UniCredit Bank Austria Business Indicator

Upturn slow to materialise

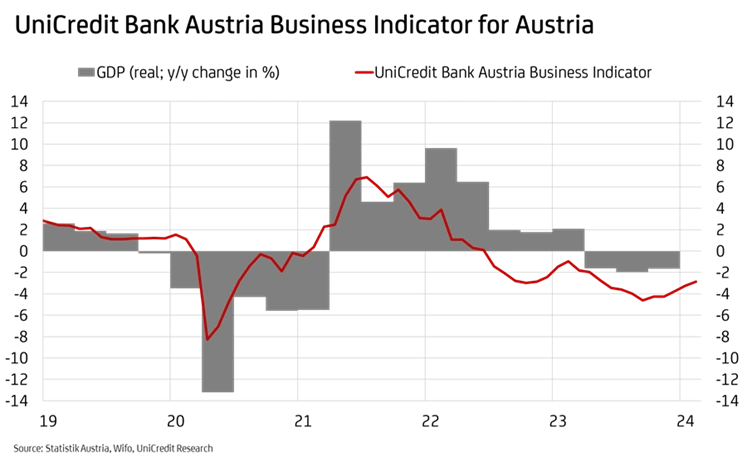

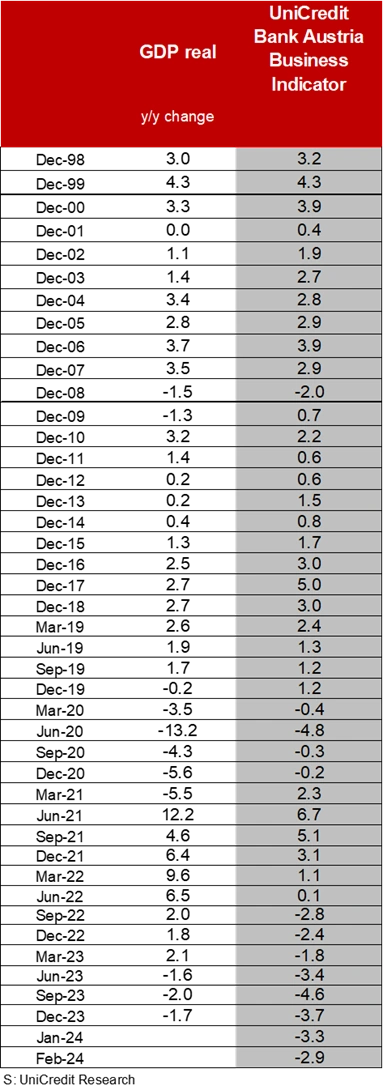

- UniCredit Bank Austria Business Indicator increases in February 2024, reaching minus 2.9 points

- Consumer sentiment and outlook for service providers bolstered following declining inflation and improved wage dynamics, but prevailing mood in construction and industrial sectors remains pessimistic

- Economy continues to move sideways but gradual improvement in economic conditions set to support moderate recovery around mid-2024

- Economic growth set to remain low in 2024 at 0.3% before accelerating to 1.5% in 2025 thanks to modest revival of investment and consumption

- Labour market challenges intensify: Unemployment rate expected to increase to at least 6.7% on average for 2024

- Inflation continues to slow: Significant reduction from 7.8% to 3.6% on average in Austria for 2024; figure at year end below 3%

- First rate cut inching closer: Key interest rates expected to fall in three increments of 25 basis points each between June and end of year

The economic situation in Austria has continued to improve at a very modest pace. "The UniCredit Bank Austria Business Indicator climbed to minus 2.9 points in February, reaching its highest level in nine months", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Despite this fifth consecutive improvement, the current indicator is still markedly below the long-term average and as such continues to point to a strained economic situation. That said, there is at least a modest upwards trend compared to the stagnant situation seen in the final quarter of last year, and this promises to bring a slight boost to economic output for the first three months of 2024." For the first quarter of 2024, the economists at UniCredit Bank Austria expect GDP to increase by 0.1–0.2% on the previous quarter.

