UniCredit Bank Austria Purchasing Managers' Index in May:

Austria's industrial sector could soon overcome stagnation

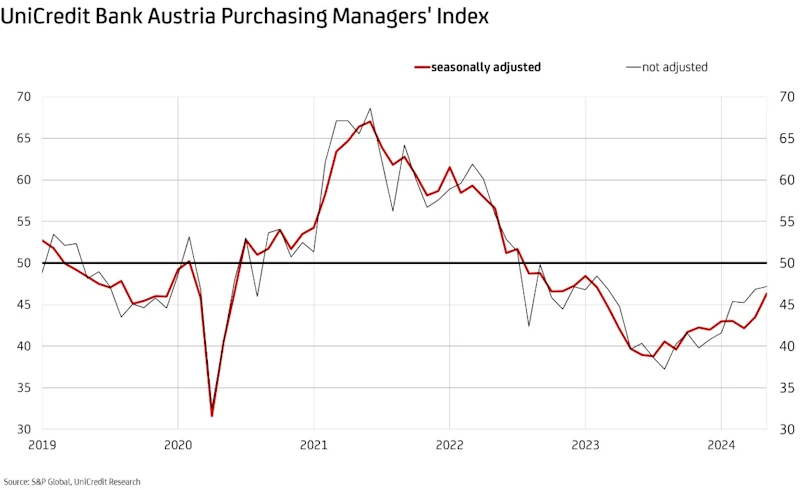

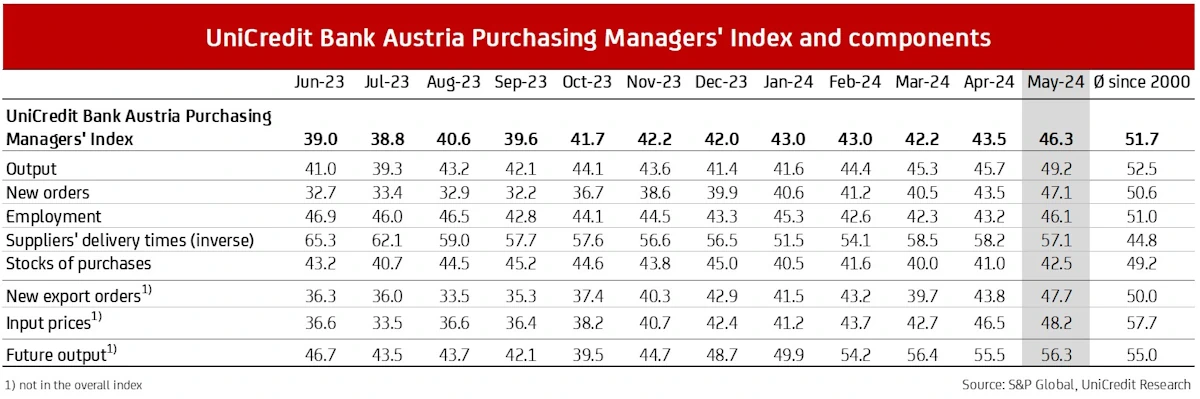

- UniCredit Bank Austria Purchasing Managers' Index rose to highest level in 15 months in May at 46.3 points

- Production output fell only slightly as decline in new business slowed significantly

- Industrial economy stabilising, with order-to-stock ratio suggesting that production will soon increase for first time in two years

- Output expectation index for next 12 months reached 56.3 points

- Slower decline in input and output prices at varying rates lead to first deterioration in earnings in a year and a half in May

- Renewed reduction in purchasing volumes resulted in further reductions in stocks of purchases, but at slower pace than previous month in both cases

- Decline in stocks of finished goods indicated sales problems easing

- Pace of job cuts slowed in May, but sector unemployment rate continued to rise to seasonally adjusted 3.8%

The monthly survey of Austrian purchasing managers in the manufacturing industry showed encouraging results for May. "The UniCredit Bank Austria Purchasing Managers' Index continued on its upward trend at an accelerated pace. The indicator rose to 46.3 points in May, reaching its highest value in 15 months. However, this still falls short of the 50-point mark that would signal growth in the domestic industrial sector", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

For the second time in a row, all of the indicator's components simultaneously contributed to the UniCredit Bank Austria Purchasing Managers' Index increasing. "For the first time in two years, production showed clear signs of stabilising in May thanks to the decline in orders slowing down significantly. Price and stock trends also indicated a reduction in the shortage of demand. The situation on the labour market continued to worsen, but this was at least at a noticeably slower pace", says Bruckbauer, summarising the details of the survey's key results.

