UniCredit Bank Austria Business Indicator

Signs of hope on the economic horizon, but noticeable recovery not expected until second half of the year

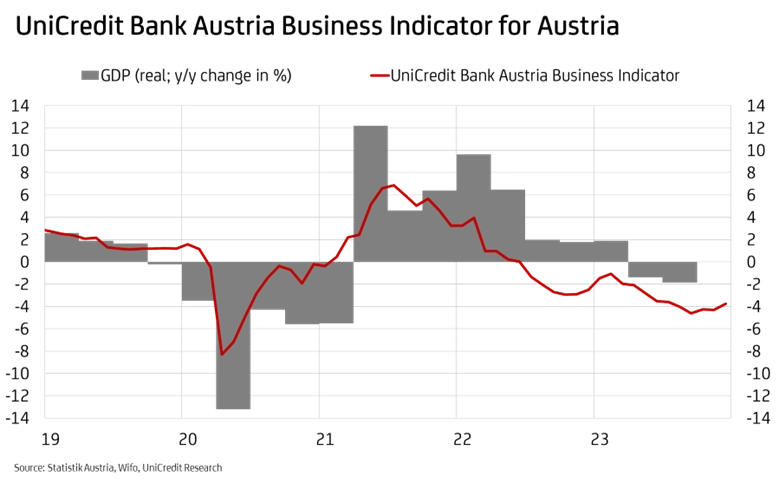

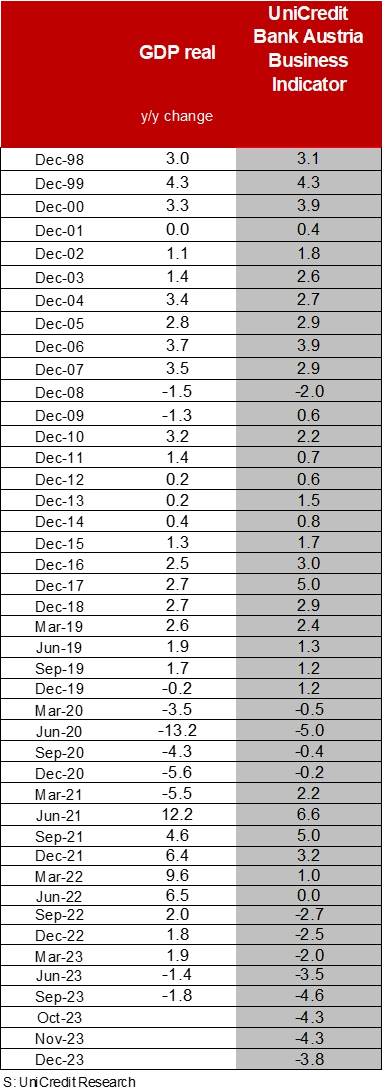

- No further deterioration in economy at least: UniCredit Bank Austria Business Indicator rises slightly to minus 3.8 points in December

- Austrian economy could climb out of recession at start of 2024, but recovery will gain little momentum before summer

- Economic growth to remain below potential at 0.3% in 2024 and 1.5% in 2025

- Late interest rate cuts from mid-2024 to increase economic risks

- Inflation in Austria to fall towards 3% at end of 2024, but will remain significantly higher than in eurozone

- Burdens on labour market set to continue increasing in coming months: Unemployment rate will rise to 6.7% in 2024

The Austrian economy was not able to climb out of recession before 2023 came to an end. "The situation in the domestic economy remains tense, but we can at least see glimmers of economic hope here and there. The UniCredit Bank Austria Business Indicator rose to minus 3.8 points in December, indicating no further deterioration in the Austrian economy at least", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer. Despite the slight improvement towards the end of the year, the UniCredit Bank Austria Business Indicator remained unchanged between the third and fourth quarters at an average of minus 4.2 points. "Austrian economic output will have fallen again towards the end of 2023, meaning it shrank for the third consecutive quarter. Given the improvement in economic sentiment at the end of the year, however, we expect the decline to be lower than in previous periods. The decline in GDP for 2023 as a whole could therefore be slightly higher than our estimate of 0.5%", says Bruckbauer.

Economic sentiment in Austria worse than the eurozone average

The improvement in the UniCredit Bank Austria Business Indicator at the end of 2023 was largely due to the noticeable upturn in sentiment in the services sector, bolstered by the less pessimistic underlying mood among consumers as a result of slower inflation and high wage agreements. Consumer-related services in the leisure and tourism sector in particular are benefitting from consistently solid demand, while many business-related services are still strongly feeling the effects of the economic downturn in the production sector.

