UniCredit Bank Austria Purchasing Managers' Index in December:

Weakness in Austrian industrial sector continues into year end but cautious optimism beckons for 2024

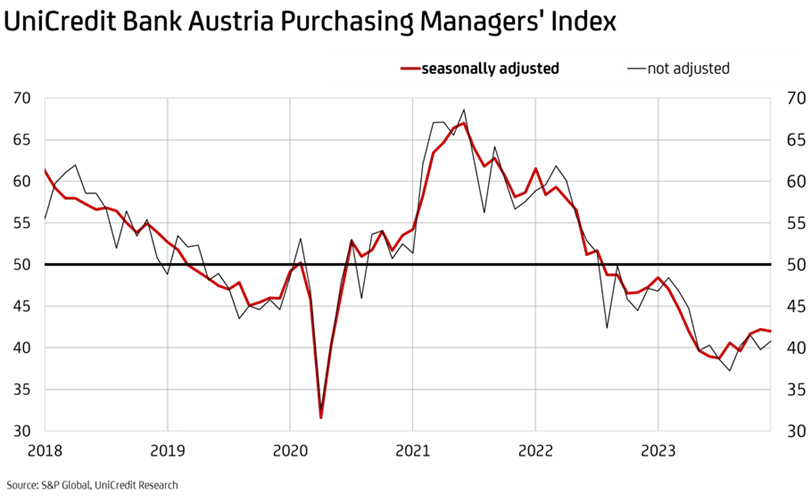

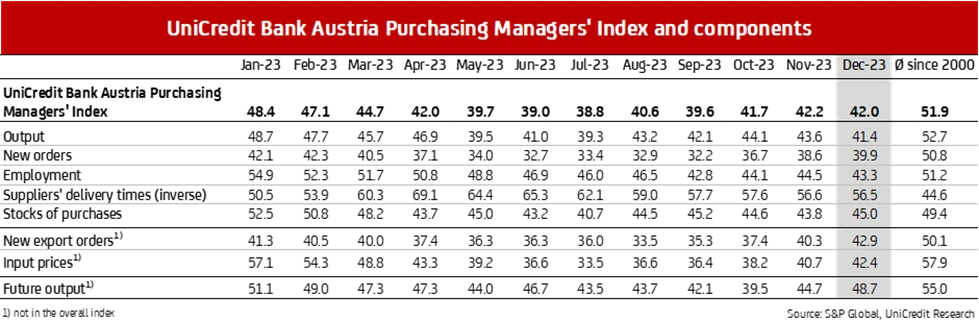

- Following two consecutive increases, UniCredit Bank Austria Purchasing Managers' Index falls again slightly to 42.0 points in December

- Despite continued easing of decline in new business, domestic businesses cut back production more drastically than in previous month

- Job cuts in industrial sector accelerate again as year draws to a close

- Fall in costs slows in December but much more modest reduction in output prices leads to improved average earnings situation

- Running down of stocks of purchases and stocks of finished goods slows

- Domestic industrial businesses anticipate further production cuts in coming months but expectation index rises to 48.7 points

- Following 6% increase in 2022, Austrian manufacturing sector set to fall by an average of 1% in 2023 with low growth expected in 2024

Austria's industrial sector remained in recession as the end of 2023 approached. "The UniCredit Bank Austria Purchasing Managers' Index fell only slightly in December, but at 42.0 points it remains significantly below the growth threshold of 50 points Although the situation in the domestic industrial sector stabilised towards the end of the year and the downturn that began in mid-2022 appears to have bottomed out, as yet there are no sign of recovery taking hold in the industrial sector", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

The results of the latest survey of domestic purchasing managers were very mixed. "Production declined more sharply than in the previous month. This was due to the continued decline in new business, albeit at a slower pace than in November. The employment level fell considerably. Lower purchasing volumes contributed to continued price reductions for primary materials and inventories were scaled back as a result", says Bruckbauer, adding: "On the whole, as we approach the end of the year the downwards trend appears to be slowing slightly for most of the sub-indicators within the UniCredit Bank Austria Purchasing Manager's Index. Most notably, though, pessimism in particular improved significantly. At 48.7 points, the production expectations index rose to its highest level since February, though it does still point to modest production losses over the coming months."

