UniCredit Bank Austria Economic Forecast 2023/24:

High inflation and weak economy call for economic policy

- Headwinds from monetary tightening, high inflation and ongoing geopolitical tensions to slow global economy sharply in 2023 and allow only tentative recovery in 2024

- High probability of recession at the end of 2022/start of 2023 in eurozone and slightly later in US, set to be followed by recovery at below-average pace

- Varying causes for inflation in US and eurozone, but similar slowdown trend heading towards central banks' 2% inflation target by mid 2024

- Key interest rates set to peak at 5% in US and 3.25% (refinancing interest rate) in eurozone in spring 2023

- Monetary policy shift expected for 2024 with total interest rate reduction of 150 basis points in US and 75 basis points in eurozone

- Gradual correcting of strength of US dollar. USD/EUR exchange rate expected to return to between 1.10 and 1.12 USD by end of 2024

- Global economic downturn and high inflation leading to recession in Austria over winter months

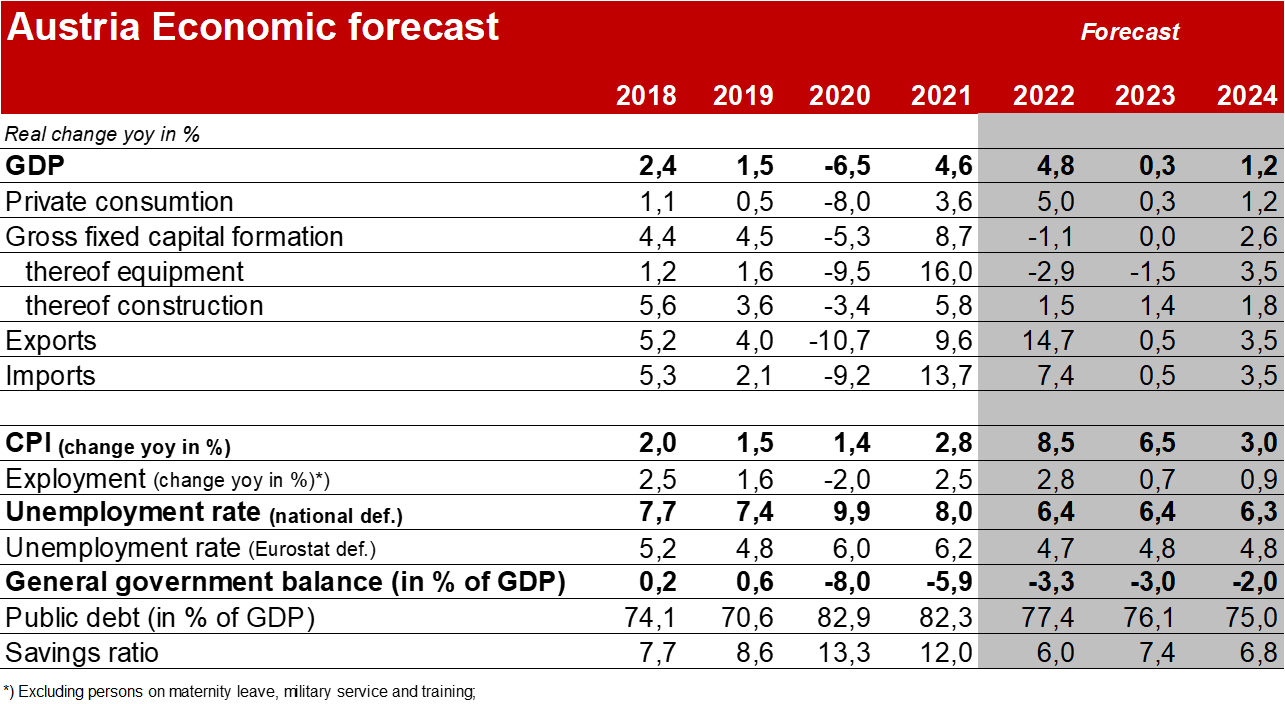

- Stagnation in Austria expected in 2023 with GDP growth of just 0.3% and moderate growth of 1.2% in 2024

