UniCredit Bank Austria Purchasing Manager Index in October:

Lack of demand prolongs recession in Austrian industry

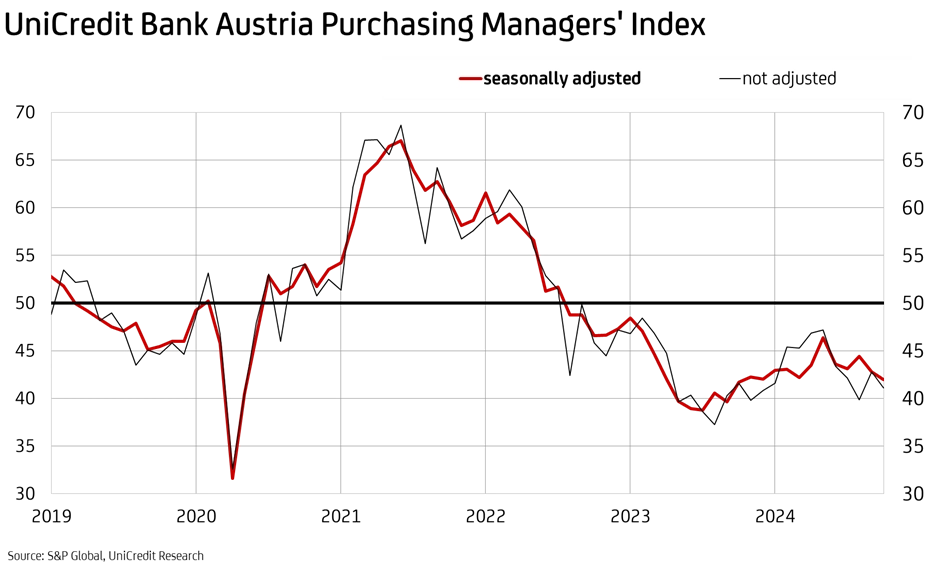

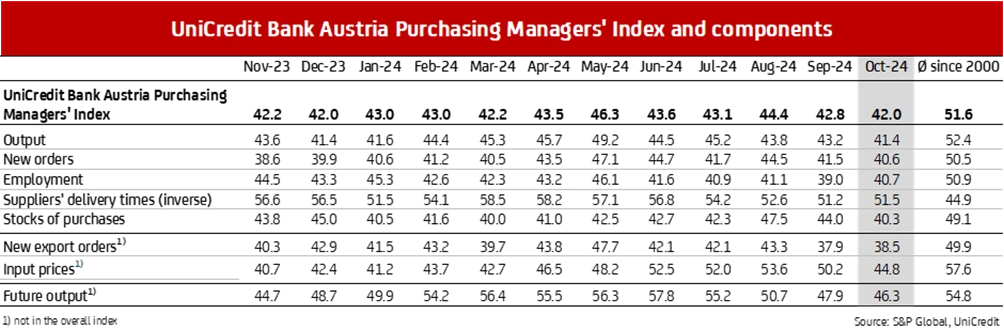

- The UniCredit Bank Austria Purchasing Managers' Index fell to 42.0 points in October. Weakness in Austrian industry continues in the fourth quarter of 2024

- Once again fewer new orders, especially domestically

- The pace of the decline in production accelerated

- The sharp job losses in industry slowed only slightly in October

- Cost relief due to falling raw material prices, but weak demand required price reductions in sales

- The outlook for Austrian industry continued to deteriorate: The index of production expectations within a year fell to 4.3 points in October, the lowest value of the current year

At the beginning of the fourth quarter of 2024, there is still no light at the end of the tunnel in Austrian industry. “Austrian industry has been in recession for more than two years, one of the longest periods of recession in decades. The tentative signs of recovery until the spring have now completely evaporated. In October, the UniCredit Bank Austria Purchasing Managers' Index fell again, reaching its lowest value of the current year at 42.0 points,” says UniCredit Bank Austria Chief Economist Stefan Bruckbauer. Developments in the domestic export industry are being hampered by the weak global economy as a result of the worsening geopolitical crises, by the problems of German industry as the most important sales market and by poorer international competitiveness due to high cost increases. This is compounded on the domestic market by the continuing weakness in investment, particularly in the construction industry, and the restrained demand from unsettled households, especially for consumer durables.

