UniCredit Bank Austria industry overview

Weak start to the second half of 2024 for most sectors in Austria

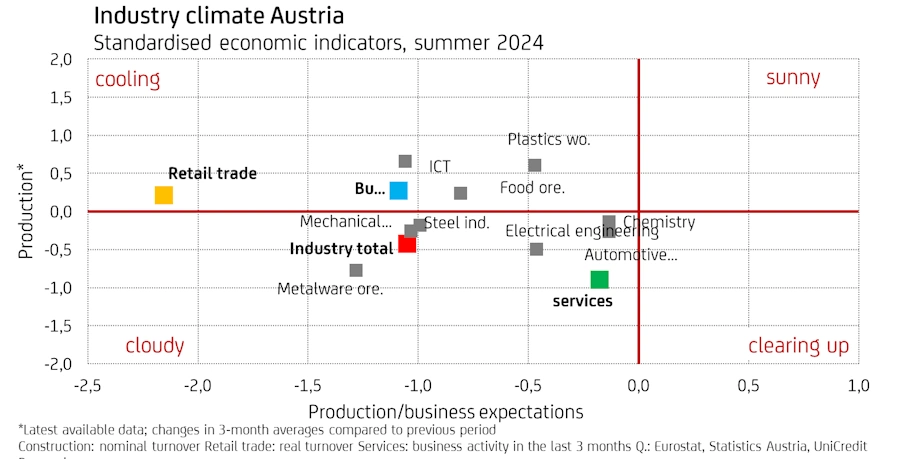

- After stabilising at the beginning of the year, the climate deteriorated again in the middle of the year across almost all sectors - signs of an incipient improvement have evaporated

- Industry remains the drag on the Austrian economy: economic turnaround not expected until autumn at the earliest

- Construction industry remains in crisis mode in the second half of 2024 - positive signs only visible in civil engineering and building refurbishment

- Slowdown in the services economy, but at least moderate growth prospects for the coming months with strong sector differences

- Situation in the retail sector remains difficult, but continued real wage growth should counteract the existing reluctance to buy due to uncertainty

The slight upturn in the Austrian economy around the turn of the year 2023/24 has lost momentum again since the spring. The domestic economy stagnated in the second quarter. Following an improvement at the start of 2024, UniCredit Bank Austria's latest industry overview now indicates a deterioration in the sector climate again.

In industry in particular, expectations of an improvement have not yet materialised due to the ongoing slump in orders. As a result, industry was characterised by a significant decline in production in the first half of 2024. The decline in production in the construction industry also continued until the middle of the year. This was offset by only slight growth impetus from the services sector.

“Following the 0.8 per cent decline in GDP in 2023, the weak development in the production sectors in the first half of 2024 resulted in a further year-on-year decline in Austrian economic output of 0.6 per cent in real terms. Only the service sector was able to record slight growth with very different industry developments”, says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

The majority of domestic companies are entering the second half of 2024 with pessimistic production and demand expectations. “The latest economic survey results continue to indicate weak economic development for the coming months. At the start of the second half of 2024, the industry climate was gloomy or cooling in all sectors. Industry and the construction industry in particular are facing a challenging environment. The situation is less tense in the services sector”, says UniCredit Bank Austria economist Walter Pudschedl, adding: “The renewed deterioration in production and business expectations suggests that the weak economic trend is unlikely to change in the coming months. We remain optimistic that the domestic economy will start to recover in the second half of the year. However, the start has been delayed at least until the autumn and the available indicators do not suggest a lightning start thereafter either.”

(To determine the industry climate indicator, the development of production and sales up to mid-2024 is compared with the results of the economic survey from July 2024)

Industry competitiveness is a cause for concern

Since the middle of 2022, Austrian industry has been in recession due to weakening export demand and falling domestic orders, also as a result of the problems in the construction industry, albeit with widely varying industry results. Production output fell by around 5 per cent in real terms in the first half of the year and only a few sectors were able to buck the general trend with production growth.

In addition to the food and beverage industry and the waste and wastewater disposal industry, only the pharmaceutical industry was able to increase its production output compared to the same period last year. In contrast, the clothing and textile industry, the electrical industry, glass and glassware production, furniture manufacture and motor vehicle production all experienced double-digit production slumps in the first half of the year. In most sectors, the negative trend intensified towards the middle of the year after a stabilisation phase in the first few months of the year.

