UniCredit Bank Austria Business Indicator

Slump in Austria's economy continues

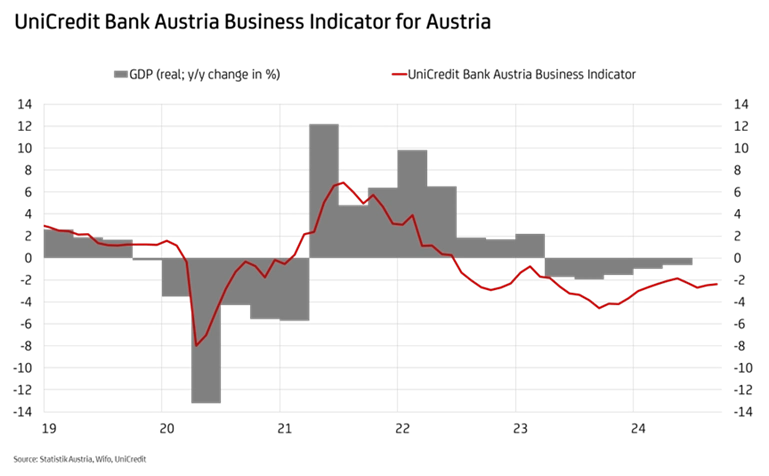

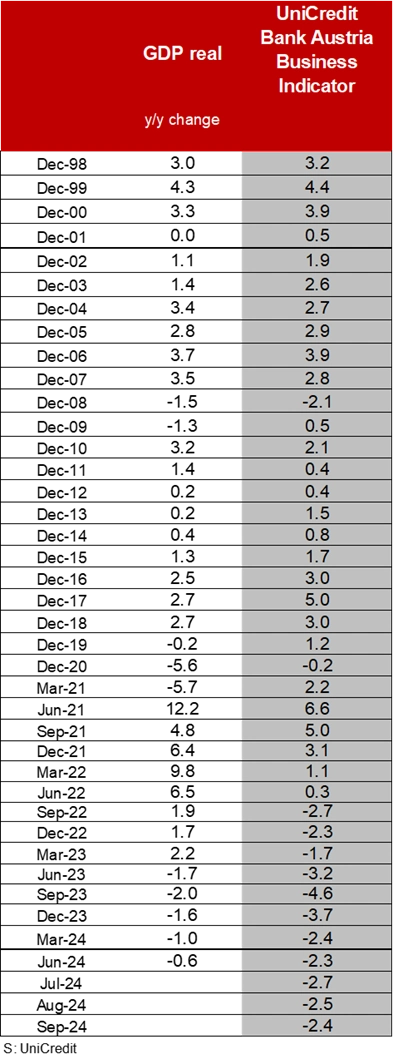

- The UniCredit Bank Austria Business Indicator improved slightly in September to minus 2.4 points

- Sentiment in industry and construction continued to deteriorate, but pessimism in the services sector declined

- The economic slowdown, which will continue at least until the end of the year, will lead to a decline in GDP for the second year in a row, probably of 0.5 per cent in 2024

- Moderate economic growth of 1.0 per cent expected in 2025 supported by real wage growth and monetary easing

- Economic growth will be too weak to improve the labour market: Annual average unemployment rate expected to rise to 7.2 per cent in 2025, after 7.0 per cent in 2024

- The weak economy is dampening inflation: inflation is expected to fall from 3.1 per cent in 2024 to just 2.2 per cent in 2025

- ECB will accelerate its interest rate cuts and its next rate move is expected as early as this October

The mood in the Austrian economy remained very tense at the beginning of autumn. “The UniCredit Bank Austria Business Indicator rose slightly to minus 2.4 points in September. However, despite the second increase in a row, the indicator is signalling a prolongation of the economic weakness in Austria,” says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: “In our assessment, the Austrian economy was unable to return to a growth trajectory in the recently concluded third quarter. Moreover, the prospects for a noticeable improvement in the economy before the end of the year are slim in view of the renewed deterioration in sentiment in industry and construction. We therefore continue to expect GDP to decline by 0.5 per cent in 2024 as a whole.” This means that the Austrian economy will shrink for the second year in a row after 2023.

