UniCredit Bank Austria Business Indicator

Burgeoning economic recovery slowly gaining momentum

- UniCredit Bank Austria Business Indicator rises to highest level in a year in May at -2.0 points

- Mood improving in all sectors of economy; sustained upturn in export environment

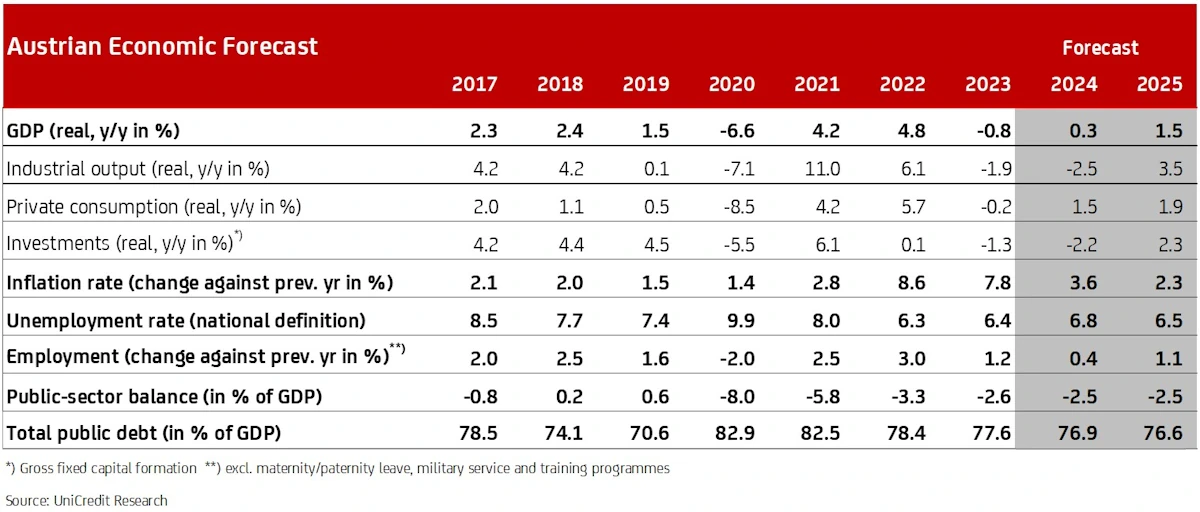

- Following slight downturn in H1, further momentum in H2 set to fuel economic growth of 0.3% for 2024 as a whole

- ECB's first rate cut fuels hopes of higher GDP growth of 1.5% for 2025

- Inflation getting harder to dampen: rate of approx. 3% expected by end of 2024, with annual average rate of 3.6%; rate of approx. 2% expected by end of 2025, with annual average rate of 2.3%

- Modest economic recovery not yet adequate to bring down unemployment rate; increase to 6.8% expected for 2024, followed by drop to 6.5% in 2025

