UniCredit Bank Austria Business Indicator

Recovery trends in the Austrian economy have faded, GDP forecast has been lowered

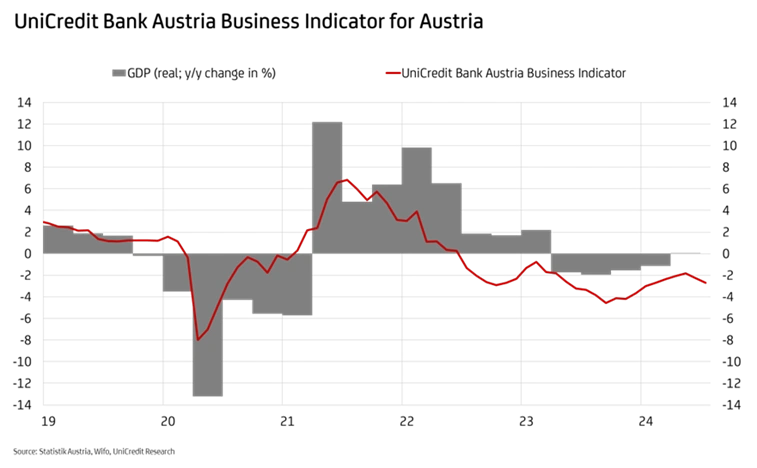

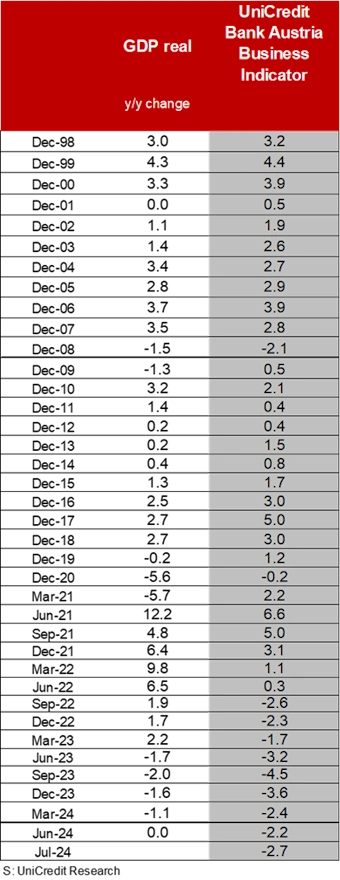

- The UniCredit Bank Austria Business Indicator fell to minus 2.7 points in July

- Persistently poor sentiment in the industrial and construction sectors had a stronger impact on the service sectors

- Political and economic uncertainties increased consumer pessimism

- Chances of a noticeable recovery before the end of the year diminished: only stagnation expected for 2024 as a whole

- Monetary easing, easing inflation and global recovery should ensure economic growth of 1.5 per cent in 2025

- Deterioration on the labour market continues: Unemployment rate expected to average 7.0 per cent in 2024. Continued good prospects for slight easing in 2025

- Weak economy dampens inflation: we have lowered our inflation forecast for 2024 from 3.6 to 3.3 per cent

Sentiment in the Austrian economy deteriorated at the start of the second half of the year. “The UniCredit Bank Austria Business Indicator fell to minus 2.7 points in July, the second deterioration in a row. The tentative signs of an improvement in the economic situation since the beginning of the year evaporated over the summer. The prospect of an imminent recovery of the domestic economy has clearly been postponed”, says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: “After the slight growth at the beginning of the year, the Austrian economy only stagnated in the spring. The renewed decline in our business indicator at the start of the second half of the year suggests that growth will remain sluggish for the time being, with no clear upward trend. We have therefore lowered our GDP forecast for 2024 slightly from 0.3 to 0.0 per cent. Only stagnation is in sight for the Austrian economy this year.”

For 2025, the economists at UniCredit Bank Austria expect a slight improvement in the economy, supported by a revival in the global economy as a result of the relatively synchronised easing of monetary policy worldwide. This should improve the framework for investments in Austria. The strengthening of consumer purchasing power due to continued real wage growth should also have a positive impact on the domestic economy in 2025 via consumption. Economic growth of around 1.5 per cent therefore still seems within reach in the coming year.

