UniCredit Bank Austria Purchasing Managers' Index in February:

Persistently weak industrial activity in Austria leading to significant job cuts

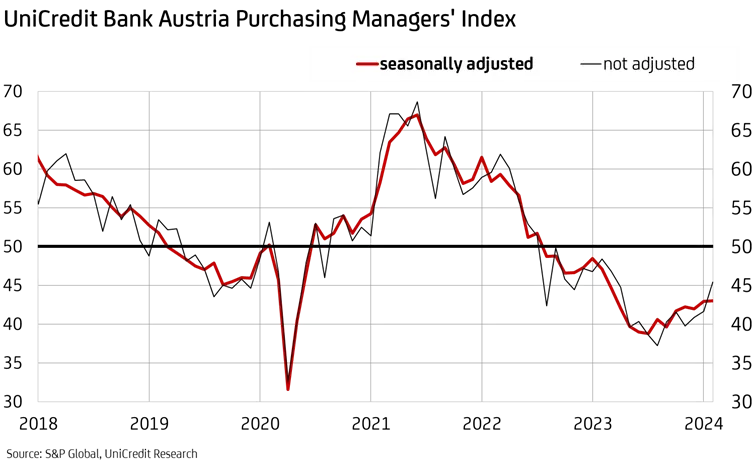

- Austrian industrial sector still in recession: UniCredit Bank Austria Purchasing Managers' Index remains at 43.0 points in February

- Industrial sector's longest period of weakness since Index was introduced in 1998

- Easing of decline in new domestic and foreign business prompting Austrian companies to reduce production output less drastically than in previous ten months

- Delivery times significantly shorter again in February following temporary lengthening due to conflict in Middle East

- Sharp acceleration in job cuts improving productivity

- Decline in costs slows in February, while reduction in sales prices significantly more restrained

- Slight optimism as domestic industrial businesses expect production to increase in coming months for first time in a year

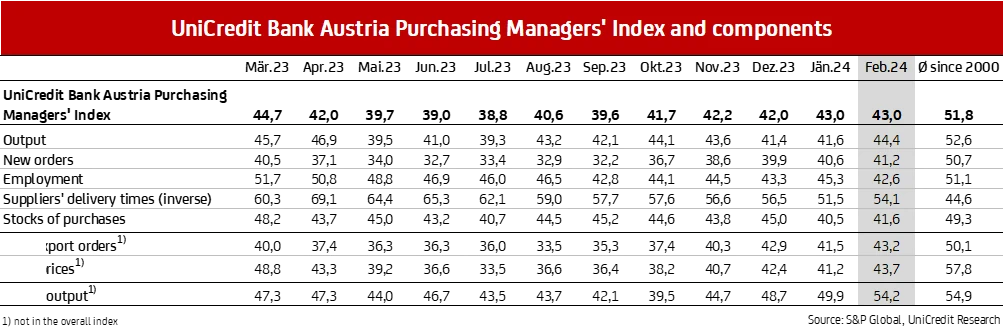

The domestic industrial sector has now been in recession for a year and a half. Although now past the lowest point, improvement in the economic situation continues to be very slow. "The UniCredit Bank Austria Purchasing Managers' Index was at 43.0 points in February. This means that the 50-point mark, which is the threshold for growth, has not been met for the 19th time in a row — the longest period since the Index was introduced in 1998", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "However, pessimism in the domestic industrial sector is starting to ease. Production fell noticeably less sharply, with February seeing the production expectations of Austrian companies increase for the first time in over a year. The expectation index has risen to 54.2 points, its highest value in two years, so we can expect an imminent increase in the production output of the Austrian industrial sector again in the coming months."

Although the current UniCredit Bank Austria Purchasing Managers' Index has not changed compared to the previous month, there is certainly an improvement in the economic situation in the industrial sector beyond the production expectations in the sub-components. "While job cuts accelerated dramatically compared to the month before, production declined less sharply as the drop in incoming orders likewise slowed down. The fall in the cost of primary materials and raw materials was greater than the drop in sales prices, which is likely to have had a generally positive impact on earnings. Moreover, the quickening of delivery times indicates that supply chains are in good working order despite container shipping being disrupted by the conflict in the Middle East", says Bruckbauer.

