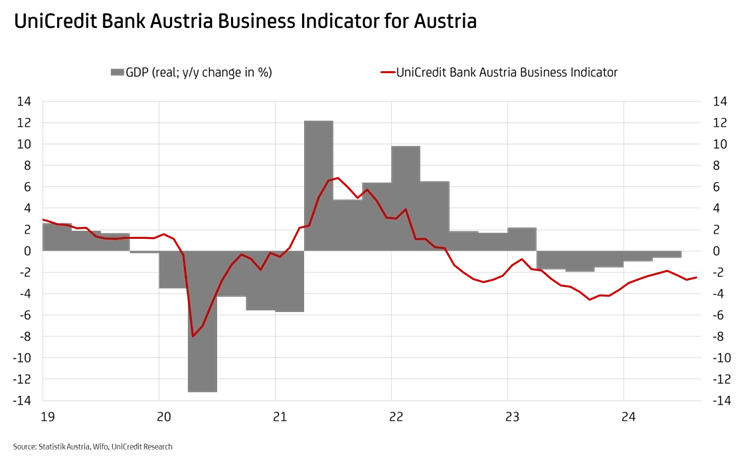

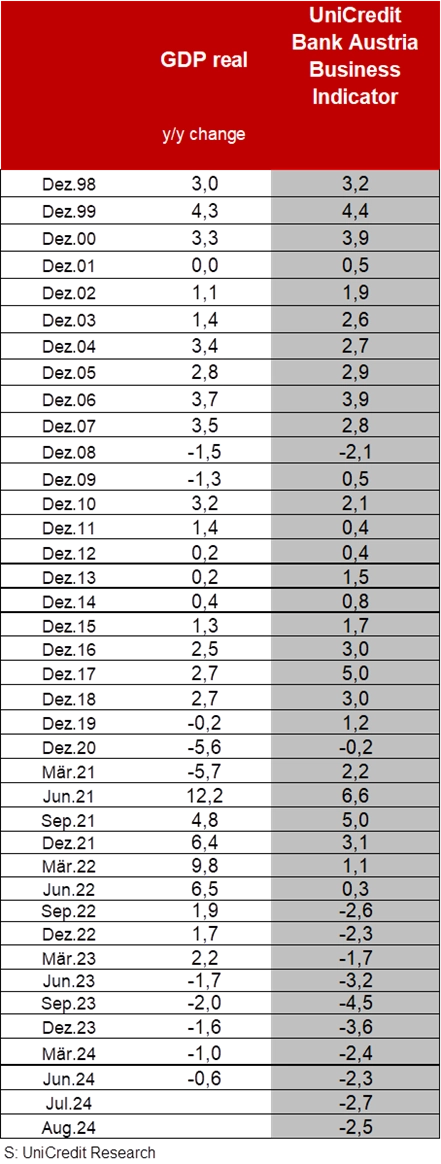

UniCredit Bank Austria Business Indicator

Austria's economy cannot find its way out of the economic slump for the time being

- The UniCredit Bank Austria Business Indicator improved slightly in August to minus 2.5 points

- The dip in sentiment in the industrial and construction sectors spread more strongly to the service sectors over the summer

- Slight improvement in consumer sentiment fuels hopes of a slow turnaround in sentiment in 2025

- Second consecutive year of GDP decline expected in Austria after 2023

- However, lower interest rates, calmer inflation and global recovery should also enable Austria to return to moderate economic growth in 2025

- Unemployment rate will rise to an average of 7.0 per cent in 2024, up from 6.4 per cent in the previous year

- Inflation could fall to an average of 2.3 per cent in 2025 and even fall below the ECB's inflation target by the end of the year

- ECB will probably continue to cut interest rates only cautiously

The Austrian economy is not emerging from its slump. “The UniCredit Bank Austria Business Indicator improved slightly in August, but with an overall value of minus 2.5 points, the indicator continues to signal a slight decline in economic development,” says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: “Following the decline in GDP in the second quarter, the Austrian economy is still not on course for growth. The lack of signs of a clear improvement trend in the coming months worsens the prospect of at least a black zero in economic development in 2024. The probability has increased that real economic output in 2024 could be below the previous year for the second time in a row.”

