UniCredit Bank Austria Purchasing Managers’ Index in July:

Persistent industrial slump has an impact on the labour market

- Bumpy start for industry in the second half of the year: UniCredit Bank Austria Purchasing Managers' Index fell to 43.1 points in July

- Lack of new business ensures continued production restrictions

- Biggest job cuts in the industry since the first lockdown during the coronavirus pandemic

- Price reductions in sales despite rising costs

- Cost-conscious warehouse management: Accelerated reduction of stocks of primary materials and stocks of finished goods

- Expectation index for industrial output for the next twelve months remains positive, albeit with a slight decline to 55.2 points

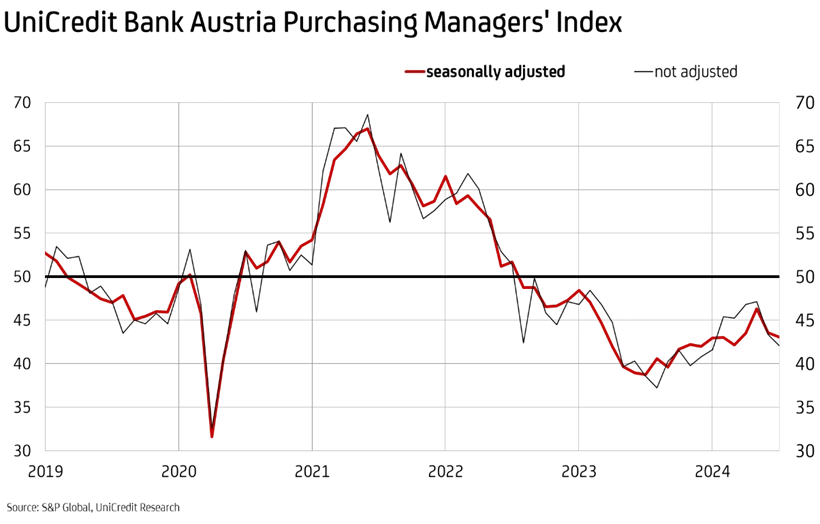

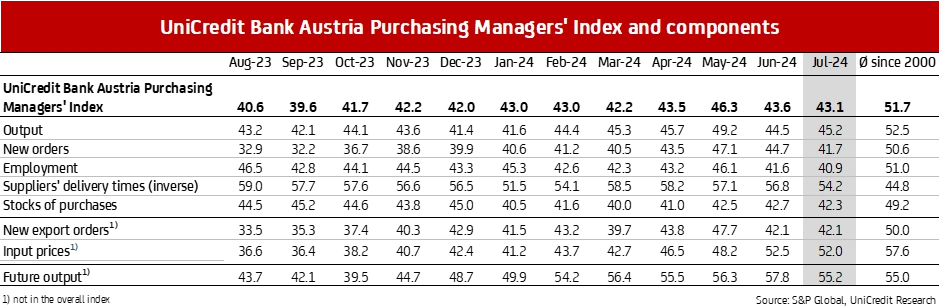

The second half of 2024 got off to a weak start for Austrian industry. “Following the decline in the previous month, the UniCredit Bank Austria Purchasing Managers' Index continued its downward trend in July. The index fell to 43.1 points, the lowest value since March”, says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: “The indicator has thus been below the 50-point mark that indicates growth in the domestic industry for exactly two years. It has also moved even further away from the growth threshold since the start of the summer. The signs of a recovery in domestic industry have now evaporated. A possible upturn is not expected before autumn.”

The international environment, especially in Europe, is also currently not providing any economic support for domestic industry. In the USA, the preliminary Purchasing Managers' Index for the manufacturing industry fell below the growth threshold for the first time this year. In the eurozone, the industrial recession deepened, as signalled by the fall in the Purchasing Managers' Index to 45.6 points. The continuing weakness of German industry, the most important sales market for Austrian suppliers, played a significant role in this.