- ECB expected to make further rate cuts of 25 basis points per quarter

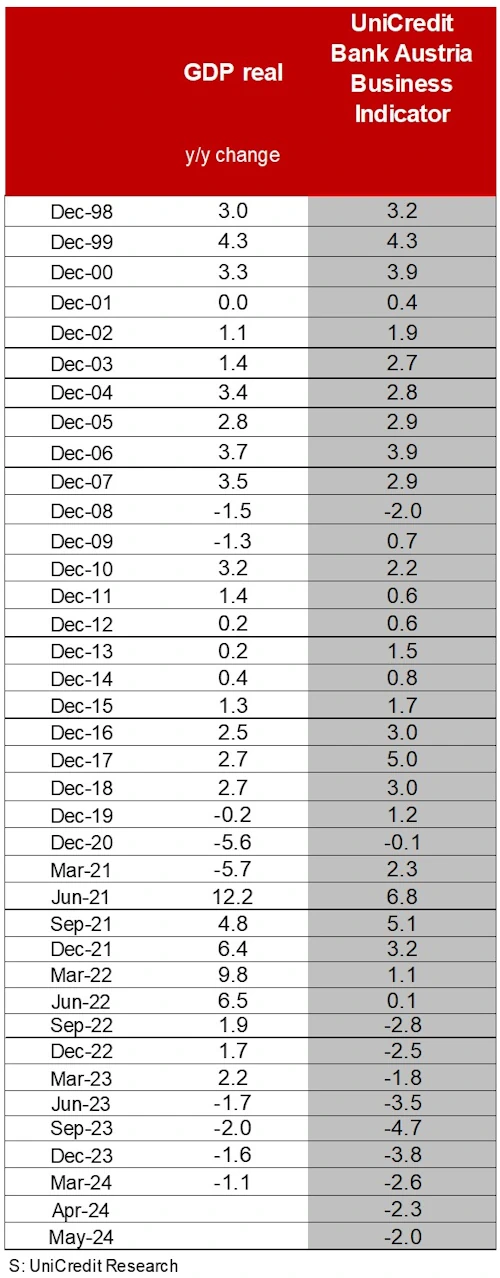

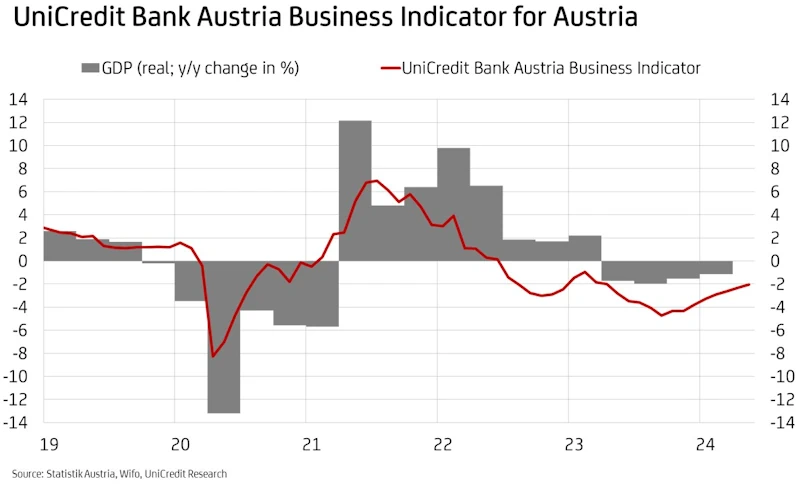

The economic situation in Austria continues to gradually improve. "The UniCredit Bank Austria Business Indicator rose to -2.0 points in May. Although this figure reveals that economic growth is still very modest and on the verge of being stagnant, the indicator has at least reached its highest point in the last two and a half years", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "The domestic industrial sector has been very slow to get going, but there is a consistent upward trend. Our business indicator has now reported economic improvement for eight consecutive months — something that last happened during the recovery phase from spring 2009 onwards after the financial crisis."

Mood improving simultaneously in all sectors of the economy

The improvement in the UniCredit Bank Austria Business Indicator in May was underpinned by a brightening of mood in all economic sectors. "Despite a little headwind from a decline in consumer sentiment, the business outlook in the services sector improved noticeably. The construction and domestic industrial sectors also continued to experience a moderate improvement in sentiment, driven in particular by renewed momentum in the global export environment", says Bruckbauer.

The improvement in the export environment, evident from the noticeable increase in the index for global industrial sentiment weighted by the Austrian share of trade, was driven by the stabilisation of the industrial economy in the eurozone and sustained improvement in key growth markets, particularly China. This had a positive impact on the economic assessments made by domestic industrial businesses. That said, the outlook remained subdued in the face of continuing weakness in the order situation and high energy and personnel costs, which are having an unfavourable impact on Austria's international competitiveness. In the construction sector, too, the situation remained muted due to high cost dynamics, but there are growing signs of an improvement in demand. Confidence also grew in the services sector in May, due to a strong start to the tourism season and initial signs of retail sales stabilising due to the real growth in purchasing power in recent months.

Recovery continues at slightly brisker pace

Over the coming months, the improved sentiment will further underpin the recovery that the Austrian economy has begun to experience, and the pace of the recovery is even likely to increase slightly.

"Following a slight increase in GDP in Q1—up 0.2% on the previous quarter—the domestic economy is expected to grow by the same amount in Q2. We even anticipate slightly stronger growth rates in H2. Taking into account the fact that GDP in H1 was down slightly by around half a percentage point on the previous year, limited economic growth of 0.3% should be possible for 2024 as a whole", says UniCredit Bank Austria Economist Walter Pudschedl. The continued revival of private consumption, which is benefiting from real wage increases, should contribute to the slight acceleration of economic momentum in H2. As such, many of the service sectors are likely to become the mainstay of the recovery in Austria.

"The monetary policy turnaround initiated in June by the ECB is bolstering the economic outlook, although the rate-cutting phase now underway is not likely to have a positive effect in terms of reviving investment until 2025 — with the domestic industrial sector and construction being the main beneficiaries. The result of these developments will be a broader base of economic growth in 2025, increasing to around 1.5%", says Pudschedl.

Labour market remains relatively stable despite weak economy

As things stand, modest economic development continues to drive a slight deterioration of the situation on the Austrian labour market. The seasonally adjusted unemployment rate rose to 6.9% in May; this is the highest figure since December 2021.

"The slight upward trend in unemployment will continue over the coming months. The improved economic performance should begin to have a stabilising effect towards the end of the year, however, driving a drop in unemployment in the year ahead. We expect the unemployment rate to sit at 6.8% on average for 2024 before falling to 6.5% in 2025. These developments will be driven by both the improved economic situation and the tight labour market", says Pudschedl.

Inflation falls to lowest point in 2.5 years but progress likely to stall for now

Inflation has fallen significantly since the start of the year, dropping to 3.3% year on year in May — the lowest figure in two and a half years. Inflation is likely to fall further over the course of the summer as lower wholesale prices of gas and electricity are passed on to households, but second-round effects in the services sector are proving slow to materialise and this is likely to slow down disinflation. "With inflation having declined noticeably since the start of the year, the disinflation process will all but stagnate in H2. Inflation is likely to fluctuate around the 3% mark until the end of the year. We continue to expect average inflation of 3.6% for 2024, but hopes of a slightly lower figure are slowly growing", says Pudschedl, adding: "We still expect inflation in Austria to fall to an average of 2.3% for 2025."

ECB begins rate cuts as expected, taking cautious approach for now

In the context of a sharp fall in inflation, the ECB made its first cut to key interest rates in June. Neither overall nor core inflation are likely to slow further to any significant degree in the eurozone over the coming months, which means the ECB is not likely to make its next rate cut until September. "We expect the ECB to continue cutting interest rates at 25 basis points per quarter, i.e. further cuts are likely in September and December. The ECB will base its decisions on inflation trends in the services sector, the potential risk of a commodities price shock and the impact the US Federal Reserve's policy has on Europe", says Bruckbauer, adding: "Given that we expect average inflation in the eurozone to fall to below 2% over the coming year, we anticipate further easing of 100 basis points. This means the deposit interest rate is likely to be 2.25% at the end of 2025."

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at