UniCredit Bank Austria Business Indicator

Economic situation in Austria remains tense

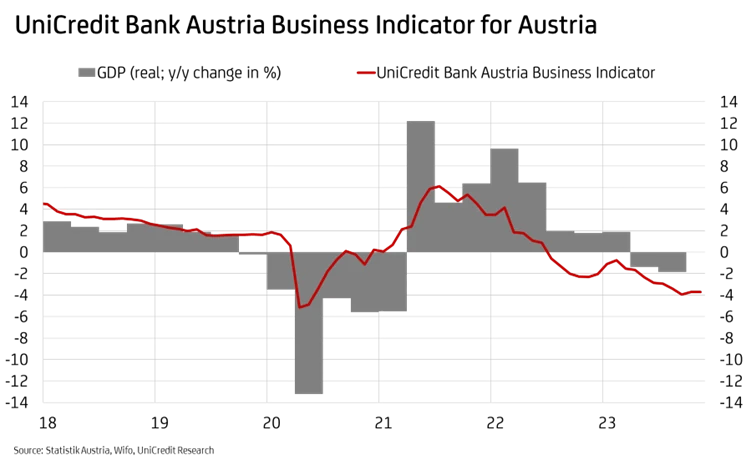

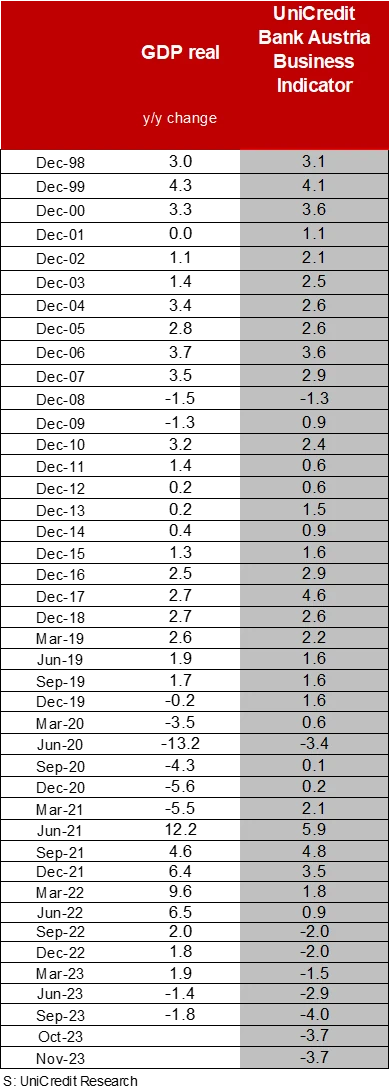

- Bottoming out but no recovery as year ends: UniCredit Bank Austria Business Indicator remains at minus 3.7 points in November

- Ongoing recession leading to GDP decline of at least 0.5% in 2023

- Recovery from 2024 onwards thanks to higher consumption and more support from global trade should enable low economic growth of 0.3%

- Pace of recovery to intensify in 2025, with GDP expected to rise by 1.5%

- Uptrend in unemployment set to continue, up from 6.4% in 2023 to 6.7% on average in 2024 — but likely to ease to 6.5% in 2025

- Inflation to fall from 7.9% on average in 2023 to forecast of 3.6% in 2024, and further still to 2.3% in 2025

- Drop in inflation making eurozone interest rate-cutting cycle likely by mid-2024 at latest

The period of weakness in the Austrian economy continues unabated. "The UniCredit Bank Austria Business Indicator remained at 3.7 points in November. Although the Austrian economy is consequently still bottoming out, an upward trend is not yet in sight for the time being", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer. There is currently no stable trend in any part of the Austrian economy that would provide a positive direction for the economy as a whole. "Pessimism in the construction industry has decreased somewhat, but sentiment in domestic industry has once again deteriorated towards the end of the year despite the global environment having improved slightly. The challenging requirements from the production sector once again had a more negative impact on the services sector and caused a noticeable decline in sentiment despite the slowing headwind in consumer confidence", says Bruckbauer.

Pessimism in all economic sectors

The UniCredit Bank Austria Business Indicator failed to continue the previous month's improvement in November. This was caused by renewed deterioration in sentiment in domestic industry as a result of orders falling further and growing concerns about competitiveness in the face of high cost dynamics. The slight improvement in the export environment due to positive impetus, particularly from the growth markets, was unable to change this. While pessimism in the services sector rose again due to declining retail sales despite healthy demand in tourism, sentiment in the construction sector improved. While the mood in Austria at the end of 2023 both in industry and in the services sector was clearly pessimistic, the business outlook of domestic construction companies returned to the long-term average. Sentiment in all sectors of the Austrian economy is clearly still lagging behind compared to the eurozone.