“Due to an accelerated decline in new orders, domestic industrial companies further reduced their production output and staffing levels at the start of the second half of the year. As a result, purchasing volumes were reduced and inventories of primary materials and finished goods fell. Although costs increased slightly for the second month in a row, companies had to grant price reductions due to weak demand”, summarises Bruckbauer the results of the monthly survey of Austrian purchasing managers.

Declining order trend accelerated

The strongest contribution to the renewed decline in the UniCredit Bank Austria Purchasing Managers’ Index was made at the beginning of the second half of the year by the continuing weakening of new business. “The particularly sharp fall in domestic demand was responsible for the decline in the new orders index to just 41.7 points in July”, says UniCredit Bank Austria economist Walter Pudschedl, adding: “Domestic companies therefore reduced production significantly, albeit at a slower pace than in the previous month, as backlogs of orders were being worked off.” As a result, order backlogs in domestic industrial companies fell more sharply in July than in the previous month and at a faster rate than production. The order backlog index fell to 41.2 points, while the production index rose to 45.2 points, but with a value below 50, this is the 26th consecutive month that production has fallen compared to the previous month.

Increasing strain on the labour market

Due to the weak order trend, domestic industrial companies have now reduced their headcount for the 15th month in a row, and once again at a faster pace in July than in the previous month. The employment index fell to 40.9 points, indicating the sharpest reduction in staff numbers in industry since the start of the coronavirus lockdown in spring 2020.

“In the hope of an economic turnaround, domestic companies started to cut jobs much later than they started to reduce production. In the meantime, however, Austrian industrial companies have abandoned their reluctance to cut staff. Since the spring, employment has been falling faster than production, which should have a positive effect on the development of labour productivity after a long period of decline”, says Pudschedl, adding: “However, the upward trend in the unemployment rate in industry is now continuing at an accelerated pace. The number of jobseekers rose to around 25,500 in July, which corresponds to a seasonally adjusted unemployment rate of 3.8 per cent. On average for 2024, the unemployment rate in the domestic manufacturing industry is expected to rise to 3.8 per cent, compared to just 3.2 per cent in 2023.”

As unemployment has risen, the number of registered vacancies in manufacturing has fallen to below 9,000. The job vacancy rate has doubled within a year to around three jobseekers per vacancy. In no federal state is the job vacancy rate now below the 1.5 mark, which is the limit for inclusion on the so-called “shortage occupation list”.

Purchasing and inventories reduced, but costs rise

Due to the decline in new business, domestic companies once again significantly reduced their quantity of purchases in July. Despite the significant production cuts, stocks of purchases also continued to fall, even at a faster rate than in the previous month. Stocks of finished goods were also reduced further in July as part of a cost-conscious inventory management programme.

“Although demand for input materials fell sharply again, costs rose for the second month in a row. In addition to energy prices, higher personnel expenses also led to higher costs. At the same time, price reductions had to be granted again due to the difficult sales situation, meaning that the average earnings situation of domestic companies deteriorated for the third month in a row in July”, says Pudschedl.

No signs of industrial recovery at present

The decline in the UniCredit Bank Austria Purchasing Managers’ Index in July signals a further deterioration in industrial activity in Austria at the start of the second half of 2024. There are currently no signs of an improvement of the situation, as the downward trend in orders that has been ongoing for over two years has accelerated again. The index ratio of new business to stocks of finished goods deteriorated significantly in July. Due to the lack of new orders, a further reduction in production capacity is to be expected in the immediate future.

“In view of the weakening demand environment, hopes of a recovery starting in the second half of 2024 have been postponed”, says Bruckbauer and concludes: “At least domestic companies continued to see the business outlook for the year as a whole as positive in July. However, the expectations index fell to 55.2 points, increasingly burdened by concerns regarding the competitiveness of domestic industrial companies on global markets in light of high labour cost dynamics and comparatively high energy prices.”

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Phone: +43 (0)5 05 05-41957;

E-mail: walter.pudschedl@unicreditgroup.at