UniCredit Bank Austria industry overview

Rocky start to year for most sectors of Austrian economy

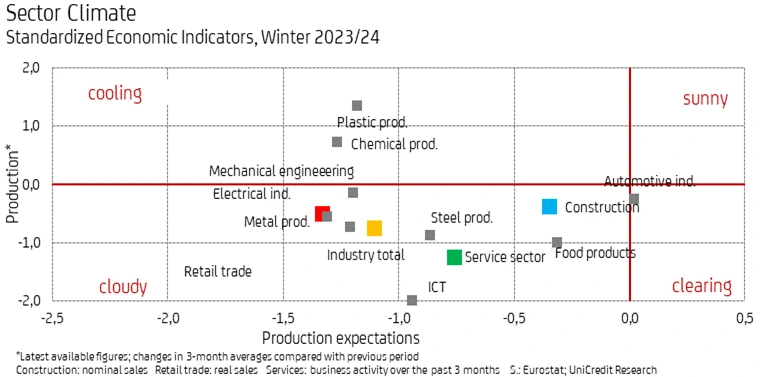

- Further deterioration of climate across almost all sectors in H2 2023 but cause for cautious optimism in coming months

- Improved sales expectations in services sector signal potential end to recession in Austrian economy at start of 2024

- Retail sector continues to struggle but rising real wage growth boosts outlook for coming months

- Construction sector remains in crisis despite improved sentiment at year end: Only building renovation and civil engineering expected to see positive momentum in 2024

- Recession in industrial sector continues but modest improvement in export demand likely to contribute to gradual easing in coming months

The Austrian economy was still in recession as 2023 drew to a close. The decline in GDP seen in the second and third quarters of 2023 appears to have continued in the final quarter, though to a lesser extent. The latest industry overview from UniCredit Bank Austria shows that the climate in the industrial sector in particular has seen a sustained downturn since the summer. Based on the economic data available at this point, production output in the domestic industrial sector looks likely to have shrunk further in the fourth quarter. The decline in production in the construction sector also appears to have continued through until the end of the year, and the retail and services sectors likewise failed to generate any meaningful growth momentum. "In the face of ongoing recession, Austria's GDP declined by at least 0.5% for 2023 as a whole, fuelled to a significant degree by the weakness of the domestic industrial sector. The construction sector, too, closed 2023 with an overall loss in value added. Only the services sector succeeded in achieving slight growth overall compared to 2022, despite the sizeable slump in retail and other areas", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

The majority of businesses are starting 2024 with a pessimistic outlook for production and demand. "The results of the latest economic survey continue to point to weak economic development over the coming months. The mood across all sectors was glum at the start of 2024, but particularly so in the industrial sector. That said, there was a slight easing in the order situation in the construction sector and in particular in the services sector", says UniCredit Bank Austria Economist Walter Pudschedl, adding: "The upwards trend in demand suggests that it will be possible to slowly overcome the economic weakness through the course of 2024 and that the Austrian economy could start to see a moderate recovery from the second half of the year."

(The industry climate indicator is determined based on a comparison of production and sales trends up to December 2023 against the results of the economic survey in December 2023).

Sales expectations in services sector improve by year end despite gloomy industry climate

The slump in the services economy continued into the second half of 2023. In the third quarter of 2023, services (excluding public and social services) saw only a nominal increase in sales of 1.8% on the previous year, which in real terms equates to a significant decrease. Other economic services performed more strongly than expected, driven by strong growth in the travel agency sector and in accommodation and catering. By contrast, transportation and warehousing suffered a significant slump. Weak performance also continued in the professional sector. Although there was a slight improvement in sales growth in some areas, such as legal and business consultancy, other areas—including architectural and engineering firms—actually suffered a nominal decline in sales due to the weakness of the construction economy.

The services economy began to stabilise towards the end of the year. Sales expectations for the coming months have improved slightly, although the climate in the sector remains sluggish. While demand expectations in the accommodation sector have improved, leading to strong capacity utilisation expectations for the coming months, sales in the catering sector will be worse affected by high inflation, which restricts purchasing power. Despite improved expectations in the transportation sector, both of these areas will be slow to see an improvement in demand in 2024. By contrast, passenger transport (e.g. air transport) is likely to continue benefiting from strong demand for tourism, while freight transport will see a longer wait for tangible momentum. The weakness in the industrial economy will continue to hamper the performance of business-related services. However, demand expectations did improve somewhat by the end of 2023 for most professional services as well as for other economic services, and the coming months are likely to see at least a moderate recovery in the services economy. The services sector is therefore expected to be a key element of bringing the recession in the Austrian economy to an end as 2024 gets underway.

