UniCredit Bank Austria Analysis

Austria's exports: High world market share put to the test

- Over the past 25 years, globalisation has led to a significant decline in the global market share of industrialised nations in favour of the emerging markets

- Compared to the USA and the eurozone, Austria performed better in this period and recorded lower market share losses

- Over the past decade, the Austrian export industry has been able to keep its global market share stable at just under one per cent

- Strong export position creates prosperity in Austria: Austria's global market share in trade is ten times higher than the country's share of the world population and is almost twice as high as the share of Austrian GDP in global economic output

- However, a relatively low level of involvement in the emerging markets and the loss of competitiveness will pose challenges for the domestic export industry in the future

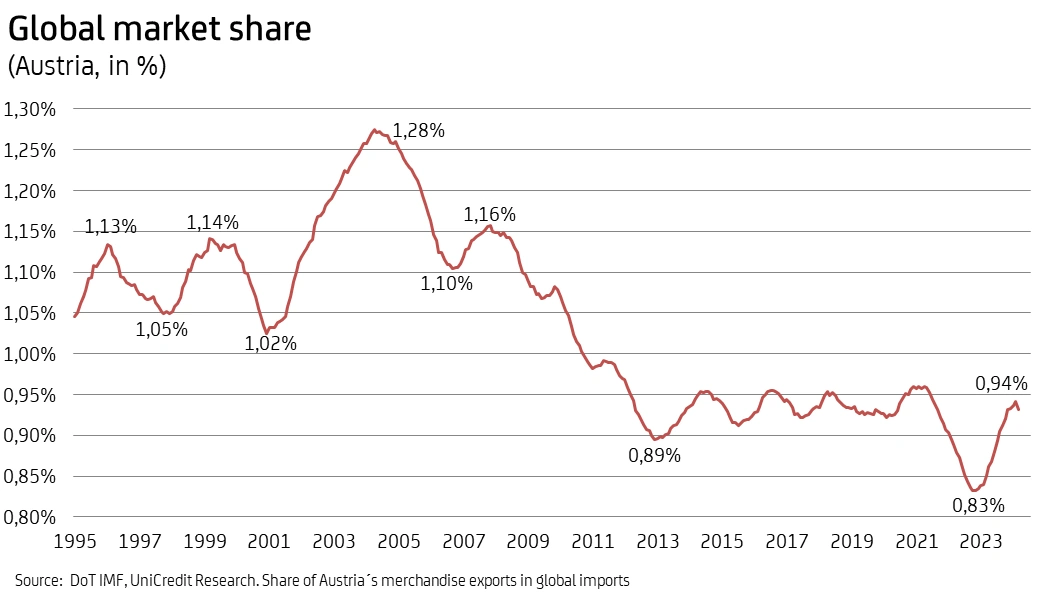

- The risk of a decline in Austria's global market share in the coming years has increased

“In the course of globalisation, the importance of industrialised countries in international trade has decreased significantly. The share of Austrian exports in global imports has also decreased compared to the early 2000s,” says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: “Compared to the USA or many other EU member states, however, Austria has been able to hold its own better. Over the past ten years, the global market share has even remained largely stable. In the first quarter of 2024, the share of Austrian exports in global imports was 0.94 per cent and has thus caught up with the average value of the past ten years after reaching a low during the coronavirus pandemic.”

Globalisation reduced the relative importance of industrialised countries, emerging markets increased

Globalisation has fundamentally changed world trade in recent decades. “The industrialised countries, which were still responsible for around 75 per cent of global exports in 2000, have lost much of their relative importance compared to the emerging markets, which are becoming increasingly integrated into global value chains. In 2023, the share of goods exported by industrialised countries was only 55% of global imports. In contrast, the share of exports from emerging markets rose from just over 25 per cent in 2000 to almost 45 per cent in 2023,” says UniCredit Bank Austria economist Walter Pudschedl.

