UniCredit Bank Austria Purchasing Manager Index in September:

Austrian industry continues to struggle with the crisis

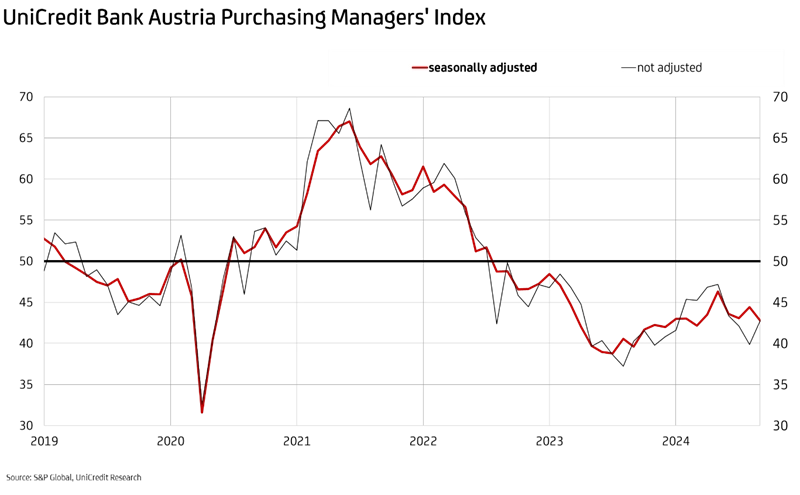

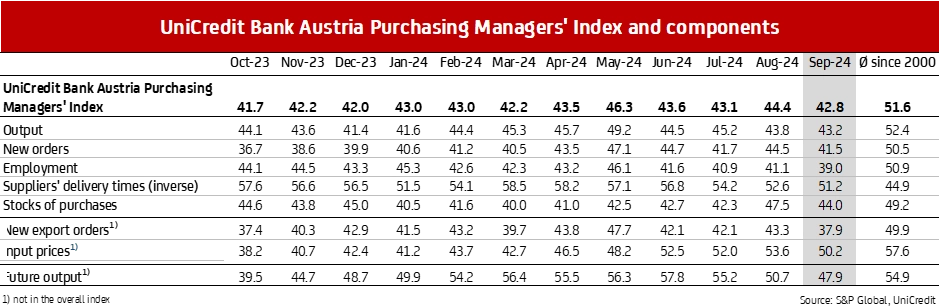

- The fall in the UniCredit Bank Austria Purchasing Managers' Index in September to 42.8 points signals a deepening of the recession in the domestic industry, which has been ongoing for two years

- In view of the accelerated decline in new orders, industrial companies cut back production at an even faster pace in September

- The start of autumn brought the sharpest job cuts in the industry since the first coronavirus lockdown in April 2020

- Very cautious procurement policy: significant reduction in purchasing volumes leads to further reduction in inventories

- High discounts in sales as a result of weak demand burdened the companies' earnings situation

- The index of production expectations within a year fell to 47.9 points in September, dropping significantly into pessimistic territory for the first time this year

The industrial economy clouded over again at the beginning of autumn 2024. “The UniCredit Bank Austria Purchasing Managers' Index fell to 42.8 points, the lowest value since March of this year. This means that the recession in Austrian industry is already entering its third year,” says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: “On the one hand, Austrian industry is suffering from the difficult international conditions, particularly the weakness of German industry. On the other hand, home-made problems, such as the sharp rise in costs and thus price competitiveness, are having a negative impact. The situation has currently been exacerbated in many places by the disruption caused by the floods.”

All components of the UniCredit Bank Austria Purchasing Manager Index indicated an acceleration of the downward trend in domestic industry in September. “Production output was reduced even more sharply in September than in the previous month, as new business declined even more significantly. As a result, companies adjusted their staffing levels downwards at a very rapid pace. Particularly cautious inventory management with significantly reduced purchasing volumes led to falling stock levels. While costs stabilised, demand once again led to significant price declines in sales,” says Bruckbauer, summarising the most important results of the monthly survey.