Rate of decline in new business continues to improve

Production output among domestic businesses fell more sharply than in the previous month. The production index fell to 41.4 points, its lowest level since the summer. "As we approached the end of the year, production output dipped rather more strongly than in the previous month due to the effects of generally modest demand, geopolitical uncertainties and tougher financing conditions. There was, however, a further improvement in the rate of decline in new orders both from within Austria and from abroad. Losses in the export business were actually at their lowest since mid-2022 in December", says UniCredit Bank Austria Economist Walter Pudschedl. The continuing decline in new business led to a further decrease in orders on hand, thereby significantly reducing average delivery times. Owing to the tense global demand situation and well-stocked warehouses, underutilised delivery capacity and improved availability of primary materials are likely to have contributed to this picture.

Costs continue to fall

"In light of the surplus supply of commodities and primary materials, domestic businesses were able to negotiate lower input prices with their suppliers. However, given rising wages and higher transportation costs, the drop in input prices slowed compared to the previous month", says Pudschedl. The input price index rose to 42.4 points in December.

Given their evidently strong pricing power, Austrian producers only partially passed on the cost advantages in output prices despite the weak demand environment. Price reductions were passed on only in the consumer-oriented and intermediate goods sectors. On average, price trends at the end of 2023 once again led to a slight improvement in the earnings situation of domestic businesses.

Cautious warehouse storage policies

In a weak demand environment characterised by uncertainty and with price expectations declining in some quarters, domestic businesses made considerable efforts in December to reduce storage costs. However, the somewhat weaker reduction in purchasing volumes resulted in only a rather moderate decline in inventories of primary materials and commodities, and stocks of finished goods were also run down to a lesser extent than in previous months. Although the index ratio of stocks of purchases to finished goods remains within a range that indicates a downturn in the industrial sector, the ratio did improve towards the end of the year and thus indicates that a reversal of the warehouse cycle and economic performance may be drawing closer.

Further job cuts

In the context of the accelerated reduction in production output, domestic businesses continued to reduce staffing levels in the industrial sector in December too, and even upped the pace of job cuts. "The Austrian industrial sector has been cutting jobs for the last eight months now. Despite this picture, there was a 1.4% year-on-year increase in employment for 2023 as a whole. This equates to an increase of just under 10,000, to more than 645,000 people in employment. Nevertheless, unemployment in the sector did increase slightly in 2023. The average annual unemployment rate rose to 3.2%, having been just 3.1% in 2022", says Pudschedl. However, this means that the unemployment rate in the industrial sector remains significantly lower than the rate for the economy overall, which is likely to average 6.4% for 2023.

Slightly improved outlook for 2024

The overall figure of 42.0 points for the UniCredit Bank Austria Purchasing Managers' Index in December is slightly lower than in the previous month, indicating a continued period of weakness in the Austrian industrial sector and further declines in production. However, there are positive indicators in certain aspects of the monthly survey, pointing to a slowing of the economic downturn in the domestic industrial sector. In particular, the decline in new business, including from abroad, is likely to be stemmed somewhat. The inventories of domestic industrial businesses have also now fallen sharply. The ratio of new orders to inventory has consequently improved towards the end of the year, although for the time being stocks of finished goods are still sufficient to be able to meet the demands of new business. In the coming months, however, production and employment are expected to decline to a lesser extent.

Following an increase in industrial production of more than 6% in 2022, the Austrian industrial sector was in recession throughout 2023. The economists at UniCredit Bank Austria estimate that domestic manufacturing has suffered an average decline in production of just over 1% for 2023, dampened by the particularly unfavourable developments in the metal processing, chemical and plastics industries. With a more stable export environment, the outlook for manufacturing is somewhat more favourable again for 2024. At least a slight increase in production of around 1% is within reach.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at