UniCredit Bank Austria Economic Analysis

Weak economy dampens inflation, ECB can bring forward interest rate cuts

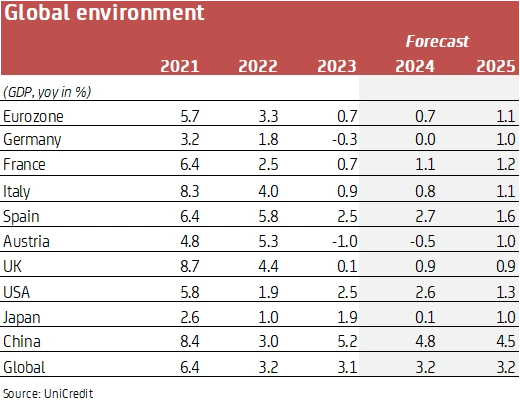

- Continued weak development of the global economy with below-average growth of 3.2 per cent expected in 2024 and 2025, burdened by the slump in manufacturing

- The downturn in the US economy with a decline in GDP growth from 2.6 per cent in 2024 to 1.3 per cent in 2025 is dampening the global economy

- Growth in the eurozone remains weak, but GDP is still expected to rise from 0.7 per cent in 2024 to 1.1 per cent in 2025

- The decline in inflation has accelerated and will continue in the eurozone in 2025, supported by the cooling of the labour market and declining inflation in the services sector

- The weak economy and the fall in inflation into the target range are increasing the pressure on the ECB, which is why we expect the cycle of interest rate cuts to accelerate, probably starting as early as October

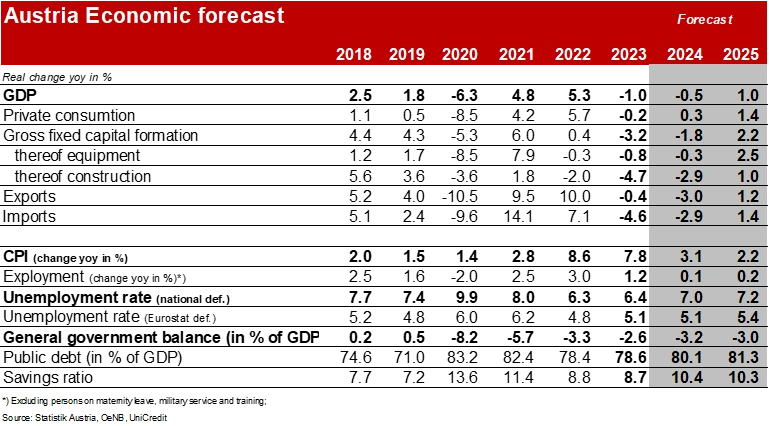

- In Austria, GDP is expected to fall by 0.5 per cent in 2024, marking the second consecutive year of decline

- We have lowered our growth forecast for Austria for 2025 to 1.0 per cent in view of the restraint in consumption and the weakness of industry

- Stabilisation on the labour market only in the course of 2025: the unemployment rate will rise from an average of 7.0 percent in 2024 to 7.2 percent in 2025

- Inflation in Austria is likely to fall from an average of 3.1 per cent in 2024 to 2.2 per cent in 2025

“The growth prospects for the global economy remain weak. At 3.2 per cent, growth in 2024 and 2025 is only expected to be below the long-term average, burdened above all by an incipient downturn in the US. However, the weakness of the European economy will also only ease slowly,” says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: “In this weak economic environment, the decline in inflation has accelerated noticeably. Inflation in the eurozone has reached the ECB’s target range this autumn. This has increased the pressure on the ECB to accelerate the return to a neutral interest rate”.