Retail sector continues to struggle but rising real wage growth boosts outlook

Strong price increases in the retail sector (excluding cars and petrol stations) in 2023 drove an average nominal sales increase of 4.2% up to November. Adjusting for pricing effects, however, sales fell by 3.7%. There was sales growth—in some instances significant—in certain quarters (such as retailers of telecommunications equipment, cosmetics and clothing and shoes), and the real-terms sales decline in food retail remained within a manageable range at less than 1%. By contrast, the construction materials and home furnishings sectors in particular saw real-terms losses of around 15%. Although sentiment in the retail sector improved considerably towards the end of 2023, the business expectations of retailers remain pessimistic. This suggests that continued weak sales growth is likely in the retail sector over the coming months. As the year progresses, however, and inflation falls—triggering real-terms income growth—consumer spending is likely to gradually increase, particularly given that the situation on the labour market is likely to remain fairly stable.

Per the latest figures as at November 2023, sales in automotive retail (including workshops) rose by more than 13% in nominal terms and by 5% in real terms, fuelled by the strong growth in new passenger car registrations. However, this momentum was driven by catch-up effects following earlier delivery issues and has now waned, causing business expectations to deteriorate by the end of 2023; momentum in the automotive retail sector is now expected to drop off gradually over the coming months. This year is unlikely to see a repeat of the nominal increase of more than 10% achieved by the automotive retail sector in 2023.

Construction sector remains in crisis despite improved sentiment at year end

The momentum seen in the construction sector at the start of 2023 was lost as the year progressed. The economy slowed across all construction sectors, with structural engineering much worse affected than civil engineering. While sales in the structural engineering segment declined by around 5% in 2023 as a whole, sales in the civil engineering segment were only around 1% below the previous year's level. The construction-related sectors posted significant growth in 2023, although sales dipped into the minus range towards the end of the year here too.

The weak construction economy in the second half of 2023 had a negative effect on the labour market. The seasonally adjusted unemployment rate for the construction sector was 8.6% at the end of the year — around half a percentage point higher than it had been a year previously. While the situation in the civil engineering segment remained stable, the increase here was due to the unfavourable developments in the structural engineering segment, which saw an increase to almost 10%, and in the related sectors. Sitting at an average of 8.5%, unemployment in the construction sector in 2023 was almost two percentage points higher than the 6.4% average for Austria as a whole.

Despite this figure now trending upwards slightly, the assessment of the order situation remains negative, pointing to a difficult economic environment for the construction sector over the coming months. The weakness of the economy as a whole, the fact that construction prices are being slow to fall, and the high credit rates will also put the brakes on demand in the coming months. Only building renovation and civil engineering are expected to see growth momentum in 2024. Both sectors benefit from subsidies for climate protection measures. Overall, however, the sales outlook for the construction sector in 2024 remains very modest, following a decline in 2023.

Recession continues in industrial sector for the time being

Following two years of strong growth, the Austrian industrial sector posted a significant real-terms decline in production of an estimated 1.5% in 2023. Despite this decline, real-terms production output in 2023 was still around 8% above the pre-pandemic level — the best performance across all economic sectors. However, the Austrian industrial sector has been in recession since mid-2022 due to weakening export demand and falling domestic orders, and also as a result of the problems in the construction sector — though the results for the individual areas vary considerably. While the pharmaceutical industry, automotive production, the electrical industry and the food and beverage industry achieved strong production growth in 2023 in some instances, by contrast there were massive losses in metal goods production, the chemical industry, paper production and the wood industry, among other areas. The industrial economy slowed still further as 2023 drew to a close. Food and beverage production slipped into the negative range, as did the electrical industry. In addition, the negative developments worsened in mechanical engineering, the steel industry, the glass industry and in metal processing.

The immediate production expectations in the capital goods industry deteriorated somewhat towards the end of 2023, but were still better than in the third quarter. In addition, the survey of Austrian purchasing managers indicated that production expectations for the next 12 months brightened significantly in December. However, at 48.7 points the indicator remains below the neutrality threshold of 50 points, meaning that it must be assumed that the recession in the industrial sector will continue over the coming months, although the intensity of the recession should gradually decrease. In the coming months, the steel industry, metal goods production, mechanical engineering and the electrical industry will face the greatest challenges given the particularly poor order situation and production expectations. These sectors are particularly badly affected by the consequences of the higher interest rates for the European capital goods industry and the weak demand in the construction industry. Economic development in the automotive industry and in food and beverage production is likely to be comparatively more favourable.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, tel.: +43 (0) 5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at