Weakening of new business slowing down

The production output of the domestic industrial sector fell again in February, but the pace of decline was slower than in the previous month. The production index rose to 44.4 points, its highest level in ten months. "Domestic businesses reduced their production less sharply than in the previous month because the decline in new business decelerated as well. The pace of decline in domestic and, in particular, international orders continued to slow", says UniCredit Bank Austria Economist Walter Pudschedl.

However, new business is still being held back by reticent global demand, geopolitical uncertainties and tougher financing conditions, not to mention high prices and high customer inventories in some cases. Despite increasing to 41.2 points, the index for incoming orders has been below the production index since May 2022. Accordingly, domestic businesses have continued to focus on processing orders on hand, which consequently fell sharply again in February. The negative trend in this regard slowed down too, however, with the reduction in orders on hand causing average delivery times to likewise decline in February — and at an even faster pace than in the previous month. Another factor that played a part in this was the overcoming of logistical challenges posed by the attacks on merchant ships in the Red Sea in connection with the conflict in the Middle East.

Job cuts in industrial sector intensifying

Despite the decline in incoming orders and production slowing, job cuts in the Austrian industrial sector accelerated in February. The employment index fell to 42.6 points, indicating the highest rate of staff reduction since job cuts started ten months ago. "The majority of domestic businesses are now downsizing their workforce due to ongoing weak demand and increased wage costs. The willingness to retain skilled workers in the currently difficult economic situation—in an attempt to hit the ground running faster in a more positive market environment at a later date—has decreased significantly due to the period of weakness that has persisted for rather a while now. Since job cuts have been more pronounced than production cutbacks, February saw productivity in domestic material goods production start to improve for the first time in around two and a half years", says Pudschedl.

With a seasonally adjusted figure of over 23,000 people, the number of job seekers in the Austrian industrial sector is now almost 15% higher than it was a year ago. The unemployment rate rose to 3.5% when adjusted for seasonal factors. "The unemployment rate in the Austrian material goods industry has been following an upward trend since spring 2023, and this is set to continue in the coming months. After an average of 3.5% in 2023, the unemployment rate in the industrial sector is expected to be slightly higher in 2024 than in the previous year. This means that the unemployment rate in the industrial sector will nevertheless remain significantly lower than the rate for the economy as a whole of 6.7%", says Pudschedl.

Skilled workers are still being sought in the domestic industrial sector, however, with companies currently reporting around 9000 vacancies. On average, there are currently 2.5 jobseekers for every open position in the material goods production sector in Austria, compared to just 1.5 about a year ago. The labour shortage has eased in view of economic weakness. The situation nevertheless continues to be challenging, especially in Salzburg where the ratio of applicants to jobs is 1.1, or in Upper Austria and Tyrol where the ratio is 1.6.

Lower demand causing prices to fall further

Due to the lower demand for raw materials and primary products, domestic businesses reduced their purchasing volumes again in February. This not only resulted in a further decrease in stocks in primary material warehouses but also, most notably, led to continued cost reductions in purchasing. "Weak demand has promoted a decline in purchasing prices for exactly one year now. However, the prices that companies are paying for primary products have fallen more slowly recently", says Pudschedl, adding: "The ongoing price reduction in purchasing has only partially been passed on to customers. Sales prices have fallen only slightly, so the earnings of domestic businesses ought to have improved on average."

Recovery slow to materialise

While the production expectations index rising to over 50 points for the first time in a year signals medium-term growth in the domestic industrial sector, the latest details of the survey indicate that the recession will continue for the time being despite improvements. The relationship between new orders and the stocks in delivery warehouses shows that incoming orders can be fulfilled directly with the existing stocks in production warehouses without having to expand production capacity.

The period of weakness in the domestic industrial sector, which is still ongoing for the time being, is confirmed not least by the lack of momentum from abroad. The provisional Purchasing Managers' Index for the manufacturing industry in the eurozone even fell slightly to 46.1 points in February, weighed down by the German indicator deteriorating to 42.3 points. "The recession in the domestic industrial sector will continue for a few more months. But the improvement in the medium-term outlook suggests a return to at least moderate growth from around the middle of the year. After the almost 2% decline in industrial production in real terms, we expect goods manufacturing to increase slightly by just over 1% for 2024 overall", says Pudschedl.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at