Improving sentiment in the service sector

The only bright spot in the economic picture in Austria in September was the slight improvement in sentiment in the service sector, which was the reason for the slight rise in the UniCredit Bank Austria Business Indicator. The continuing decline in inflation has led to a stabilisation of retail sales. In addition, the first signs of a good winter season in tourism reduced the pessimism, which is due to a high level of uncertainty in many sectors. This uncertainty is also reflected in the slight deterioration in the mood of domestic consumers, who continue to exercise restraint in their spending and increase their savings ratio despite real wage growth.

The pessimistic mood in the Austrian economy at the beginning of autumn continued to be determined by the weakness in the manufacturing sector. The mood in the construction sector is consistently negative due to low demand, particularly in residential construction. In September, at least the signs of a stabilisation of the situation continued, albeit at a low level. In contrast, the mood in domestic industry continued to deteriorate significantly. In addition to the uncertainty caused by weak incoming orders from the domestic market, concerns about competitiveness in the export business are growing following the high cost increases in recent months. In addition, the crisis in the German automotive industry appears to be having an even stronger impact on the domestic supplier industry and the export environment has generally deteriorated. In September, global industrial sentiment weighted with Austrian export shares fell significantly to its lowest level in a year. In addition to the weakness of the German economy, the prospects for positive impetus from other markets have also diminished.

“At the beginning of autumn, sentiment in all sectors of the domestic economy was pessimistic, in some cases significantly below the long-term average. Moreover, sentiment in all economic sectors in Austria was worse than in the eurozone as a whole. In industry in particular, pessimism is much more pronounced than the European average,” says Bruckbauer.

Only moderate growth expected in 2025

There are currently no signs of an incipient recovery in the Austrian economy. However, the general conditions have improved in recent months due to the sharp fall in inflation and the ECB's interest rate reduction cycle, which has already begun. As a result of the significant fall in inflation, domestic consumers have been benefiting from high real wage growth for months. Collectively agreed wages rose by 8.5 per cent year-on-year in the first three quarters of 2024, while inflation only increased by an average of 3.3 per cent.

“We assume that consumer uncertainty will subside in the coming months in view of the high real wage growth and that private consumption will be able to provide a noticeable boost to the Austrian economy in 2025. In addition, the improvement in financing conditions due to further interest rate cuts by the ECB should have a positive effect on the willingness of domestic companies to invest,” says UniCredit Bank Austria economist Walter Pudschedl, adding: “After two years of declining economic output, the Austrian economy should be able to return to at least moderate growth in 2025. We expect GDP to increase by 1.0 per cent.”

Unemployment rate continues to rise slowly

In view of the ongoing economic weakness, the situation on the domestic labour market continues to deteriorate. In September, the seasonally adjusted unemployment rate rose to 7.2 per cent, which is already half a percentage point higher than at the start of the year.

“We have to assume that the situation on the labour market will continue to deteriorate in the coming months. In particular, the declining order trend in industry and the lack of prospects for a noticeable trend reversal in this sector are clouding the outlook. After an average of 7.0 per cent in 2024, we now also expect the unemployment rate to rise to 7.2 per cent in 2025,” says Pudschedl.

Inflation in Austria below 2 per cent for the first time in 3.5 years

The slowdown in inflation is progressing, even faster than expected. Inflation is expected to have fallen below 2 per cent again in September but should pick up again slightly by the end of the year due to a base effect from energy prices. “Apart from short-term spikes, inflation in Austria should also be close to the ECB target of 2 per cent in the coming months. The pricing power of producers appears to remain muted in view of the weak demand for goods. Price pressure on food is also likely to remain limited. In addition, the second-round effects in the services sector will become increasingly weaker over the course of 2025. We expect average inflation in Austria to fall from 3.1 per cent in 2024 to just 2.2 per cent in 2025,” says Pudschedl.

Next key interest rate cut expected in October

“Now that the latest economic indicators and inflation in the eurozone have surprised to the downside, we expect the ECB to make its next interest rate cut in October. For December, we expect a further reduction in the deposit rate by 25 basis points,” says Bruckbauer and adds: “For 2025, we expect a reduction in key interest rates by a further 100 basis points, whereby the deposit rate should have already reached its final level in the current interest rate cycle at 2 per cent in September.”

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0) 5 05 05-41957;

E-Mail: walter.pudschedl@unicreditgroup.at