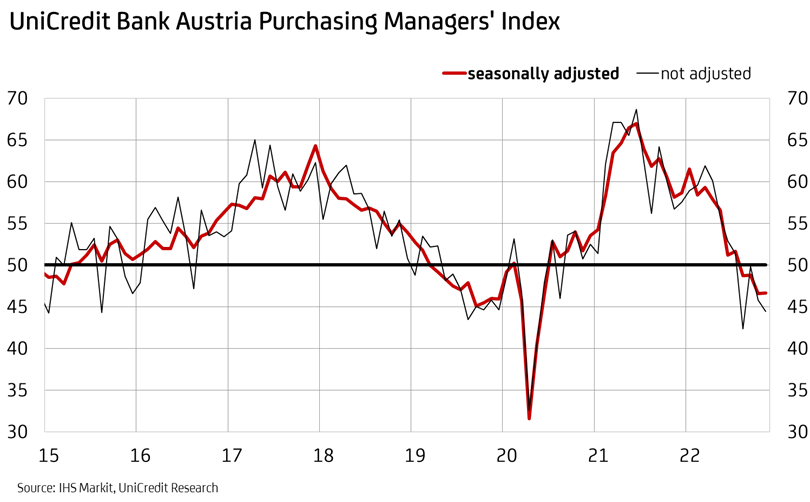

- Dip in industrial activity: UniCredit Bank Austria Purchasing Manager’s Index sits at 46.6 points in November, placing it below growth threshold for fourth consecutive month

- Stable labour market despite weak economy: Unemployment rate of 6.4% in 2023 and 6.3% in 2024 expected

- Inflation in Austria exceeds double-digit peak in winter, falling to 6.5% on average in 2023 and 3.0% in 2024

- Unusually high economic risks owing to geopolitical uncertainties, (energy) commodity price trends and risks to financial stability due to monetary policy overshoot

"The global economy is facing increasing headwinds. The strongest yet also fastest tightening of monetary policy in decades will exacerbate the effects of high inflation and severe irritation in international exchange ratios in many countries (known as terms-of-trade shocks). Continuing geopolitical tensions will continue to create uncertainty", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, introducing UniCredit Bank Austria's current economic overview and adding: "We expect global GDP to rise by just 1.9% in 2023, which essentially equals a recession. Stagnation is expected next year in the large developed economies of the US and the eurozone."

Economic development is likely to be characterised by a technical recession towards the end of 2022/start of 2023 in the eurozone and over the first half of 2023 in the US. "Despite the slowdown in the global economy, the high energy costs for companies and the loss of purchasing power caused by declining real wages, we are expecting the recession to be mild. The supportive fiscal policy, the favourable liquidity situation in the corporate sector and households' high savings—plus the further easing of supply chain problems and stable labour markets—should prevent a significant collapse", says Bruckbauer, adding: "The economy will start to recover in the first half of 2023. Due to the delayed impact of monetary policy, we expect the pace of recovery in both the US and the eurozone to be below average, with growth rates of 0.9% and 1.0% respectively in 2024; although the current pessimism does seem a little too high."

Monetary policy tightening until spring 2023, followed by shift in 2024

Inflation in the US is being driven primarily by demand, triggered by fiscal and monetary policies that were too relaxed during the pandemic. Inflation in the eurozone, by contrast, is being driven mainly by costs, as a result of high prices for energy imports. This difference in the source of the inflationary shock is why the monetary policies of the two economies have been tightened to varying extents.

"Central banks will continue to tighten the reins of monetary policy—overshooting the target in our view—in order to play it safe in the fight against inflation. We expect key interest rates in the US and the refinancing rate in the eurozone to peak in spring 2023, at 5% and 3.25% respectively (deposit rate: 2.75%). Furthermore, the ECB's quantitative tightening will soon include a reduction of around EUR 15 billion per month in the securities portfolio from the purchasing programmes", says Bruckbauer.

UniCredit Bank Austria economists are expecting 2024 to be a turning point in monetary policy. The US Federal Reserve is expected to cut key interest rates by a total of 150 basis points, and the ECB by 75 basis points. With the start of the easing cycle and the reduction in the interest differential, the strength of the US dollar against the euro will diminish. By the end of 2024, the exchange rate of the US dollar is expected to return to between 1.10 and 1.12 for one euro.

Inflation set to fall into central banks' target range by mid 2024

Despite the varied causes of inflation in the US and the eurozone, the slowdown in inflation is expected to be uniform. The prices of goods will decrease in the first instance due to demand, and the prices of services will follow after some delay. "By the end of 2023, we expect inflation to have fallen to around 3% in the US and 2.5% in the eurozone. By mid 2024, inflation should only be at 2%, putting it back within the central banks' target range", says Bruckbauer. Following 2022's figure of 8.6%, average inflation in the eurozone is expected to fall to 5.9% in 2023 and 2.1% in 2024.

