UniCredit Bank Austria Business Indicator

Industry slows down pace of economic recovery

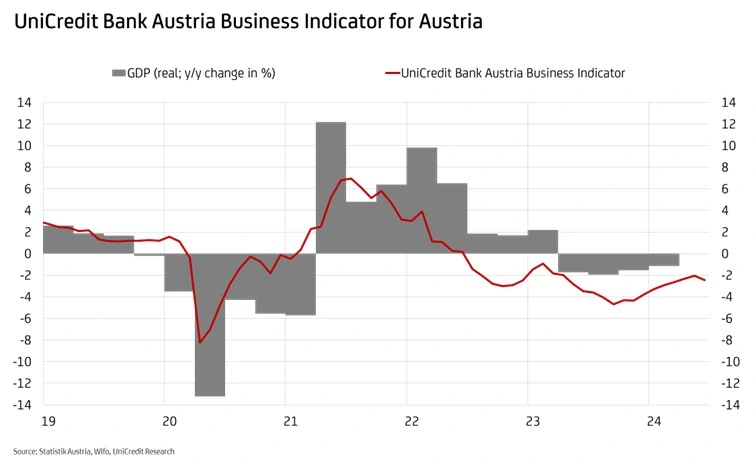

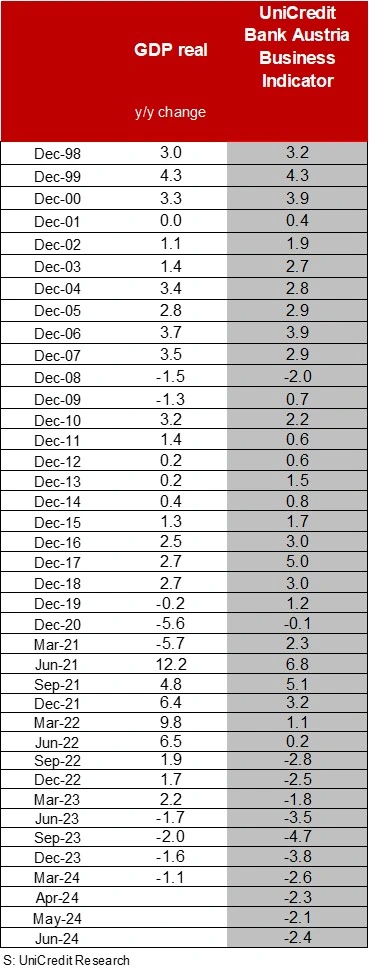

- UniCredit Bank Austria Business Indicator fell to minus 2.4 points in June

- Negative impact from significant deterioration in industrial sentiment and service sentiment due to industry-related service areas

- Recovery remains bumpy in the second half of the year: growth forecast for 2024 unchanged at just 0.3 %

- Monetary easing and global recovery should enable a slight acceleration in GDP growth to 1.5 % in 2025

- Inflation stabilises at around 3% in the second half of 2024. After an average of 3.6 % in 2024, inflation is likely to fall to 2.3 % in 2025

- We raise the unemployment rate forecast for 2024 to 6.9 % and 6.7 % on average for 2025

The recovery of the Austrian economy is making only sluggish progress, characterised by a high level of uncertainty. “The previously restrained but stable upward trend in the economy came to an end in the middle of the year. After rising for eight months, the UniCredit Bank Austria Business Indicator fell to minus 2.4 points in June,” says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: “Although the economy stabilised in the first half of the year, the pace of recovery remained slow. With the current setback, there are currently no signs of a better start to the second half of the year. The recovery is unlikely to gain any momentum over the summer, especially as there is no sign of an easing of the divergent economic trends in the service and manufacturing sectors.” While many service sectors are benefiting from the rising purchasing power of domestic consumers, production in industry and construction is continuing to be scaled back due to a weak order trend.

