UniCredit Bank Austria Purchasing Managers' Index in June:

Setback on road to recovery for Austrian industrial sector

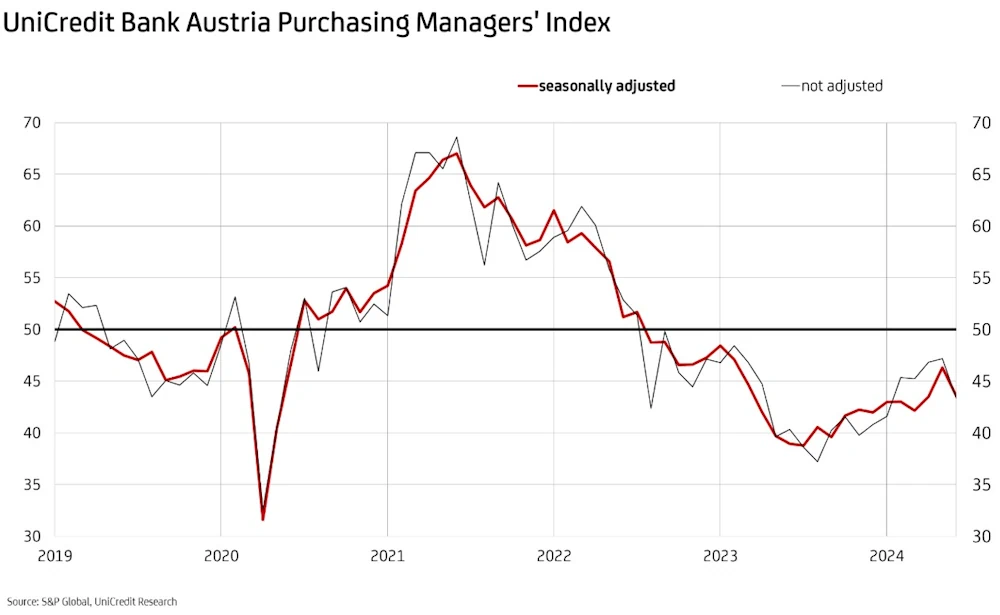

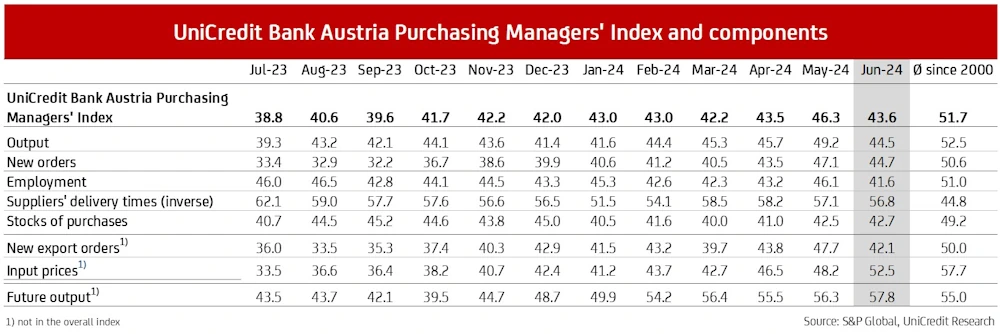

- Upward trend halted: UniCredit Bank Austria Purchasing Managers' Index falls to 43.6 points in June

- Production drops significantly following another slump in new orders, especially from abroad

- Declining demand accelerates job losses in domestic industrial businesses

- Lower purchasing volumes provoke further reduction in stocks of purchases; stocks of finished goods decreases less sharply

- Sluggish demand prompts renewed price reductions in sales

- First input price increase in 16 months causes earnings to trend downwards

- Short-term economic outlook worsens but expectation index for industrial output for next 12 months rises to 57.8 points, its highest level since early 2022

The positive performance of the Austrian industrial sector in the last few months has come to an abrupt halt. "Instead of the slight upward trend seen in recent months continuing as expected, the UniCredit Bank Austria Purchasing Managers' Index fell significantly in June to 43.6 points. This means that the indicator has moved even further away from the 50-point mark that indicates growth in the domestic industrial economy", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Unfortunately, the previous month's encouraging results failed to hold true. Hopes of a recovery in the industrial sector have been pushed a little further down the road again — the trend towards stabilisation in industry has been set back in the rest of Europe too and this has played no small part."