Prospect of at least a slow recovery from 2024

The Austrian economy has been in a recession since the spring, which is expected to continue until the end of 2023. As the year got off to a relatively good start, however, the decline in GDP for 2023 as a whole will be limited to around 0.5%.

"We expect a moderate recovery to begin over the course of 2024, which ought to allow GDP to rise slightly by 0.3%. For 2025, we expect the moderate growth rate to continue, with GDP rising by around 1.5%", says UniCredit Bank Austria Economist Walter Pudschedl. Bolstered by the further slowdown in inflation, real wages rising will enable an upward trend in consumption. Following the sharp reduction in inventory levels in 2023, the trend in the warehouse cycle reversing will also boost growth. World trade, which is slowly starting to pick up again, is also likely to support the Austrian economy. Monetary policy, however, which remains restrictive, will continue to pose a major challenge to investment activity in 2024, thereby limiting the pace of recovery. This will also be impacted by households having lower savings due to high inflation, pent-up demand (in tourism, for example) petering out and fiscal policy being less supportive.

Buoyed by the increasing purchasing power of households, the services sector is likely to progress in terms of economic recovery over time — but the situation in construction, especially in structural engineering and primarily in industry, will remain tense for even longer and is unlikely to show a clear upward trend until 2025.

Unemployment continues to rise for now, but trend is expected to reverse in autumn 2024

As a result of the weak economic development, the situation on the labour market has now deteriorated noticeably. Austria's seasonally adjusted unemployment rate has risen from 6.2% at the beginning of the year to 6.6% according to recent figures. While unemployment actually fell in 2023 in some service sectors, the upward trend is being driven by developments in construction and the capital goods industry. However, the strongest increase can be seen in the provision of other economic services. This sector includes the placement of temporary workers, so this increase is mainly attributable to production-based areas.

Favourable development at the beginning of the year limited the rise in the unemployment rate to 6.4% on average in 2023, compared with 6.3% in the previous year. "The situation on the labour market is likely to deteriorate even further for the time being, despite the prospect of an incipient recovery in the economy. We expect the unemployment rate to rise to an average of 6.7% in 2024. Only from autumn onwards should stronger economic growth enable the trend to be reversed, with the unemployment rate expected to fall to 6.5% in 2025", says Pudschedl. The relatively rapid reversal of the trend will be made possible by the tight domestic labour market. Due to demographic effects such as baby boomers retiring from the workforce, the development of the labour market and the number of working hours on offer in Austria can barely keep pace with demand.

Inflation continuing to fall, but more slowly

After inflation peaked at double-digit levels at the beginning of the year, lower energy and commodity prices in particular have caused it to fall significantly, but this has lost some of its momentum towards the end of the year. While the renewed decline in the price of crude oil due to the weakening of global demand and the easing of food price inflation are noticeably putting the brakes on inflation, strong second-round effects and consistently high demand in some service sectors are causing the slowdown in core inflation to be restrained. As inflation is expected to continue exceeding 5% at the end of the year, inflation in Austria will only fall to an average of 7.9% in 2023, having been 8.6% in the previous year.

Consequently, inflation in 2023 will significantly surpass the eurozone's forecasted annual average of 5.5%. The anticipated decline in inflation in 2024 and 2025 will continue to be slower in Austria than in the eurozone. This is due to greater increases in energy prices triggering higher knock-on effects, such as through rent indexation. "Despite a moderate increase in many service prices due to the noticeable wage increases, we expect inflation to slow to 3.6% in 2024 and to 2.3% in 2025", says Pudschedl.

Interest rate reversal on the way

Monetary tightening has peaked and a shift in monetary policy is in sight. "Given the weak economy and the marked fall in inflation in the eurozone, the ECB's next step will be to cut key interest rates. However, we expect monetary policy to only ease for the first time, cautiously approaching a neutral interest rate level, in June 2024. Key interest rates are expected to be reduced by 75 basis points by the end of 2024 and by a further 100 basis points in 2025. This means that the refinancing rate will gradually decrease from 4.50% currently to 2.75% at the end of 2025", concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at