UniCredit Bank Austria analysis:

Industrialised countries particularly hard hit by supply bottlenecks and cost increases

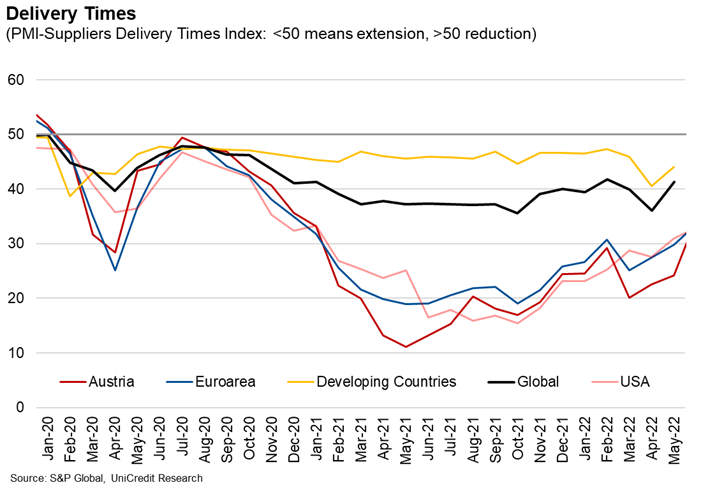

- Persistent supply problems for over two years with problems in global value chains leading to rapid extension of delivery times for primary materials

- Supply chain problems peaked in mid-2021, but have slightly eased since then

- Nine out of ten domestic industrial companies continue to see completion of their products delayed due to materials shortages

- Among industrial countries Austria hit to above-average degree by delivery delays, making it in summer 2021 the EU country with longest delivery delays for industrial companies

- Greatest delays are in supply chains for complex technological equipment, followed by mechanical and plant engineering, with "simple" products such as commodities and raw materials less affected

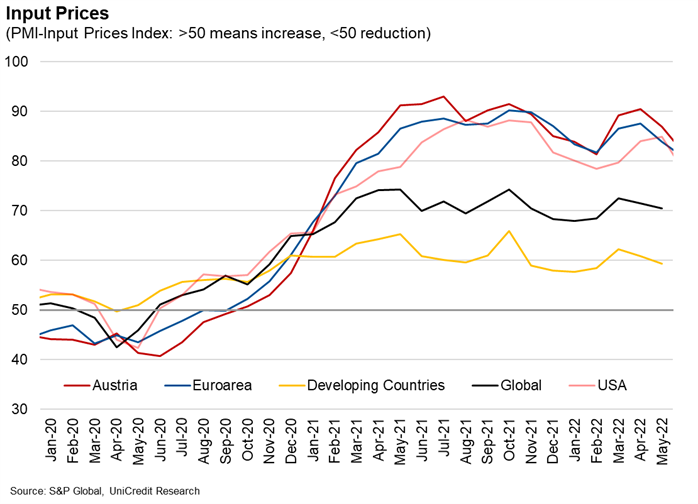

- Extension of delivery times leads to significant increase in purchasing costs; factors driving the price rises are the distortions on the commodity markets caused by the war in Ukraine

- Rising sales prices peaked in April 2022 after slight delay and are expected to rise further

The optimal utilisation by global value chains of the strengths of different locations has enabled efficient and cost-effective production of goods for decades, increasing prosperity worldwide. However, upheavals in the economic recovery caused by the pandemic have revealed the vulnerability of these long supply chains to disruptions. Although supply chain problems seem to be improving slowly despite the war in Ukraine, a reorientation is taking place in the economy.

"Existing supply problems within companies are leading to a critical re-evaluation of the resilience and sustainability of global value chains with large numbers of potentially unstable partners. Security of supply is gaining in importance over narrow focus on cost arguments and is being deliberately strengthened by measures to increase resilience such as diversification of supplier companies and regions," says UniCredit Bank Austria Chief Economist Stefan Bruckbauer and adds: "We do not believe that we are seeing the end of globalisation, but the pandemic and recent geopolitical changes will permanently change the business organisation and management concepts of companies in industrialised countries in the coming years."

The analysis of supply problems based on monthly surveys of purchasing managers shows that delivery times for primary materials and raw materials have been increasing for about two and a half years, reaching a peak in the summer of 2021. "Delivery delays had become temporarily more pronounced with the beginning of the war in Ukraine, but the delivery time index is already showing signs of easing. Nevertheless, around nine out of ten domestic industrial companies are currently reporting that completion of their products is delayed due to material shortages," according to Bruckbauer.