In the eurozone, the preliminary Purchasing Managers' Index for the manufacturing industry fell to 45.6 points, its lowest level this year. Growing weakness in demand on the export markets caused significant declines in output in both Germany and France. "Despite the economic environment improving around the world, setbacks in Europe are weighing on the industrial sector in Austria and it is consequently unable to generate momentum", says Bruckbauer, who summarises the results of the monthly survey of Austrian purchasing managers in the manufacturing industry as follows: "New orders from Germany and abroad fell massively in June, with output being cut back considerably and redundancies made with increased speed. Careful warehouse management led to lower purchasing volumes and subsequently to lower inventory levels. While sluggish demand triggered output price reductions, costs increased for the first time since the start of 2023."

Dampened demand at end of second quarter

The downturn in the domestic industrial sector in June was particularly evident in the unfavourable new orders trend. "The index for new orders dropped to 44.7 points; while this constitutes the second-highest level in the last year and a half, the upward trend seen in recent months has nonetheless reversed, with demand from abroad in particular falling very sharply. As a result, domestic businesses reduced their output substantially — at as high a rate as they did four months ago", says UniCredit Bank Austria Economist Walter Pudschedl.

The volume of orders on hand with domestic industrial businesses fell again in June, at a significantly faster pace than in the previous month and quicker than output. "By processing orders on hand, the industrial sector was able to maintain a higher level of production than the order books would otherwise have permitted. This led to a further reduction in delivery times in June as well. Despite ongoing geopolitical crises, such as the war in Ukraine and the conflict in the Middle East, global supply chains are currently working smoothly, due in part to weak demand", says Pudschedl.

Significant job losses in domestic industrial sector

Owing to dwindling demand and the significant cutbacks made to production in June, workforce downsizing in the Austrian industrial sector was carried out at a faster pace than in the previous month. The employment index fell to 41.6 points, signalling the harshest job cuts since the COVID-19 lockdowns were implemented in spring 2020. Consequently, unemployment continued on the upward trend seen in recent months.

"The number of job seekers reached over 25,000 in June, correlating to a seasonally adjusted unemployment rate of 3.8%. This means that while the 6.8% unemployment rate in the sector was low compared to the economy as a whole, it was still a significant 0.8 percentage points above the lows recorded at the start of 2023", says Pudschedl.

The unemployment rate in manufacturing is expected to rise to 3.8% on average in 2024, compared with just 3.2% in 2023.

Inventory levels down, costs up

The sharp decline in new business resulted in domestic businesses reducing their purchasing volumes in June. Consequently, stocks of purchases also continued to decline despite the significant cutbacks in production.

"Although the demand for primary materials declined, costs increased for the first time since the start of 2023. Energy prices combined with increased payroll costs contributed to higher cost dynamics than in the eurozone, Germany in particular, and this has increased concerns about the international competitiveness of domestic producers. Given that price reductions had to be made at the same time due to the difficult sales environment, the earnings situation of domestic businesses deteriorated on average in June, for the second month running", says Pudschedl.

Start of recovery in industrial sector delayed at best

Due to the deterioration of the UniCredit Bank Austria Purchasing Managers' Index in June to 43.6 points—in conjunction with setbacks both at home and in the eurozone, and in Germany in particular—hopes for continued stabilisation of the industrial economy in Austria and imminent recovery have been dashed.

As a rule, new orders are a good indicator of short-term economic development. "The marked acceleration of the decline in orders compared to the previous month could indicate that recovery in the domestic industrial sector is further down the line than originally anticipated", says Pudschedl, adding: "In fact, June saw the index ratio of new business to stocks of finished goods deteriorate dramatically, signalling that the poor order situation might even require further cuts to be made to production in the coming months."

According to economists at UniCredit Bank Austria, any recovery in the Austrian industrial sector is likely to be delayed further, but is not off the cards entirely. At any rate, in June domestic businesses viewed the business outlook for the year more positively than in the previous month: The expectation index rose to 57.8 points, which is not only above average but also the highest level since March 2022.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at