"The upswing in the services sector combined with the improvement in the construction industry have boosted economic sentiment in Austria. The negative trend caused by the energy crisis and subsequent price increases is slowly giving way to the expectation of positive effects on income and falling interest rates. Weakness in the industrial sector—which actually worsened slightly at the end of the year—continues to weigh heavily though. That said, further improvement in the export environment has already had a positive impact on the production expectations of domestic businesses", says UniCredit Bank Austria Economist Walter Pudschedl.

Despite the recent improvement, economic sentiment in Austria is pessimistic across all sectors of the economy, and is particularly negative in the domestic industrial sector. Although the long-term average is now slightly higher in the construction industry, compared to Austria's European partner countries, economic sentiment is much worse in all sectors of the economy. The biggest difference in sentiment can be seen in industry, and the smallest in construction.

Slow and delayed recovery

Despite the slight improvement in economic sentiment, the Austrian economy is starting 2024 under difficult conditions. Real wage shrinkage and wealth reduction caused by high inflation in the previous year are still putting a damper on consumer satisfaction. The impact of monetary policy tightening on investment activity is very noticeable, which is particularly detrimental to the domestic production sector. Furthermore, the global economy is not providing any momentum. The first early indicators suggest a slight upturn in global trade, however, which should gradually give Austrian export business more of a boost. Furthermore, the real wage growth that has already begun ought to increasingly strengthen consumption in the coming months. From the middle of the year, the decline in interest rates should bolster the economy too, and investment activity in particular.

"Due to the persistently difficult economic environment, we expect economic development in Austria to remain very sluggish in the coming months. Although we assume the recession will end at the beginning of the year, the slight improvement in economic sentiment doesn't yet arouse any expectations of a recovery that really warrants the name", says Pudschedl, adding: "It's unlikely that a fundamental economic recovery will kick in until the second half of the year, buoyed by an upturn in consumption and global trade. Despite higher momentum from late summer, economic growth of considerably less than 1% is all that's in sight for 2024.

As a result, the rest of the recovery will be shaped by household spending behaviour and companies' willingness to invest in response to what is forecast to be gradual improvement in the economic environment. "The development of consumption and investment are key parameters when it comes to the pace of recovery. We are cautiously optimistic and expect economic growth to increase to around 1.5% in 2025", says Pudschedl. However, this means that the Austrian economy will still not be able to fully exploit its potential.

Will the restrictive monetary policy continue?

UniCredit Bank Austria economists believe that, in addition to the spending behaviour of consumers and companies, the anticipated monetary policy will also pose a risk to the actual pace of recovery that should not be underestimated.

"In view of the weak economy and the marked fall in inflation in the eurozone, the European Central Bank will start a cycle of interest rate cuts in 2024. However, based on the statements made by the members of the Governing Council to date, initial easing of the monetary policy to cautiously approach a neutral interest rate level cannot be expected until June 2024. Key interest rates are likely to be reduced by 75 basis points by the end of 2024 and by a further 100 basis points in 2025. This means that the refinancing rate should gradually decrease from 4.50% currently to 2.75% by the end of 2025", says Bruckbauer, adding: "However, there is a risk that interest rate cuts will start too late, which could prove to be a particular obstacle to investment. For the time being, the ECB seems to want to continue pursuing a somewhat restrictive monetary policy, which is not very supportive of the economy."

Inflation continuing to decline, albeit more slowly

In any case, the progress made in reducing inflation speaks in favour of easing monetary policy earlier. Despite temporary setbacks, inflation in the eurozone was already below 3% year on year at the close of 2023. Following an average of 5.4% in 2023, inflation is set to fall to 2.3% on average in 2024, reaching the ECB's target of 2% towards the end of this year.

In 2024, inflation in Austria will once again be significantly higher than in the eurozone. However, inflation will continue to decline, albeit relatively slowly. The bigger energy price increases compared to most eurozone countries continue to trigger greater knock-on effects, for example through rent indexation. "Despite a noticeable increase in many service prices as a result of markedly higher costs for materials and personnel, we expect inflation in Austria to slow down. However, there are now significant upward risks to our forecast of annual averages of 3.6% in 2024 and 2.3% in 2025", says Pudschedl.

Unemployment continuing to rise for now

The situation on the labour market is likely to deteriorate even further for the time being, despite the prospect of an incipient recovery in the economy.

"We expect the unemployment rate to rise to an average of 6.7% in 2024, having been 6.4% in 2023. Only from autumn onwards should stronger economic growth enable an improvement, with the unemployment rate expected to fall to 6.5% in 2025", says Pudschedl. The relatively rapid reversal of the trend can be explained by the markedly tight domestic labour market. Due to demographic effects such as baby boomers retiring from the workforce, the development of the labour market and the number of working hours on offer in Austria can barely keep pace with demand.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at