The opening up of the Chinese economy played a significant role in this. The share of Chinese exports in global imports alone rose from 5.7 per cent in 2000 to 13.3 per cent in 2023. In contrast, the importance of the world's largest economic power, the USA, in international trade fell rapidly from 13.1 per cent to just 8.2 per cent. The share of exports from the current member states of the European Union in global imports (measured without trade between EU countries) has also decreased significantly over the past 25 years. However, with a decline from 13.4 per cent in 2000 to 11.8 per cent in 2023, this was lower than that of the USA. Within the European Union, all major trading nations have seen a decline in market share. Germany's global market share fell by over 20 per cent. Italy (down 29.3 per cent) and, above all, France (down 50.9 per cent) suffered even greater losses.

Successes in industrialised countries limit the Austrian export industry's loss of market share

“The decline in Austria's global market share from 2000 to the present day was below average at 17 per cent compared to other export-oriented industrialised countries. One of the reasons for this was that the Austrian export industry was even able to expand its position in the industrialised countries. However, it lost market share in the dynamically growing emerging markets,” says Pudschedl.

Austria's market share in industrialised countries rose to over 1.2 percent in the first quarter of 2024, an increase of almost 4 percent compared to the average value in the period from 2011 to 2020. This was due in part to a sustained upward trend in market share in the USA. The Austrian economy now accounts for 0.54 per cent of US imports, a doubling compared to the years 2000 to 2010 and an increase of 30 per cent compared to the years 2011 to 2020. In contrast, Austria's market share in the emerging markets was 0.5 per cent in the first quarter of 2024 and only 0.22 per cent in China, with a downward trend.

Successful companies ensure above-average market penetration in many sectors

Austria plays a far greater role in global trade than would be expected based on the country's population and economic output. Austria's global market share in trade is ten times higher than the country's share of the world population and almost twice as high as the share of Austrian GDP in global economic output.

In around 40 product groups (classification according to the Combined Nomenclature at two-digit level), the share of domestic exports in global imports is above the overall average. “The Austrian export industry has the highest global market share in the product group 'rail vehicles including signalling equipment' at over 4.5 percent. The top three successful domestic products also include 'wood and wood products' with a global market share of 3.6 per cent in 2023 and 'manufacture of metal products' with 3.3 per cent,” says Pudschedl.

The strong position on the global market in individual product groups is often the result of the success of a few or sometimes even just a single company. This can be assumed for the high global market share of 3 per cent in the “Artificial Textiles” sector, 2.7 per cent in “Beverages” and 1.2 per cent in “Glass and Glassware”.

Decline in Austria's global market share expected

In both the short and long term, the Austrian export industry faces major challenges if it is to maintain its strong position in international trade. From today's perspective, the risk of a decline in the global market share of Austrian exports has clearly increased in the coming years.

“On the one hand, the strong growth of the emerging markets, in which domestic exporters are only participating to a below-average extent, speaks in favour of Austria's declining importance in global trade in the long term,” says Pudschedl, adding: “On the other hand, the domestic economy appears to have lost competitiveness recently, which is currently reflected in a weakening industrial and export economy. The high wage settlements as a result of high inflation in Austria are a burden.”

Wage costs per employee have risen by around 15 per cent in Austria since 2022 and by 9.5 per cent in the eurozone. There was also a decline in labour productivity in Austria, as qualified employees were retained in companies despite production cuts. Unit labour costs have risen by almost 9 percent in Austria since 2022, by almost 7 percent in the eurozone and by 6.3 percent in Germany. According to the economists at UniCredit Bank Austria, in addition to the higher labour costs due to inflation, the comparatively higher energy costs compared to the US and other countries also have a negative impact on Austria's competitiveness.

Further information can be found in our analysis: “Fighting windmills”, UniCredit Bank Austria, July 2024.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0) 5 05 05-41957;

E-Mail: walter.pudschedl@unicreditgroup.at