Uncertainty weighs on the service sector

“The assumption that the revival in many service sectors, driven by the fall in inflation and the sharp rise in real wages, could have a positive impact on the economy in industry and construction and thus trigger a noticeable recovery in the domestic economy has not yet materialised. On the contrary, the weakness in the manufacturing sector continues and is increasingly spreading to various service sectors”, says Bruckbauer.

Uncertainty caused by geopolitical crises, high cost increases and the deteriorating situation on the labour market dampened the mood of domestic consumers in July. Business assessments in the service sector fell to their lowest level since the beginning of the year due to the renewed increase in consumer restraint, and this was also clearly reflected in real declines in retail sales. Demand expectations were very mixed in the individual sectors at the beginning of the second half of the year. The weakness in construction and industry had a particularly negative impact on the other business services sector. However, the mood in the accommodation sector also began to suffer, primarily due to the high price level compared to other destinations in Europe and overseas.

Despite a deterioration in the export environment, sentiment in Austrian industry and construction improved slightly in July. However, sentiment remained clearly pessimistic, which suggests that the recession in these sectors of the domestic economy is continuing.

“While sentiment in industry and construction has eased slightly, the outlook in the services sector deteriorated in July, especially as consumer confidence fell again. Sentiment in all sectors of the domestic economy was pessimistic at the start of the second half of 2024, in some cases significantly below the long-term average. In addition, sentiment in all economic sectors in Austria was worse than in the eurozone as a whole, with the gap being particularly marked in industry”, says UniCredit Bank Austria economist Walter Pudschedl.

Unemployment rate already above 7 per cent in July

Given the weakness of the economy, the situation on the labour market has steadily deteriorated since the beginning of the year. At the beginning of the second half of the year, the seasonally adjusted unemployment rate rose to 7.1 per cent, its highest level since September 2021. Industry and the construction sector in particular accounted for a comparatively high proportion of the rise in the unemployment rate. In both sectors, employment in 2024 to date has fallen compared to the previous year, with the construction industry even seeing a decline of around 3 per cent.

Employment rose exclusively in the service sector, which was still enough for a slight increase of 0.2 per cent year-on-year for the economy as a whole. Due to the significant slowdown in employment growth, the number of jobseekers in Austria rose by more than 10 per cent by July. In the construction industry, the increase was an above-average 12 per cent and in industry it was as high as 18 per cent. The 18 per cent rise in the unemployment rate in industry was therefore also the highest of all economic sectors. However, at an average of 3.6 per cent, the unemployment rate in industry remains the lowest, while the highest unemployment rate of over 10 per cent can be found in the construction sector.

“The upward trend in the unemployment rate is likely to continue in the second half of the year, driven by the ongoing problems in construction and industry. However, conditions in the services sector are also likely to deteriorate further. We have therefore raised our forecast for the unemployment rate in 2024 to an average of 7.0 per cent. The relatively slow increase in labour supply will prevent a significant deterioration in the coming months and, together with the slightly better economic development in 2025, will ensure a slight easing. We expect the unemployment rate to fall to 6.9 per cent”, says Pudschedl.

Economic slowdown favours stronger decline in inflation

According to preliminary figures, inflation fell to below 3 per cent for the first time in exactly three years at the beginning of the second half of the year. Inflation thus averaged 3.6 per cent in the first seven months of 2024. In addition to the fall in energy prices, the weak economy, which dampened the second-round effects in the services sector, also contributed to the reduction in general inflation in recent months. Second-round effects are also likely to remain relatively limited in the coming months due to low demand.

“Despite an upward trend in energy prices, which will push inflation back up towards three per cent towards the end of the year, average inflation in 2024 remains below our previous expectations. We have lowered our inflation forecast for 2024 from 3.6 per cent to 3.3 per cent. For 2025, we continue to expect inflation to fall to an average of 2.3 per cent”, says Pudschedl.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0) 5 05 05-41957;

E-mail: walter.pudschedl@unicreditgroup.at