"In an international comparison, Austrian companies are affected by delivery delays to an above-average extent. As in all industrialised countries, there is a greater impact than in developing countries, because long and complex supply chains are used to increase efficiency and reduce costs. The current delivery time index found by the purchasing managers' survey is 32.8 points for industrialised countries and an average of 44.0 points for developing countries," according to UniCredit Bank Austria Economist Walter Pudschedl. The eurozone's current delivery time index of 33.5 points means that halfway through 2022 it is about as badly affected as the US. However, the additional burdens resulting from the war in Ukraine had a further negative impact on the supply situation in Europe over the previous months.

"Within Europe, countries whose industry is closely linked to that of Germany are particularly affected. In Germany itself, delivery delays were felt somewhat earlier and more strongly than in other EU countries due to particularly severe supply bottlenecks for semiconductors intended for the automotive industry. In summer 2021, Austria was the EU country with the longest supply delays in industry, though it was finally surpassed by Denmark in the autumn", Pudschedl continued. By contrast, some eastern European countries, such as Poland and especially southern European countries such as Greece, Spain and Italy, were far less affected by delivery delays. All values below 50 mean an extension of delivery times compared to the previous month, and the lower the value, the greater the delay compared with the previous month.

The longer the chain and the more complex the product, the greater the delivery delays

At a global level, there are clear sectoral differences in delivery delays. "While the supply problems are the lowest for commodities, raw materials, metals and now also for construction materials, the biggest delays in the supply chains are for technological equipment, which also includes the production of semiconductors, followed by mechanical and plant engineering," explains Pudschedl. General manufactured goods are now followed by food, whose supply situation has deteriorated in recent months compared with the development of products from other sectors.

In general, the length of delivery times depends heavily on the number of components installed in the end product and the complexity of the production process, i.e. on the use of long global value chains. An exception is the development in connection with food, which is likely to be related to the war in Ukraine. From a global perspective, delivery times are currently increasing in all product groups surveyed, albeit at a slowing pace.

War in Ukraine continues to drive up costs

The length of delivery times is an important indicator for the assessment of supply and demand conditions on the markets. An imbalance is affecting price trends. The price-driving factors are currently the upheavals on the commodity markets, especially for oil and natural gas, as a result of the war in Ukraine in addition to the strong demand resulting from the pandemic and the supply-side problems caused by transport difficulties and production stoppages due to quarantine regulations. Purchasing prices for companies are rising rapidly worldwide. The global purchasing price index is more than 70 points, just below the absolute peak last autumn.

"As a result of the different delivery time problems and dependencies, the price increases in developing countries are significantly lower than in the industrialised countries, with a slightly greater impact in Europe compared with the US due to the gas component, among other factors," says Pudschedl and adds: "A June purchase price index of 81.6 points means the development in Austria remains characterised by an acceleration in costs above the European average".

Cost transfer to sales prices is fuelling delayed inflation

Purchasing prices began to rise worldwide in the autumn of 2020, but it was not until the beginning of 2021 that the selling prices accelerated. "The higher costs for raw and primary materials have been reflected in rising sales prices from industry after a delay of about three months because, among other things, price commitments in existing contracts had to be fulfilled. Sales price dynamics only peaked in April 2022, fuelled by the strong increases in energy costs, which had an above-average impact on industrialised countries," says Pudschedl. Price dynamics in the US were particularly high until the end of 2021, and since then the development in the eurozone has been more dynamic.

Countries that are more affected by delivery delays, such as Germany and Austria, show a disproportionately high increase in selling prices on average. The index ratio between output and input prices from the purchasing managers' survey shows us that during the first year of the pandemic in 2020 the significant decline in costs was not fully transferred to selling prices. In some cases, the index ratio was well above one, i.e. purchase prices had fallen more sharply than sales prices. Just before the turn of the year 2020/21, the situation changed. The rapid rise in purchase prices exceeded the increases in sales prices. Manufacturers' price-setting power was driven up by the increasing duration and intensity of the costs increase, as well as strong demand, and transfer of the higher costs to sales prices improved. Nevertheless, the data has so far indicated a higher dynamic for costs than for selling prices, which suggests that further cost pressure on sales prices is to be expected in the coming months.

Further information can be found at: International comparison of supply chain problems, Unicredit Bank Austria, July 2022

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Stefan Bruckbauer, Tel.: +43 (0)5 05 05-41951

Email: stefan.bruckbauer@unicreditgroup.at