“Immediate production expectations in the manufacturing industry continued to deteriorate at the beginning of the second half of the year, increasingly burdened by concerns about the competitiveness of domestic industrial companies on global markets in view of high labour cost dynamics and comparatively high energy prices”, says Pudschedl, adding: “The greatest challenges in the coming months will be faced by the steel industry, metal goods production, mechanical engineering, the electrical industry and automotive manufacturing in view of the particularly gloomy order situation and production expectations.”

The economy should continue to develop comparatively more favourably in food and beverage production. Some tailwinds also appear to be building up for the paper industry. Overall, however, the recession in the industry is expected to continue in the coming months, although its intensity should gradually decrease. Although production expectations for the next twelve months according to the survey of Austrian purchasing managers also fell in July, the expectations index is still optimistic at 55.2 points.

Construction industry unable to emerge from crisis mode

There was a further economic slowdown in construction in the first half of 2024. While there was a double-digit drop in turnover in building construction, turnover in civil engineering was “only” around 6 per cent below the previous year's level. The ancillary construction sectors even recorded a slight increase, as in civil engineering, with a slight upward trend towards the middle of the year.

The persistently negative assessment of the order situation promises that the economic situation in the construction industry will remain very challenging in the coming months. The weak general economy, the slow decline in construction price momentum and the high interest rates on loans will continue to curb demand in the coming months.

The pressure on building construction in particular remains high, while the assessment of the order situation in civil engineering and the ancillary construction trades improved moderately towards the middle of the year. In addition to civil engineering, growth impetus can therefore only be expected in the area of building refurbishment in the coming months. Both sectors are benefiting from subsidies for climate protection measures and the tradesmen's bonus could also have a positive impact.

“After the significant decline in the first half of the year, the overall sales outlook for the construction industry for 2024 as a whole is very subdued, despite some bright spots in civil engineering and some ancillary construction trades, for example. The construction industry is likely to see an even sharper decline in production than in the previous year”, says Pudschedl.

Cooling of the service economy

The situation in the services sector tightened slightly in the first half of 2024, but the sector was still the only growth driver in the overall economy, albeit with a downward trend. Developments in the individual areas were very mixed. While positive growth impetus came from the areas of financial and insurance services as well as real estate and housing, real turnover fell noticeably, particularly in the production-related areas of other economic services. Labour recruitment and some freelance activities were particularly hard hit. Accommodation and food services, information and communication services and transport services (excluding air transport) also saw real declines in the first half of 2024.

“Turnover expectations in the service sector are significantly more favourable than in the manufacturing sector, but lack a clear upward trend for the coming months. The industry climate remains gloomy”, says Pudschedl. While demand expectations in the accommodation sector have improved slightly and therefore suggest good capacity utilisation for the coming months, sales in the catering sector will suffer even more from high inflation, which is having a dampening effect on purchasing power.

The improved expectations in the transport sector are exclusively attributable to passenger transport (e.g. air transport), while freight transport will have to wait longer for noticeable impetus.

The weakness of the industrial economy will continue to dampen development in business-related services. Demand expectations have deteriorated at the start of the second half of 2024 for many professional services as well as other business services, which hardly promises a revival in the service economy in the coming months. Although the services sector should remain on course for growth, the momentum will only be moderate, at least until the autumn.

Reluctance to spend despite high real wage growth weighs on the retail sector

The increased purchasing power of consumers hardly had a positive impact on retail sales in the first half of 2024 due to the high level of uncertainty and consequently cautious spending behaviour. By May 2024, sales (excluding petrol stations) had risen by just under 3% in nominal terms, although this only meant stagnation in real terms. The biggest losses were in the non-food sector. Business expectations deteriorated in mid-2024 and fell back into pessimistic territory, although real wage growth among consumers should lead to expectations of a gradual improvement in the sector economy.

As expected, the sales trend in the motor vehicle trade (including garages) in the first half of the year was unable to match the high momentum of 2023, which was driven by catch-up effects. However, sales increased by around 3 per cent in real terms, driven by a sharp rise in new car registrations. Business expectations remain in negative territory. Despite generally cautious consumer sentiment, business expectations at the start of the second half of 2024 are better than at the end of 2023. Although sales growth is likely to slow further in the second half of the year, the industry could continue to record growth.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0) 5 05 05-41957;

E-mail: walter.pudschedl@unicreditgroup.at