Declining sentiment in industry despite stable export environment

The deterioration in the UniCredit Bank Austria Business Indicator in June was primarily triggered by a slump in sentiment in industry. “Despite a stable export environment, sentiment in domestic industry deteriorated significantly in June. Business assessments in the service sector also fell slightly, although consumers are now more positive about the future than they were two and a half years ago. The moderate improvement in sentiment in the construction sector continued,” says UniCredit Bank Austria economist Walter Pudschedl.

While the global recovery is slowly making progress, Austrian industry has hardly been able to benefit from this so far. Increased energy and labour costs are having a negative impact on international competitiveness, which is reflected in persistently weak orders. Concerns in export-dependent sectors increased significantly towards the middle of the year. Sentiment deteriorated in the manufacture of plastics products and motor vehicles in particular. By contrast, business expectations in sectors that are heavily dependent on domestic demand, such as the food and beverage industry, were relatively positive. Optimism also continued to prevail in the services sector, although confidence declined somewhat in June. This was due to the worsening outlook for industry-related service areas, such as the provision of temporary workers. In contrast, real growth in purchasing power in consumer-related sectors such as accommodation and catering provided a further tailwind, especially as consumer sentiment continued to improve in June. The situation in the construction industry also improved again slightly despite the sharp price rises, supported by a moderate upturn in sentiment in building construction and special construction activities.

Recovery should continue, but the road remains rocky

Following the modest economic improvement in the first half of the year, the sentiment indicators now available do not point to any noticeable acceleration in the pace of recovery for the time being. “Driven by consumption, the moderate economic upturn will continue in the second half of the year, but without any significant acceleration. The ongoing reluctance to invest, due to the restrictive monetary policy and the unfavourable development of new orders in the domestic export-oriented production sector, stands in the way of this. We are therefore sticking to our modest growth forecast of 0.3 % for 2024,” says Pudschedl.

The economists at UniCredit Bank Austria have not made any changes to their growth forecast for 2025 either. The economic outlook should improve, supported by a slight acceleration in the global recovery and the gradual easing of monetary policy, so that at 1.5 %, a slightly higher and more broadly based GDP increase in Austria is possible compared to the current year.

Slight deterioration in the labour market also in the second half of the year

The weak economy triggered a slight increase in the unemployment rate from a seasonally adjusted 6.7 % at the turn of the year to 6.9 % in June. In view of the sluggish recovery, the restrained upward trend will continue in the coming months.

“In the second half of the year, the seasonally adjusted unemployment rate is likely to crack the 7 % mark. We have therefore raised our annual forecast for 2024 to 6.9 %. For 2025, we now expect the unemployment rate to fall to 6.7 % in 2025. In addition to the improved economy, the slow increase in the labour supply will also make this reduction possible,” says Pudschedl.

Inflation expected to fluctuate around 3 % in the second half of the year

The year-on-year decline in inflation continued until June to 3 %. With the help of the lowest value in almost three years, average inflation in the first half of 2024 has fallen to 3.8 %. In the second half of the year, inflation is expected to fluctuate around 3 % and therefore no further noticeable slowdown in inflation is expected. On the one hand, this is due to the fading of the dampening effects of the fall in energy prices. On the other hand, inflation in services is unlikely to slow down for the time being, as the strong wage increases will continue to exert high cost pressure, which can easily be passed on to consumer prices due to solid demand. This is offset by weak demand in the production sector, which should ensure subdued goods price inflation.

“For 2024, we expect average inflation of 3.6 %, but the likelihood that inflation could be somewhat lower has increased. Inflation should slow further to 2.3 % in 2025. While cost increases due to wage rises will keep inflation in services in particular on the rise, the underutilisation of capacity in the domestic economy should counteract any excessive upward pressure from goods prices,” says Pudschedl.

In view of the further decline in inflation throughout the eurozone, the ECB will continue to ease its monetary policy. “We expect the key interest rates to be reduced by 25 basis points at the end of this quarter and the next. By the end of 2025, the deposit rate should have fallen from the current 3.75 % to 2.25 %,” concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0) 5 05 05-41957;

E-mail: walter.pudschedl@unicreditgroup.at