Support from international upward trend

In light of the cautious signs of the situation stabilising, the end of the recession in the domestic economy seems to be on the horizon. "There is increased optimism amongst Austrian industrial companies. For the fourth month in a row, the expectation index for the next 12 months showed an increase in production and even rose to 56.3 points in May, placing it slightly above the long-term average", says Bruckbauer, adding: "For the first time in two years, the index's ratio for new business to stocks of finished goods also indicated that, due to low inventory levels, the only way to meet demand is to increase production. This means that domestic industry is expected to return to growth in the coming quarter."

These positive expectations are also underpinned by trends in Austria's key sales markets. The provisional Purchasing Managers' Index for the manufacturing industry showed a clear upward trend in all major industrial countries in May. The current values in the US and the UK even indicated growth. While the preliminary Purchasing Managers' Index in the eurozone remained below the growth threshold, it did rise to 47.4 points as a result of widespread support from almost all European countries, driven by Germany.

Production index at highest level in two years

The decline in production output in domestic industry fell significantly in May. The corresponding indicator has already been trending upwards since December and has now accelerated significantly.

"May saw the production index reaching its highest level in two years, climbing to 49.2 points, where it sat just below the growth threshold. This was thanks to significantly fewer sales problems. The decline in new orders slowed noticeably, in particular from abroad", says UniCredit Bank Austria Economist Walter Pudschedl. The export orders index rose by almost 4 points to reach 47.7 in May — its highest result since May 2022, when the indicator first showed a decline in demand from abroad.

Warehouse management on the offensive

The continuing decline in new business resulted in domestic companies reducing their purchasing volumes in May. This also led to stocks of purchases decreasing. In both cases, however, the decline slowed as a result of sales problems easing somewhat. "Following the increase last month, stocks of finished fell in May at the highest rate seen this year. This indicates that domestic industrial companies were pleasantly surprised by the strength of demand", says Pudschedl. The differing stock trends in purchasing and sales underscores the ongoing stabilisation of the industrial economy, which is accompanied by a gradual departure from the extremely cautious stock policy of recent months.

Decline in costs slowed while output prices remained stable

The upward trend in the industrial economy has also been reflected in price trends. In view of the demand environment being more stable, costs decreased at a significantly slower rate in May compared to previous months. At the same time, the pace of price reductions in sales remained stable.

"As a result of the lower decline in input prices on the previous month in comparison with output prices, the earnings situation of domestic businesses has generally worsened for the first time in about a year and a half", says Pudschedl.

Unemployment increasing but labor shortages persist in some federal states

With the decline in production slowing, the pace of job losses in the Austrian industrial sector also slowed slightly in May. The employment index rose to 46.1 points, reaching its highest level in nine months, though unemployment still continued on the upward trend seen in recent months. "The number of job seekers reached figures of around 25,000 in May, correlating to a seasonally adjusted unemployment rate of 3.8%. This means that while the 6.8% unemployment rate in the sector was relatively low compared to the economy on the whole, it was still a significant 0.8 percentage points above the lows recorded at the beginning of 2023", says Pudschedl, adding: "Despite the rise in unemployment, some sectors are still experiencing labor shortages. As well as discrepancies between the qualifications required for positions and those offered by candidates, a regional imbalance is clear to see. In Salzburg, Tyrol and Upper Austria, for example, data shows that there are fewer than two jobseekers per vacancy in manufacturing."

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at