudschedl.

There are some early signs that the economy is slowly bottoming out, pointing to the recession finishing towards the end of 2023. Rising real wage-growth as a result of falling inflation should kick-start a moderate recovery at the beginning of 2024, driven by consumption. The trend reversal for the warehouse cycle should also stimulate growth. By contrast, restrictive monetary policy will continue to pose a major challenge to investment activity in 2024.

While the recovery should be led by the services sector, which has been supported by increasing household purchasing power, the situation remains tense in industry and the construction sector, and in structural engineering in particular. However, a gradual recovery in the global economy is likely to increasingly boost export-focused industries.

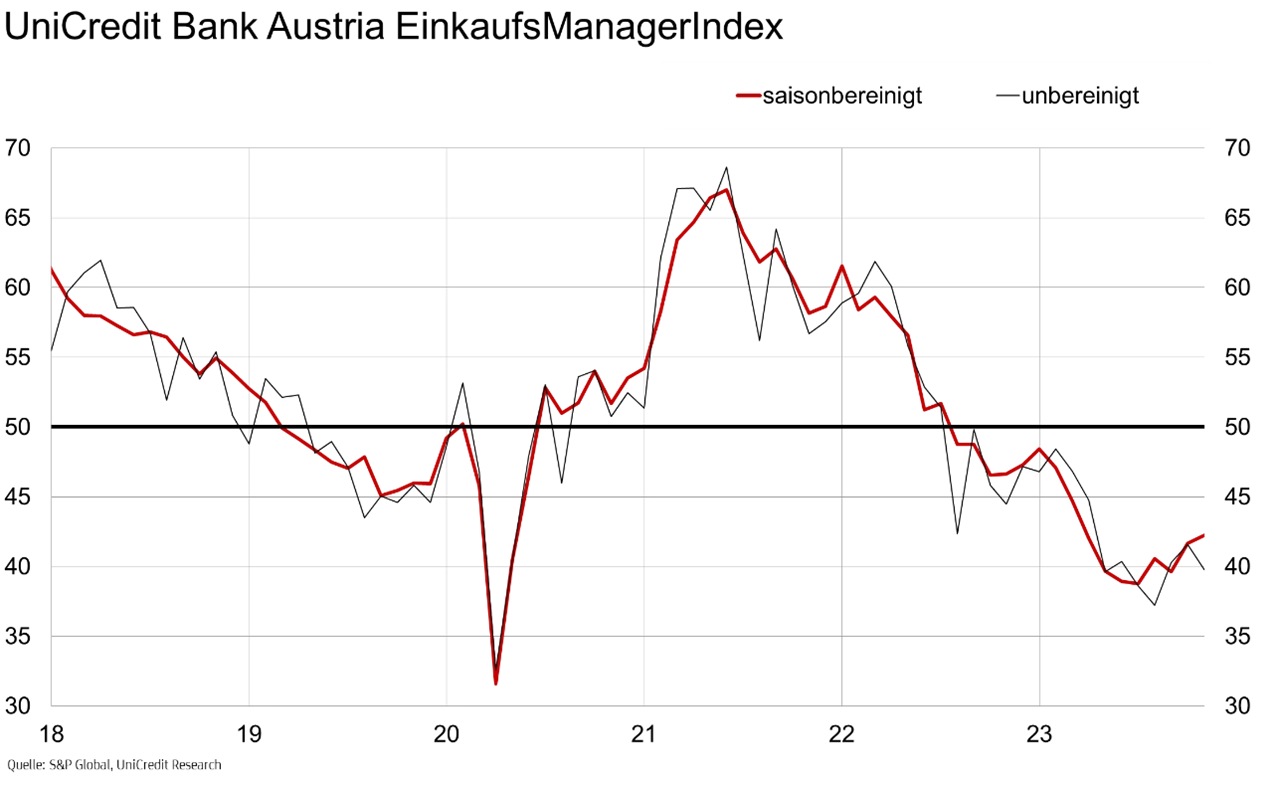

UniCredit Bank Austria Purchasing Managers' Index signals end to industrial downturn

Industry is expected to follow the recovery of the Austrian economy, which will be driven by the services sector, over the course of 2024, albeit at a slower pace. The domestic industrial sector has been in recession since mid-2022, but recent data indicates that the downturn may be slowly bottoming out.

"The UniCredit Bank Austria Purchasing Managers' Index rose to 42.2 points in November, but remains below the growth threshold of 50 points for the sixteenth consecutive month. However, the current value is still the best seen since March. Entrepreneurs' production expectations also improved somewhat in November, but, at 44.7 points, the corresponding index continues to signal a decline in production in the Austrian industrial sector over the course of the year", says Pudschedl. The industrial economy is stabilising, but an imminent upturn is not in sight for the time being.

Order volumes fell sharply once again both domestically and abroad, albeit at a slightly slower pace. Production output was therefore reduced again in November, although it was a slightly stronger showing than in the previous month. Employment rates have been adjusted to keep pace with lower production requirements. In view of the weak demand, inventories continued to be reduced at an increased pace to minimise costs, delivery times continued to get shorter and input prices fell again. Companies' increased pricing power was reflected in a delayed and slower drop in output prices, meaning that the earnings situation tended to improve in this difficult environment.

Inflation to fall more slowly in Austria than in eurozone

Following a double-digit peak in inflation at the start of the year, lower energy and commodity prices in particular have triggered a decline that will slow inflation to around 5% year-on-year by the end of 2023. Inflation in Austria is declining significantly more slowly than the eurozone average. This is due to greater increases to energy prices, which have triggered higher second-round effects, for example, through rent indexation.

"Following an anticipated annual average of 7.8% in 2023, we expect inflation to clearly slow down to 3.6% in 2024 and 2.3% in 2025, even with downwards trends in many service prices being rather restrained due to noticeable wage increases", says Pudschedl.

Unemployment rate rising moderately

Austria's seasonally adjusted unemployment rate has risen from 6.2% at the beginning of 2023 to now stand at 6.6%.

"The situation on the labour market is likely to deteriorate further in the coming months, mainly due to weakness in the industrial and construction sectors. Following the unemployment rate rising to an average of 6.4% in 2023, we expect an average rate of 6.7% for 2024. Stronger economic growth should see this fall again to 6.5% in 2025", says Pudschedl. The strong resilience in a persistently weak economic phase is thanks to the tight domestic labour market. Due to demographic effects, such as baby boomers retiring from the workforce and part-time work being highly attractive, development of the labour market and number of working hours on offer in Austria can barely keep pace with demand.

High risks but also opportunities depending on geopolitical developments

The economic outlook of UniCredit Bank Austria economists for the next two years is characterised by unusually high risks. The geopolitical uncertainties in particular will be crucial. "Growth expectations are highly dependent on geopolitical developments. A large number of elections, above all in the USA, could also bring additional uncertainty", says Bruckbauer.

According to UniCredit Bank Austria's economists, the fact that higher interest rates and the tightened financial conditions of central banks' excessive monetary policy have increased the risks to financial stability cannot be ignored either. "Despite the challenges to financial stability posed by the excessive monetary policy, we are not expecting a systemic crisis as household and corporate balance sheets are generally in good shape and the global banking sector is well capitalised", concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at