“Austrian industry was confronted with a further accelerating decline in new business in October, meaning that production was reduced at a faster pace than in the previous month and employment was also cut significantly further. While inventories were greatly reduced for cost reasons, there was a sharp drop in input prices and less severe output price reductions in October,” says Bruckbauer, summarising the most important detailed results of the monthly survey of purchasing managers at Austrian industrial companies.

Lack of demand caused further production cuts

The main reason for the decline in the current Bank Austria Purchasing Manager Index was renewed production cutbacks. “Domestic companies recorded noticeably fewer new and follow-up orders in October. There was a lack of new business from abroad in particular, although the pace of decline has slowed somewhat. Domestic industry has therefore noticeably reduced its production output again,” says UniCredit Bank Austria economist Walter Pudschedl. The index for production output fell to 41.4 points in October, the lowest value since the end of 2023. In view of the particularly weak order development, however, order backlogs fell significantly.

Weak demand and high costs: companies are forcing the reduction of stocks

In view of the deterioration in the order situation, Austrian companies once again sharply reduced purchasing volumes in October. As a result, stocks of purchases were reduced significantly, even faster than in the previous month. The reduction in costs was the main motivation for companies, especially as the availability of primary materials and raw materials improved. Delivery times were further reduced thanks to well-stocked warehouses, although there were some delays in deliveries from Asia and disruptions due to the flooding in Europe. Stocks of finished goods also fell sharply, at the highest rate in 15 years. “The month-on-month acceleration in the reduction of primary material and sales inventories is an expression of the ongoing cost-conscious inventory management in Austrian industry, but it also indicates that companies are very cautious about further economic development,” says Pudschedl. Cost savings are being prioritised over potential market opportunities.

Staff reductions continue

“As a result of weak demand and significant production cutbacks, Austrian industrial companies once again reduced their workforce in October. The number of employees in the domestic manufacturing industry has been declining for one and a half years now. With a seasonally adjusted labour force of just under 635,000, there are currently around 12,500 fewer people employed in the manufacturing industry than one and a half years ago,” said Pudschedl. The employment index rose to 40.7 points in October. Although the rate of staff reduction was slightly lower than in September, it was still historically high. The index points to the second-highest rate of job cuts since the first pandemic-related closures at the beginning of 2020. Around 30 per cent of the companies surveyed stated that they had reduced their workforce in October and only 10 per cent hired additional workers.

Costs fell more sharply than output prices

After four months of slight growth, costs in the domestic industry fell again in October, and at a rapid pace. Lower raw material prices, particularly for steel and energy, and the declining pricing power of suppliers due to the weak demand environment contributed to this. Output prices also continued to fall due to increased competition for new orders, now for the nineteenth month in a row. “Costs fell much more sharply than output prices in October. For the first time in six months, the earnings situation of domestic companies is likely to have improved somewhat on average due to the current price trends,” says Pudschedl.

Bleak prospects, but hope for 2025

Following the temporary improvement in spring, the industrial economy in Austria has deteriorated again. Hopes of a recovery have evaporated in Austrian companies, as can be seen, for example, from the continuing sharp reduction in employment. The renewed decline in the UniCredit Bank Austria Purchasing Managers' Index points to a continuing recession in Austrian industry in the coming months due to the noticeable deterioration in the order situation.

In addition to the lack of domestic orders, export demand in particular is weakening. This can also be inferred from the weak purchasing managers' indices in Europe. Although the preliminary Purchasing Managers' Index for the manufacturing industry in the eurozone rose to 45.9 points in October, strongly supported by an improvement in the index to 42.6 points in Germany, the most important trading partner of Austrian industry, the values are well below the growth threshold of 50 points. “In view of the weak international environment and pessimism among domestic companies, we expect the industrial economy in Austria to remain weak in the coming months. After 2023, we now expect the second consecutive decline in industrial production in 2024. At up to 4 per cent on an annual average, this will be significantly higher than in the previous year,” says Bruckbauer. The outlook for 2025 continues to be burdened by political trends, but also by increasing protectionist trends in global trade. However, the synchronised easing of monetary policy worldwide supports the hope that the domestic industry will be able to overcome the recession in the course of the coming year.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Phone: +43 (0)5 05 05-41957;

E-mail: walter.pudschedl@unicreditgroup.at