UniCredit Bank Austria Purchasing Managers' Index in March:

Recession in Austrian industrial sector continues, but expectations are improving

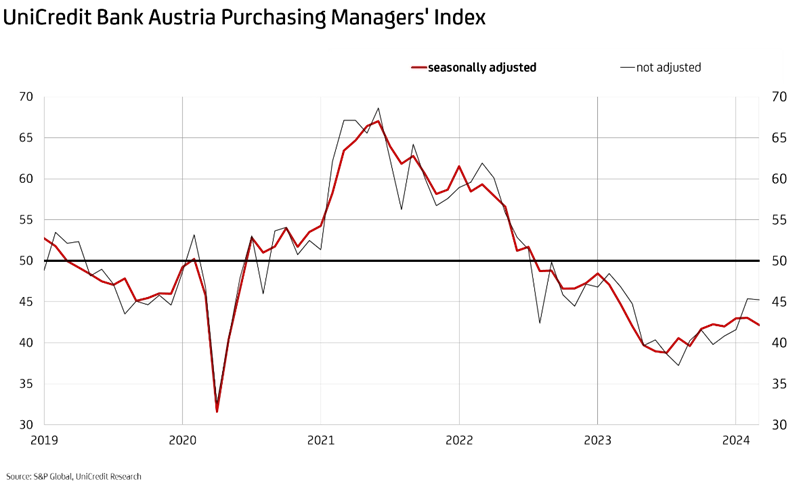

- March sees UniCredit Bank Austria Purchasing Managers' Index fall to 42.2 points, placing it below 50-point growth threshold for 20th month in a row

- Despite accelerated decline in new business, Austrian businesses cut back production output less drastically than in previous month

- Job cuts continue in March at slightly increased rate

- Weak demand triggers increased inventory reduction

- Costs and output prices fall at faster rate than in previous month

- However, growing optimism for future: Production expectations for domestic industrial businesses for coming months rises to two-year high

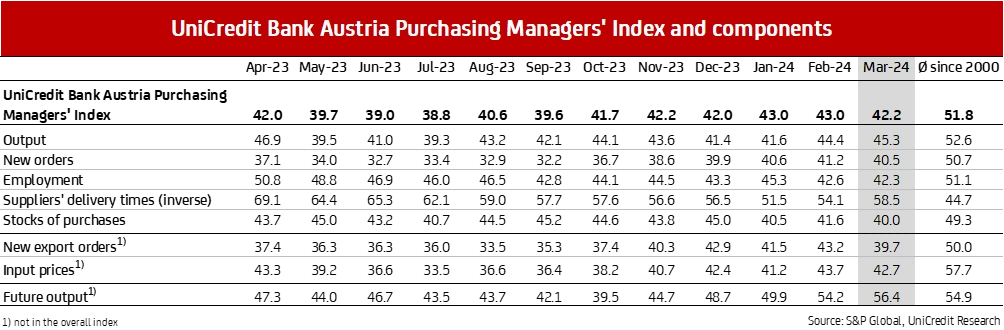

The hesitant improvement in the industrial economy that began last autumn suffered a setback in the first quarter of 2024. "The UniCredit Bank Austria Purchasing Managers' Index decreased by 0.8 to 42.2 points in March. This was due to the accelerated slump in new business, faster job cuts, a rapid reduction in inventory and increased price reductions. Only the slower reduction in production output helped to mitigate the indicator's decline, which has now fallen below the 50-point mark signifying the threshold for growth for the 20th month in a row", says UniCredit Bank Austria's Chief Economist Stefan Bruckbauer.

Austria was not the only country in which the easing of the industrial economy was disrupted in March. "The preliminary Purchasing Managers' Index for the manufacturing industry in the eurozone fell to 45.7 points in March, weighed down by declines in the industrial powerhouses of France and Germany. Despite this setback, European industrial businesses are optimistic and expect production to increase in the coming months", says Bruckbauer.

Business expectations improved throughout Europe in March. The expectation index rose to 56.7 points in the eurozone, buoyed by the increase to 51.9 points in Germany. Austrian industrial businesses are now more optimistic than their German business partners: the expectation index rose to 56.4 points in March, even exceeding the long-term average. "Hopes of an economic recovery and interest rate cuts in the second half of 2024, as well as expectations of successful expansion into new, more dynamic sales markets, fuelled domestic businesses' optimism, despite the current economic slowdown", says Bruckbauer.

Fewer new orders, especially from abroad

The deterioration in the order situation, which began almost two years ago, continued at the end of the first quarter of 2024. The positive trend of recent months, which led to February seeing the lowest drop in new orders in a year, was reversed in March. The index for new business fell to 40.5 points, mainly impacted by a particularly sharp decline in the intermediate goods segment. Foreign demand in particular fell significantly in March, with many businesses citing a reduction in incoming orders from Germany as the primary cause.

"Full warehouses and a low willingness to invest accelerated the decline in new domestic and, in particular, international orders, triggering Austrian industrial businesses to significantly reduce production in March. However, production output declined less sharply than in the previous month. The production index rose to 45.3 points, its highest level for almost a year", says UniCredit Bank Austria Economist Walter Pudschedl.

Even more jobs lost in the industrial sector

Despite the decline in production slowing, job cuts in the Austrian industrial sector once again accelerated somewhat in March. The employment index fell to 42.3 points, indicating the highest rate of staff reduction since job cuts started almost a year ago. "Due to the prevailing order slump, the majority of domestic industrial businesses reduced their workforce in March. In addition to the lack of production capacity utilisation, the reduction in personnel was also caused by increased efforts to cut costs following high wage increases", says Pudschedl, adding: "The upward trend in unemployment in manufacturing will continue in the coming months. After an average of 3.2% in 2023, the unemployment rate in the industrial sector is expected to reach around 3.6% in 2024. This means that the unemployment rate in the industrial sector will, despite an above-average increase, remain significantly lower than the rate for the economy as a whole of 6.7%."

Lower inventories, lower costs

In order to better position themselves in the currently weak demand environment, domestic businesses placed more emphasis on not only reducing personnel costs, but also cutting back on storage costs. For the sixth month in a row, stocks of finished goods declined at a moderate but slightly increasing rate. Stocks of purchases were reduced to a significantly greater extent, pointing to cautious business planning by the Austrian industrial sector due to the high degree of uncertainty.

"In view of the lower production requirements, inventories of primary materials and raw materials were reduced to an extent last seen in autumn 2009. This was not only driven by declining demand, but also by greater efforts to increase liquidity. This strategy was supported by the improved availability of materials, as delivery delays due, among other things, to problems on the shipping route through the Red Sea, were rare", says Pudschedl. Delivery times in March were shortened to an extent not seen for over six months.

Falling costs hamper producer prices

Due to the lower demand for raw materials and primary products, domestic businesses reduced their purchasing volumes again in March, which helped to accelerate the decline in purchasing prices. In addition to wood, paper and packaging, many metals have also become cheaper. Declining energy prices also pushed costs down. "Due to fierce competition and customers' demands to pass on the reduced costs, the ongoing price reduction in purchasing had a greater impact on output prices than in the past three months. Nevertheless, output prices have fallen more slowly than input prices, so on average the earnings of domestic businesses ought to have improved again somewhat", says Pudschedl.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at