Moderate recovery to follow Austria's winter recession

Following a strong first half of 2022, the economy in Austria has since slowed significantly. "In view of the decline in the international economy and the high inflation that is burdening consumption and investment activity, we expect a mild recession for the Austrian economy as 2022 ends and we head into 2023", says UniCredit Bank Austria Economist Walter Pudschedl, adding: "With inflation slowing, a recovery should begin in spring, buoyed by the development in the eurozone. Due to the weak start to the year, however, stagnation is all that can be expected for 2023 with a GDP increase of 0.3%. The pace of recovery remains slow, dampened not least by the delayed effects of the financing conditions being tightened. We are expecting economic growth of just 1.2% for 2024." Nevertheless, this should bring the increase in GDP slightly above the eurozone average once again.

UniCredit Bank Austria Purchasing Managers' Index indicating stabilisation of industrial downturn

For a start, the economic slowdown in Austria is characterised by a downward trend in the services sector. With inflation declining and fiscal stimuli and positive wage developments providing a boost, the services sector will lead the recovery in Austria from the spring. The domestic industrial economy has already slipped into recession and there is no imminent reversal of this trend in sight. The production sector is therefore expected to lag behind the recovery of the Austrian economy, driven by the services sector, from 2023 onwards.

"The UniCredit Bank Austria Purchasing Managers' Index stabilised at 46.6 points in November, but remains below the growth threshold of 50 points for the fourth consecutive month. Entrepreneurs' production expectations improved somewhat in November but, at 40.9 points, the corresponding index signals a continued decline in production in the Austrian industrial sector over the year", says Pudschedl.

While employment growth is losing momentum, new business has again fallen sharply and production has been reduced, albeit at a slightly slower pace. This weak demand is also reflected in rising inventory levels, shorter delivery times and significant easing in purchasing prices compared to the previous month.

Inflation to fall more slowly in Austria than in eurozone

With the drop in demand, inflation in Austria will likewise weaken from next year. "This decline in demand—in combination with base effects, the substantial stabilisation of prices for raw materials (energy in particular) and the further easing of material shortages—is expected to facilitate a slowdown in inflation from an average of 8.5% in 2022 to 6.5% in 2023 and 3.0% in 2024. Nonetheless, inflation in Austria will fall more slowly than in the eurozone, as more second-round effects can be expected from higher wage dynamics and stronger fiscal stimuli", says Pudschedl.

Tight labour market creating challenges

Despite the weak economic development, the labour market in Austria is expected to prove quite resilient. "Following the drop in the unemployment rate to an average of 6.4% in 2022, we expect it to stabilise at 6.4% in 2023 and to decline slightly to 6.3% in 2024", says Pudschedl. This optimistic view is driven by the current tightness of the domestic labour market. The job vacancy rate—i.e. the number of registered vacancies in relation to employment—has risen to a record level of 3%.

"The Austrian labour market is characterised by a shortage of labour, which is a structural problem. This is caused by factors such as the female employment rate being too low and the decline in average working hours. If the employment rate in Austria increased to the level it's at in Germany, or each employee increased their working hours by one hour a week from the current average of 27, the current number of vacancies of around 120,000 would be fully covered", says Pudschedl.

High risks but also opportunities depending on geopolitical developments

The economic outlook of UniCredit Bank Austria economists for the next two years is characterised by unusually high risks. The geopolitical uncertainties in particular will be crucial. "Growth expectations are highly dependent on geopolitical developments, particularly the conflict in Ukraine and its consequences for energy and other commodity prices. On the one hand, these could be resolved sooner than expected; on the other, they could also escalate significantly. This would put the brakes not only on the recovery but on the expected easing of inflation", says Bruckbauer, adding: "In this case, we would expect further increases in commodity prices and disruptions in trade and supply chains. The job of the central banks would then become even more challenging."

According to UniCredit Bank Austria's economists, the fact that higher interest rates and the tightened financial conditions of central banks' excessive monetary policy have increased the risks to financial stability cannot be ignored either. "Despite the challenges to financial stability posed by the excessive monetary policy, we are not expecting a systemic crisis because as household and corporate balance sheets are generally in good shape and the global banking sector is well capitalised", concludes Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel. +43 (0)50505 - 41957

Email: walter.pudschedl@unicreditgroup.at