In the USA, economic growth is likely to fall from 2.6 per cent this year to just 1.3 per cent in 2025 due to the slowdown in consumer growth. The situation on the labour market is becoming tighter, interest rates are still high, and the savings accumulated during the pandemic have mostly been used up. By contrast, economic growth in the eurozone will increase slightly in 2025, but with GDP growth rising from 0.7 per cent in 2024 to 1.1 per cent in 2025, the economic weakness in Europe will largely be prolonged, especially as the German economy is likely to be slow to emerge from the crisis. The manufacturing industry will remain under strong pressure, which will weigh on the service sector. Despite higher real wages, private consumption will show little sign of recovery for the time being, while investment spending will continue to struggle in the face of weak demand, lower profitability and persistently tight financing conditions.

Inflation in the eurozone within target range

The slowdown in inflation is progressing faster than the ECB had expected. Inflation fell below 2 per cent in September but should pick up again slightly by the end of the year due to a base effect from energy prices. “Apart from short-term fluctuations, inflation is expected to approach the ECB’s target in the near future. The pricing power of producers appears to remain muted in view of the weak demand for goods. Price pressure on food is also likely to remain limited. Finally, the fading second-round effects in the services sector should drive the last part of the decline in inflation to 2 per cent in the course of 2025. We expect average inflation in the eurozone to fall from 2.4 per cent in 2024 to just 1.8 per cent in 2025,” says Bruckbauer.

Key interest rates expected to be lowered more quickly

“The downside risks to both growth and inflation forecasts are increasing the pressure on the central bank to bring forward interest rate cuts and accelerate the return to a more neutral stance. Accordingly, we are changing our forecast for the deposit rate. We now assume that monetary easing of 100 basis points is likely to take place quickly, with interest rate cuts of 25 basis points at successive meetings, probably starting as early as October,” says Bruckbauer, adding: “The pace of interest rate cuts will probably only slow down once the deposit rate reaches 2.5 per cent at the end of the first quarter of 2025. This is a level that is considered largely neutral by the majority of the ECB Governing Council. At 2 per cent in September 2025, the deposit rate should have reached its final level in the current interest rate cycle.”

Lower growth prospects for Austria

In view of the subdued development of the global economy, particularly in the eurozone and Germany, the growth prospects for the Austrian economy have become somewhat gloomier. “Following the renewed decline in GDP in 2024 by an expected 0.5 per cent, the Austrian economy should slowly return to a growth trajectory, although this is likely to remain more subdued than we previously expected. We have lowered our GDP forecast for 2025 to 1.0 per cent,” says UniCredit Bank Austria economist Walter Pudschedl. Consumption and investment should provide growth impetus, albeit with the handbrake on somewhat. Although the noticeable increase in real wages due to lower inflation will increase purchasing power, the high level of uncertainty will keep the savings rate high and thus only lead to a moderate increase in consumption. The improved financing conditions will boost investment activity, but growth is likely to remain limited. The impetus from the global economy will remain subdued, especially as the challenges for domestic exporters to keep up with price competition have increased significantly due to the high cost dynamics to date.

In the weaker economic environment, the situation on the domestic labour market will only stabilise in the course of 2025. “The rise in the unemployment rate will continue in the coming months. After 7.0 per cent on average in 2024, we now expect the unemployment rate to rise again in 2025. However, at 7.2 per cent, the situation remains relatively favourable, especially as there is likely to be the prospect of an incipient improvement in the second half of the year,” says Pudschedl.

The inflation shock of the past two years has definitely come to an end. “With inflation rates in line with the ECB target or only slightly above it, average inflation in Austria will fall to around 3.1 per cent in 2024. A low oil price could even cause surprises on the downside. We currently expect inflation to average 2.2 per cent in 2025. After a slight upward trend around the turn of the year, inflation should fall below the 2 per cent mark as the year progresses,” concludes Pudschedl.

More details on the global economic assessment can be found in the publication “Economics Chartbook”.

To download please click here: https://www.bankaustria.at/en/economy-economic-chartbook.jsp

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0) 5 05 05-41957;

E-Mail: walter.pudschedl@unicreditgroup.at