UniCredit Bank Austria Business Indicator

Slight economic upturn in very small increments

- UniCredit Bank Austria Business Indicator rises to minus 3.2 points at start of 2024

- Austrian economy appears to have ridden out recession but is unlikely to pick up momentum until summer

- Sentiment improving somewhat in industrial sector and certain service sectors but mood remains pessimistic overall

- Mood in construction sector deteriorated further, however

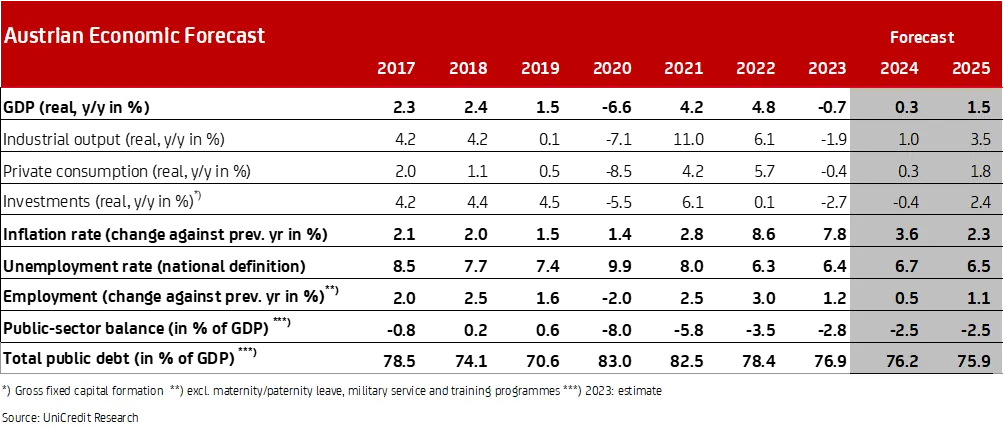

- Muted economic growth of 0.3% expected for 2024 due to upturn in consumption and trend reversal for warehouse cycle

- Unemployment rate set to increase to 6.7% in 2024 before declining to 6.5% in 2025 due to stronger growth

- Inflation expected to drop to 3.6% on average for 2024 and 2.3% in 2025, underpinning economic recovery via significant real wage increases

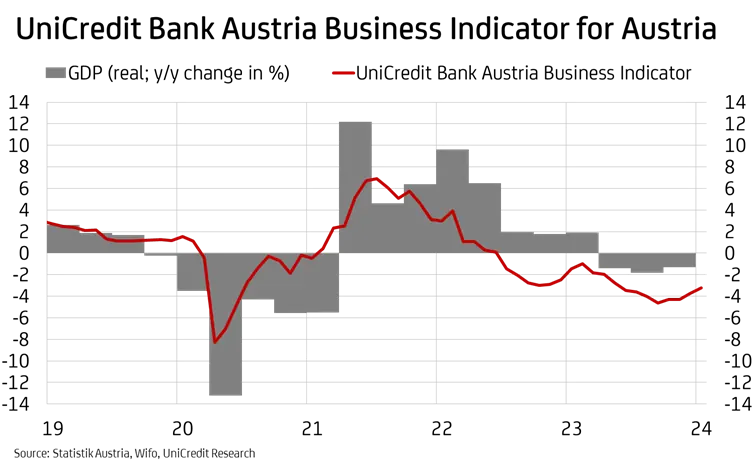

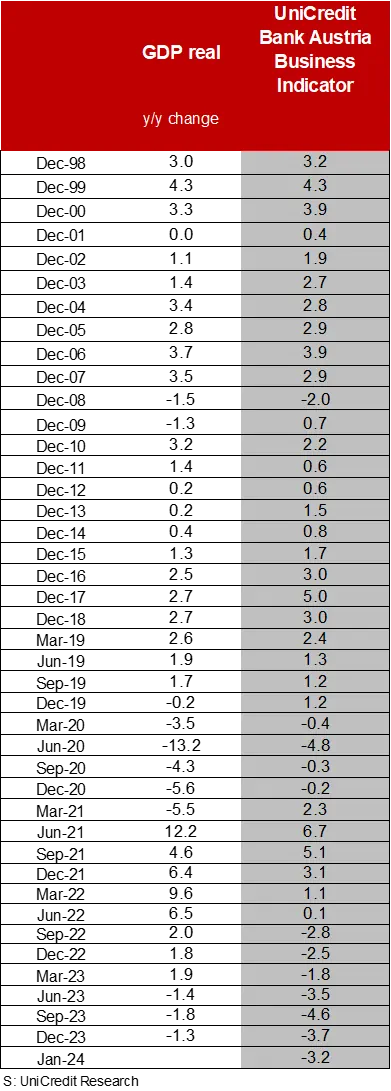

The Austrian economy is beginning to rise up from its low and show gradual signs of improvement. "The UniCredit Bank Austria Business Indicator increased to minus 3.2 points at the start of the year. This marked the fourth consecutive increase and the best performance since May of last year", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Although the recession appears to have bottomed out just before the end of 2023, the latest indicator is still well below the long-term average — suggesting only limited improvement in the economic situation. There is no sign of the kind of momentum that would herald an imminent and meaningful recovery of the Austrian economy."