Sentiment in the domestic industry continues to deteriorate

The poor mood in the Austrian economy towards the end of the summer was still characterised by the weak economy in the manufacturing sector. Despite a slight improvement compared to the previous month, pessimism in the construction sector was more pronounced in August than in the first half of the year. Parts of the building construction sector, in particular residential construction, continued to be affected by particularly weak demand. The unfavourable financing conditions and high cost dynamics had a particularly negative impact here. In contrast, the situation in civil engineering remained stable and some ancillary construction trades even saw a slight improvement in sentiment, supported by government subsidies.

By contrast, the mood in Austrian industry darkened again towards the end of the summer. The decline in orders, increased energy and labour costs and unsettling signals from the most important market, Germany, particularly from the automotive industry, increased economic concerns. While the global environment for industry improved somewhat and stable global export growth can be expected in the coming months, domestic industry is increasingly concerned that it will not benefit from this due to the deterioration in price competitiveness.

Sentiment in the service sector also deteriorated in August, falling to its lowest level since the beginning of the year. Despite real wages having been rising for over a year, unsettled domestic consumers are exercising restraint in their spending, which is slowing down developments in retail and many leisure services, among others. The improvement in consumer sentiment in August, which reached its best level in almost 2.5 years, could be a promise for the future.

“The weakness in the manufacturing sector persisted over the summer and increasingly spread to various service sectors. At the beginning of autumn, sentiment in all sectors of the domestic economy was pessimistic, in some cases significantly below the long-term average. Moreover, sentiment in all economic sectors in Austria was worse than in the eurozone as a whole. In domestic industry, the gap even climbed to a record level since Austria joined the EU in 1995,” says Bruckbauer.

Despite the current poor sentiment, the economists at UniCredit Bank Austria are optimistic that the economy will improve in 2025. On the one hand, consumption is expected to strengthen, as purchasing power should continue to increase in 2025 due to renewed real wage growth. On the other hand, the easing of monetary policy is not only expected to stabilise the construction sector, but also increase investment in domestic industry, which should also benefit from the improvement in the global environment. “The deterioration in price competitiveness due to the comparatively high cost increases and the strong focus on the German market could diminish the positive effect of the more favourable global conditions on the domestic economy in 2025. Despite this, we expect moderate economic growth in Austria in 2025,” says UniCredit Bank Austria economist Walter Pudschedl.

Unemployment rate continues to rise slowly

In view of the ongoing weakness of the Austrian economy, the slight deterioration in the situation on the labour market continued over the summer. In August, the unemployment rate was 7.1 per cent after just 6.7 per cent at the beginning of the year.

“The upward trend in the unemployment rate is likely to continue in the coming months, driven by the ongoing problems in construction and industry. However, conditions in the service sector are also likely to deteriorate somewhat. We expect the unemployment rate to average 7.0 per cent in 2024 and continue to expect it to fall to 6.9 per cent in 2025. In addition to the improved economy, the improvement will also be primarily due to the slow increase in labour supply,” says Pudschedl.

Fall in inflation supports further interest rate cuts by the ECB

Due to falling energy prices, also as a result of the weak economy, inflation in Austria weakened significantly over the summer. At 2.4 per cent year-on-year, inflation reached its lowest level in 40 months in August. Inflation is unlikely to fall any further in the coming months and may even rise again towards 3 per cent towards the end of the year due to energy prices. However, the downward inflation trend should continue in the coming year, albeit at a much slower pace than before due to persistent second-round effects in the services sector. “After an average inflation rate of around three per cent in 2024, we expect a decline to 2.3 per cent next year with year-end values below the ECB's inflation target,” says Pudschedl.

In view of the fairly favourable inflation trend throughout the eurozone, the European Central Bank decided to cut the deposit rate by 25 basis points to 3.50 per cent in September, as expected, after June.

“We continue to expect a gradual reduction in the key interest rate by 25 basis points per quarter until the end of 2025. The next step in the deposit rate should therefore take place in December at 3.25 per cent. Amidst the tension between inflation risks, particularly in the services sector, on the one hand and concerns about unfavourable economic and labour market developments on the other, we expect a steady but cautious easing cycle from the ECB. In view of our favourable medium-term inflation forecast, we assume that the deposit rate will fall to 2.25 percent by the end of 2025,” concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0) 5 05 05-41957;

E-mail: walter.pudschedl@unicreditgroup.at