UniCredit Bank Austria Purchasing Managers' Index in January

Austria's industry had a weak but less pessimistic start to 2024

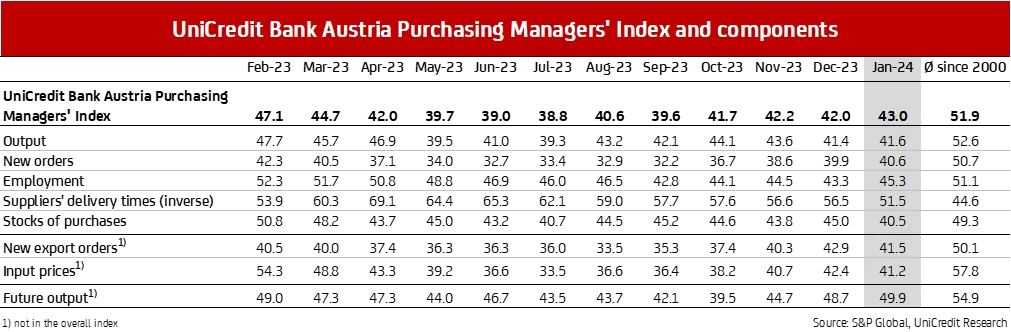

- Slight improvement in UniCredit Bank Austria Purchasing Managers' Index at 43.0 points in January, which nevertheless continues to signal a recession in the industrial sector

- At the beginning of the year, domestic businesses reduced their production output slightly less than in the previous month after the decline in new business slowed once again

- Reduction of socks in purchases and stocks of finished goods at a faster pace than in the previous month

- Improved average earnings situation: Decline in costs accelerated at the beginning of the year, while reduction in output prices was significantly more restrained

- Job cuts in industrial sector decreased slightly at the beginning of 2024

- Domestic industrial companies expect production to stabilise in the coming months: Expectation Index rises to highest level in a year at 49.9 points

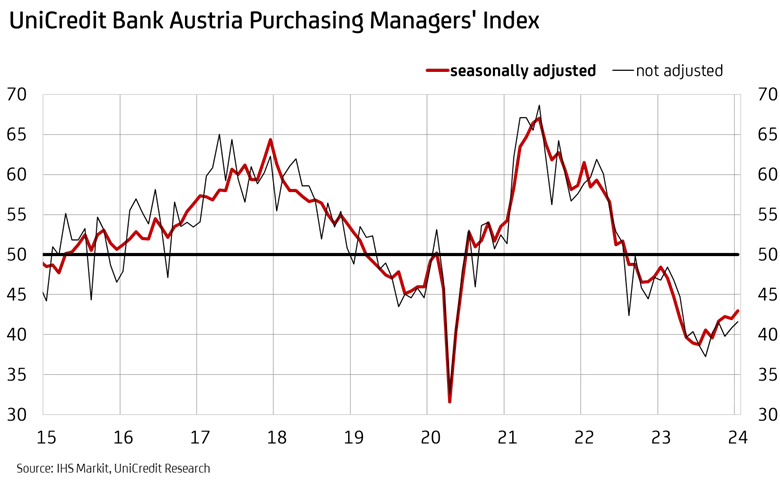

The industrial sector in Austria continued to weaken at the beginning of 2024. "The UniCredit Bank Austria Purchasing Managers' Index rose slightly in January compared to the previous month. It reached its highest level in ten months at 43.0 points. However, the index is still significantly below the threshold of 50 points that would signal growth," says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Even though the economic situation improved slightly at the beginning of the year, domestic industry has not yet been able to overcome the recession that has persisted since mid-2022. The decline in production is also expected to continue in the coming months, although pessimism has decreased significantly. At 49.9 points, the production expectations index rose for the third month in a row to its highest level in a year."