Sentiment eases slightly, with the exception of construction

As was the case in the previous month, the renewed improvement in the UniCredit Bank Austria Business Indicator at the start of the year was due in large part to the brightening mood in the services sector — though this varied greatly across the individual segments. While the business situation in January in the IT-related sectors and for consulting services was judged to be overwhelmingly positive—and likewise in the hospitality sector due to strong booking figures—most business-related service companies remained pessimistic, especially those in the construction and real estate sectors. The mood in the construction sector deteriorated at the start of the year due to declining orders in structural engineering and related sectors, while the prospects for civil engineering actually brightened slightly.

"While performance in the construction sector was muted, the services sector and the domestic industrial sector helped boost economic sentiment in Austria at the start of the year. Firstly, there was a slight revival of domestic demand in certain consumer-related segments of the industrial sector, such as the foodstuffs industry and automotive manufacturing. Secondly, the indicator of global industrial sentiment—weighted to account for Austria's foreign trade—pointed to another slight improvement in the export environment", says Bruckbauer.

Despite the recent improvement, economic sentiment in Austria was pessimistic across all sectors of the economy at the start of 2024, and was particularly negative in the services sector. Economic sentiment in Austria across all sectors significantly underperformed the figures for the eurozone. While the gap in sentiment did narrow in the services and industrial sectors, it widened significantly for construction.

Growth prospects gradually improving

Based on the current leading indicators, the Austrian economy is only likely to move sideways over the coming months. That said, the improvement in the economic environment that began to take effect just before the end of the year is likely to continue gradually, with the domestic economy expected to show signs of recovery by no later than the second half of the year. "Given the rather muted start to the year, we are of the opinion that GDP is only likely to increase very slightly for 2024 as a whole (to 0.3%) despite the gradual brightening of the economic picture. We expect consumption to improve over the coming months following strong real wage growth in the wake of falling inflation. Furthermore, a trend reversal in the warehouse cycle following the sharp decline in inventories in the previous year is likely to stimulate growth", says UniCredit Bank Austria Economist Walter Pudschedl.

The moderate economic recovery is set to continue in 2025. The economists from UniCredit Bank Austria believe that rate cuts by the ECB and the likely resulting boost to investment will create a broader base of economic growth, rising to around 1.5%.

Unemployment continuing to rise for now

The favourable growth prospects mean that the upwards trend in the unemployment rate seen over the last few months is set to reverse around the end of 2024/start of 2025. Over the coming months, however, the rate will increase slightly from the seasonally adjusted 6.7% seen at the start of 2024. Construction and manufacturing in particular are likely to see an unusually strong increase in job seekers.

"We expect the unemployment rate to rise to 6.7% on average for 2024, up from 6.4% in 2023. As a result of the moderate economic upturn, the unemployment rate is likely to drop back again in 2025 to an average of 6.5%. This turnaround is also underpinned by weaker growth in labour supply compared to previous years", says Pudschedl. Despite an average of almost 300,000 registered job seekers, many sectors will continue to experience a shortage of workers. Reducing the skills imbalance between supply and demand will be a key challenge for the Austrian labour market over the coming years.

Inflation slowly declining

Inflation fell to 4.5% year on year at the start of 2024 — the lowest figure in two years. The decline in inflation will continue in the coming months, but this will no longer be determined by lower energy prices. However, while energy prices are not expected to cause upwards pressure, core inflation is likely to be slowed as second-round effects are phased out.

"The delayed adjustment of salaries to take account of high inflation is resulting in considerable real wage increases; these increases prop up the economy by boosting consumer demand but at the same time will slow down the ongoing disinflation process. That said, we are optimistic that inflation will fall below 4% on average in 2024. We expect average inflation of 2.3% for 2025, which is just slightly above the ECB's target. As a result, inflation in Austria will continue to sit at a higher level than in the eurozone due to the comparatively slow easing of core inflation", says Pudschedl. The economists at UniCredit Bank Austria expect an inflation rate of 2.2% in the eurozone for 2024 and just 1.8% for 2025.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at