Concern among consumers lessens and export environment improves slightly

The increase in the UniCredit Bank Austria Business Indicator in February was due primarily to the improvement in the mood among Austrian consumers. Sharp wage increases and a noticeable slowing of inflation contributed to a gradual improvement in purchasing sentiment, and this also had a positive impact on the mood among domestic service providers.

"In addition to the slight improvement in the outlook for the services sector, fuelled by increasing confidence among domestic consumers, the continuing consolidation of the export environment also currently points to a gradual easing of conditions in the Austrian economy", says Bruckbauer.

Momentum from abroad, however, is very weak and comes exclusively from outside of Europe. Neither the European industrial sector nor the export-focused Austrian industrial sector have responded in a noticeably positive way to the slight global tailwind in the first few months of the year. In Austria, the construction-related industrial sectors continued to feel the strain; metal processing, for example, was affected by the ongoing challenges in the construction sector. The lack of new orders dampened sentiment in the sector, especially in structural engineering and construction-related areas.

Despite the further improvement, economic sentiment in Austria was pessimistic across all sectors of the economy in February 2024, and was particularly negative in the services and industrial sectors. By direct comparison with the eurozone, economic sentiment was significantly worse in Austria across all sectors of the economy. While the gap in sentiment did narrow in the services and construction sectors, it widened somewhat in the industrial economy.

Weak growth in 2024 but momentum set to improve slightly in 2025

The current business and sentiment indicators continue to point only to largely sideways momentum in the Austrian economy over the coming months. "We are optimistic that the gradual improvement in conditions will continue and that a significant revival of the Austrian economy will be seen from the middle of the year onwards. Given the cautious start to the year, however, we expect economic growth for 2024 as a whole to be rather weak at 0.3%. With some tailwind from less restrictive monetary policy, a stronger increase in GDP of up to 1.5% should be possible in 2025", says UniCredit Bank Austria Economist Walter Pudschedl.

Unemployment rate continues sustained upwards trend

Owing to the ongoing economic slowdown, the situation on the Austrian labour market is likely to continue deteriorating into autumn 2024. The employment rate is even likely to fall slightly over the coming months, while the number of job seekers is expected to increase even more strongly than before. The seasonally adjusted unemployment rate, which was 6.7% in each of the first two months of the year, will therefore continue to move upwards, although only modestly. The labour market is set to remain fairly resilient against economic trends, but the willingness to retain a skilled workforce, particularly in the construction and industrial sectors, appears to be declining.

Despite the pace of recovery remaining only moderate, the upwards trend in unemployment is expected to reverse again towards the end of 2024. "We expect the unemployment rate to rise to at least 6.7% on average for 2024, up from 6.4% in 2023. As a result of the moderate economic upturn, the unemployment rate is likely to drop back again in 2025 to an average of 6.5%", says Pudschedl. While the labour market situation in the services sector should improve again as early as the second half of 2024, the upwards trend in unemployment for both the construction and industrial sectors is expected to continue throughout the year.

Inflation still declining

With the second-round effects triggered by higher energy prices gradually phasing out, the decline in inflation is set to continue over the course of 2024. "Given the inflation trend in the first few months of the year, we remain optimistic that inflation will slow to below 3% by the end of 2024. Following an average of 3.6% for 2024, we expect inflation of 2.3% in Austria in 2025", says Pudschedl.

Given the favourable inflation trend right across Europe, the UniCredit Bank Austria economists believe that interest rate reductions are coming ever closer. "We still anticipate a first rate cut from the ECB in June, with a delayed start to the easing cycle being the main risk. The ECB will take a cautious approach, gradually lowering the rate in increments of 25 basis points; there will be cumulative interest rate cuts of 75 basis points this year and 100 basis points in 2025", concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at