The results of the latest survey of domestic purchasing managers indicate a slight upward trend in the industrial economy in Austria at the beginning of the year. "Although production declined almost as strongly as in the previous month because new business continued to fall, its decline was slightly less than in December. The employment level fell at a slower pace. Despite an acceleration in the fall in prices for primary materials and raw materials, purchasing volumes reduced sharply and, as a result, inventories fell significantly," says Bruckbauer.

The rise in the UniCredit Bank Austria Purchasing Managers' Index in January was in line with most European indices. The provisional Purchasing Managers' Index for the eurozone rose to 46.6 points, supported by an improvement in the German indicator to 45.4 points. "The Austrian industrial economy seems to be lagging somewhat behind the rest of Europe. The UniCredit Bank Austria Purchasing Managers' Index has been below the value for both the eurozone and Germany, our most important export market, for several months. Specifically, new business in Austria is showing a less favourable trend particularly in export demand, which leads to greater production losses," says Bruckbauer.

Rate of decline in production output stabilises

Production output among domestic businesses decreased slightly less in January than in the previous month. However, the production index rose by just 0.2 points to 41.6 points. "Impacted by the generally restrained demand, geopolitical uncertainties and tougher financing conditions, production output once again sharply reduced at the beginning of the year. However, the decline in new orders also slowed, with domestic orders being responsible for this. By contrast, losses in export business increased at a faster rate in January than in the previous month, but were the second lowest of the last one and a half years," says UniCredit Bank Austria Economist Walter Pudschedl. Despite the slight increase to 40.6 points, the index for incoming orders was lower than the production index for the 21st consecutive month. Domestic companies therefore once again concentrated on processing order backlogs, which consequently fell sharply in January, supporting a further reduction in average delivery times. However, delivery times fell at the slowest rate in a year after cargo was diverted via the Cape of Good Hope as a result of attacks on merchant ships in the Red Sea.

Increased inventory reduction and falling prices

In January, purchasing activities were once again cut back sharply as a result of declining production requirements. Companies also endeavoured to reduce their stocks of primary materials and raw materials for cost reasons. Stocks of finished goods were reduced to the extent last seen in autumn 2009 during the financial crisis. Stocks of finished goods also fell more sharply than in the previous month.

In view of the surplus supply of raw materials and primary materials, domestic companies were able to negotiate lower purchasing prices with their suppliers. The fall in input prices even accelerated compared to the previous month. The input price index fell to 41.2 points in January. "The renewed decline in input prices shows that the increased freight costs in maritime trade will not have a noticeable impact on total unit costs in Austria for the time being. However, the attacks on merchant ships in the Red Sea and the diversions via the Cape of Good Hope led to higher costs for freight, especially from Asia, due to the extension of the transport time by around seven days and additional fuel requirements. This could have an unfavourable impact on the development of delivery times and output prices in Austria too in the coming months. However, the consequences for domestic industry are likely to remain manageable," says Pudschedl.

Output prices fell in January at the same rate as in the previous month and at a significantly slower rate than input prices. On average, price trends at the beginning of 2024 once again led to a slight improvement in the earnings situation of domestic businesses.

Further job losses

Due to the continued sharp reduction in production output and the rapidly decreasing backlogs of orders, domestic industrial companies further reduced their personnel capacities in January. However, the employment index rose to 45.3 points, signalling the slowest rate of job cuts since August last year.

"At the beginning of 2024, the seasonally adjusted unemployment rate in Austrian manufacturing was 3.4%. While Tyrol has the lowest rate of just under 2.0%, the unemployment rate in Vienna is the highest in the sector at 7%. In addition to Vienna, Burgenland, Carinthia and Vorarlberg also have an above-average unemployment rate in the manufacturing sector," says Pudschedl.

In the coming months, the situation in the labour market in the industrial sector is expected to deteriorate further, so that after an average unemployment rate of 3.2% in 2023, an increase to an average of around 3.5% is likely in 2024. This means that the unemployment rate in the industrial sector will remain well below that of the economy overall, which is estimated to be 6.7%.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at