Accelerated decline in demand, particularly from abroad

The biggest influence on the decline in the overall index was the particularly sharp fall in new business. “The index for new orders fell by three points to just 41.5 points. The pace of the decline in orders in the domestic industry was last this high six months ago. This was mainly due to a slump in export business in September. There has recently been an increasing lack of new orders, particularly from the most important export destination, Germany, where the automotive industry in particular is experiencing major difficulties. As a result, domestic industrial companies have significantly reduced their production,” says UniCredit Bank Austria economist Walter Pudschedl. The reduction in production in September was faster than in the previous month. The production index fell to 43.2 points, the lowest value since the beginning of the year. The production index thus clearly exceeded the index for new orders, another rather unfavourable economic signal for the domestic industry.

Even more jobs lost

The adjustment of production capacities to the significant decline in demand was also reflected in a sharp reduction in jobs in September. The employment index fell to 39.0 points, the lowest value since the first coronavirus lockdown in April 2020. “Job cuts in Austrian industry have accelerated once again. At the beginning of autumn, around 11,000 fewer people were employed in manufacturing than at the start of the year. The seasonally adjusted unemployment rate rose to 4.0 per cent, the highest level since summer 2021,” says Pudschedl. This means that the unemployment rate in industry is still significantly lower than in the economy as a whole at 7.1 per cent, although the upward trend has been stronger so far.

As the deterioration in the labour market is likely to continue, the economists at UniCredit Bank Austria expect the unemployment rate in the sector to average 3.8% in 2024, compared to just 3.2% in the previous year. The deterioration of the labour market situation in the industrial sector will therefore also have a significant impact on the upward trend at a macroeconomic level. In the economy as a whole, the unemployment rate is likely to rise to 7 per cent in 2024.

Almost stable costs, but sharply falling output prices

Cost pressure in Austrian industry eased noticeably in September. The input price index fell to 50.2 points. The slowdown in the rise in costs was due to the declining demand for primary materials and the reduction in the price of some raw materials, including steel and fuel. “Although costs barely rose in September for the first time in three months, the earnings situation of domestic industrial companies is likely to have deteriorated further on average. As a result of weak demand, high price reductions had to be granted in sales,” says Pudschedl. The output price index fell to 44.5 points, the lowest value for almost a year.

Uncertainty prevails in procurement policy

Due to weak demand, Austrian industrial companies were even more cautious in their procurement activities in September than in previous months. The quantity of primary materials and raw materials purchased was reduced more than ever before in the current year. The index for purchasing volumes fell to 35.8 points. As a result, stocks of purchases fell sharply. “Stocks of finished goods fell at a faster rate in September than in the previous month, more sharply than in the summer of 2021. What would normally be seen as an indication of strong demand is, however, the exact opposite in the current situation,” says Pudschedl, adding: “Domestic companies do not expect demand to pick up immediately, which would require higher stock levels to fulfil customer requests quickly. Instead, the focus is increasingly on minimising storage costs in order to improve the liquidity position.”

No end to the recession in sight

The latest UniCredit Bank Austria Purchasing Managers' Index signals a renewed worsening of the downturn in the manufacturing industry in Austria and has dashed hopes of an imminent recovery. Especially as no positive impetus can be expected from the international environment either. “The decline in industrial production accelerated in both the USA and the eurozone in September. The respective preliminary purchasing managers' indices fell to 47.0 and 44.8 points, the lowest values of the current year in each case. Production fell particularly sharply in Germany and France. However, industry in the other eurozone countries was also unable to grow in September,” said Pudschedl.

Everything indicates that the recession has taken hold in the domestic industry. The ratio between new orders and stocks of finished goods makes it clear that new orders can be fulfilled directly with the existing stocks without having to expand production capacities. Beyond this, however, the companies' medium-term assessment of future developments in particular has clearly deteriorated. For the first time since the beginning of the year, production expectations fell significantly into the pessimistic range. Austrian industrial companies are therefore expecting a decline in production over the next twelve months.

“There is currently no end in sight to the recession in the domestic industry. For 2024, we expect a significant decline in production of up to 3 per cent in real terms. The improvement in global demand and the easing of monetary policy support the hope that domestic industry will slowly return to a moderate growth path over the course of the coming year,” says Bruckbauer, adding: “The weakness in industry is increasingly spreading to other sectors of the economy, especially some service industries, and is dampening the economic outlook for Austria. Following the 0.8 per cent decline in GDP in 2023, a further decline of around 0.5 per cent in 2024 is becoming increasingly likely and the growth prospects for 2025 are also deteriorating to only around 1 per cent.”

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Phone: +43 (0)5 05 05-41957;

E-mail: walter.pudschedl@unicreditgroup.at