UniCredit Bank Austria analysis:

Strong price increases for residential property reduce affordability throughout Europe - particularly in Austria

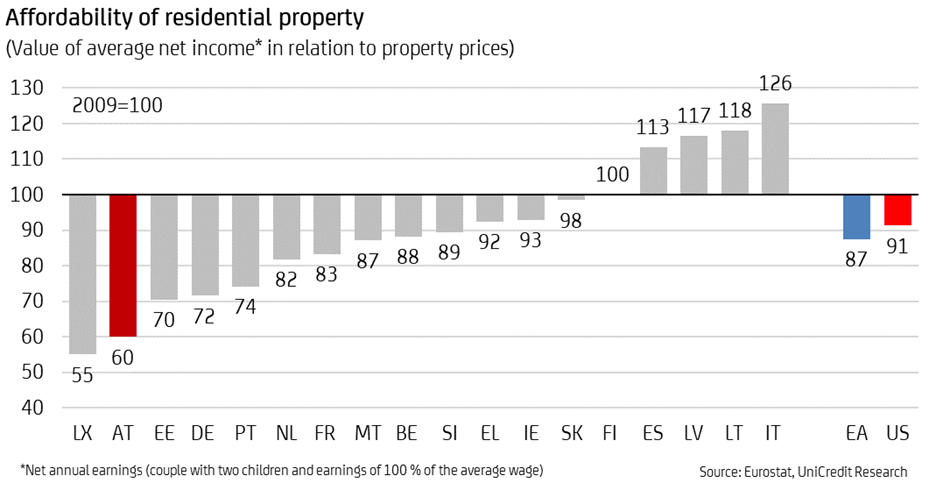

- Residential property price increases in the eurozone have significantly outpaced average net earnings increases in recent years. The real-terms value of net income in relation to property prices has fallen annually by more than 1% to around 87% of the figure for 2009

- Luxembourg and Austria have seen a particularly sharp drop in the affordability of residential property since the financial crisis. By contrast, the value of average income in relation to property price developments has increased in Italy, Lithuania, Latvia and Spain

- Despite the high real-terms value loss affecting income in Austria, housing is still relatively cheap compared to the rest of Europe. The purchase of a newly built residential property covering 100 square metres costs an average of 6.5x a household's net annual salary in 2022, which is less than in Germany, Spain, France and other countries

- Despite the tightening of monetary policy, the sharp rise in property prices is clearly the cause of the reduced affordability of residential property in the eurozone and in Austria

- A 50 m2 property now costs an average of EUR 230,000, compared to EUR 100,000 in 2009

"Residential property prices in the eurozone have risen significantly more than earnings in recent years. Affordability has therefore markedly decreased. Average net earnings in relation to property prices have declined by around 13% since 2009; in Austria the figure is almost 40%", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: "Since mid-2022, the affordability of residential property has also been influenced by the ECB's tightening of monetary policy. Our calculations show, however, that the drastic increase in property prices rather than interest rate trends is the main driver behind the reduction in affordability. In Austria, monthly repayments on property loans are now more than twice as high as they were in 2009 for a property of a comparable size. Around 95% of this increase is attributable to the higher property prices and only 5% to increased loan costs."

Eurozone property prices up 45% since financial crisis

"Prices for residential property in the eurozone were 45% higher in 2022 than in 2009. This equates to an average property price increase of almost 3% per year since the financial crisis", says UniCredit Bank Austria Economist Walter Pudschedl. The biggest increase was in Estonia, with prices tripling (+9.1% per year), followed by Luxembourg where prices increased by a factor of 2.5 (+7.2% per year). In Austria, too, prices for residential property have more than doubled since 2009. Austria therefore has the third-largest increase in the eurozone; and with the average annual increase sitting at 6.6%, Austria also outpaces the USA.

General inflation is significantly lower than property price increases

"The rise in property prices in the eurozone since the financial crisis has significantly exceeded the rise in consumer prices. Real estate has therefore become significantly more expensive by comparison with other goods and services. The price of residential property rose by an average of 2.9% per year between 2009 and 2022, while annual inflation was only 1.9%", says Pudschedl.

In three quarters of the 20 eurozone countries, the rise in property prices up to 2022 was higher than the rise in consumer prices — in some cases considerably so. The biggest difference in momentum between property prices and consumer prices can be seen in Estonia, at five percentage points per year, followed by Luxembourg. In Austria, the annual difference has been more than four percentage points since 2009, against the backdrop of property prices that have more than doubled and a 35% increase in general price levels during the same period. Only in four countries did inflation exceed property price increases. The countries in question were primarily battling the aftermath of a property bubble, like Spain.

Property price momentum outstrips net earnings increases — leading to significant decline in affordability

Since income largely follows consumer price trends, the affordability of residential property in the eurozone has decreased significantly since the financial crisis. Property prices declined temporarily in the immediate aftermath of the crisis in 2009 and affordability actually increased, but the subsequent low-interest phase supported a sharp rise in property prices that far outstripped increases in income. The momentum gap between property prices and income then widened further during the COVID-19 crisis.

"As at the end of 2022, property prices in the eurozone had increased by 45% since 2009, while net income had increased by just 27%. What this means is that real-terms net income in the eurozone in 2022 in relation to property prices only amounted to around 87% of the 2009 level", says Pudschedl.

Luxembourg has seen the biggest drop in the affordability of property since the financial crisis. The value of the average annual income in relation to property prices sank to just 55% of the 2009 level. In Austria, too, there was above-average loss in the value of income in relation to property prices, at around 60%. The value of income in relation to property prices rose in just five countries during this period: Finland, Spain, Latvia, Lithuania and Italy.

Due to the considerable momentum seen in recent years, the square metre prices for a newly built property in Austria in 2022 were among the highest in Europe at around EUR 5200. On average, the purchase price of residential property in Austria exceeds even that in France and Germany. In Spain and Italy as well as in the surrounding Eastern European countries, property prices are even significantly lower.

"Despite the high price per square metre and the associated high value loss affecting income in Austria, housing is still relatively cheap compared to the rest of Europe. According to our calculations based on the Deloitte Property Index, the purchase of a newly built residential property covering 100 square metres in 2022 costs an average of 6.5x an Austrian household's net annual salary. Housing in Austria is therefore still slightly more affordable than in France, Spain or Germany", says Pudschedl. Affordability in the Central and Eastern European countries is significantly lower. In Slovakia, it costs on average almost 14x the annual income to purchase a residential property of the same size.

The problem is prices, not interest

As a result of the ECB raising the base rate in mid-2022, credit interest rates in Austria have risen to around 4% p.a. as at mid-2023. In 2009, the monthly costs (repayment and interest) for a property loan in excess of EUR 100,000 over 20 years at an interest rate of slightly less than 4% were just under EUR 600. Following declining rates over subsequent years and a low in 2021, tightening of monetary policy once again led to an increase in the monthly cost of a comparable loan, to just over EUR 600 currently. Taking into account the income increase since 2009, the proportion that the monthly costs for a property loan in excess of EUR 100,000 over 20 years makes up of net monthly income is currently 9%, which is higher than the annual average for 2022 at 7.4% but significantly lower than the 12% seen in 2009.

"The rise in property prices means that a significantly higher budget is required now than was the case in 2009 to purchase a property of the same size. A 50 m2 property that could be acquired for around EUR 100,000 in 2009 now costs an average of EUR 230,000, resulting in monthly loan costs of more than EUR 1375 compared to just under EUR 600 in 2009", says Pudschedl, adding: "The sharp rise in property prices between 2009 and mid-2023 accounts for around EUR 750 (more than 95%) of this difference. Only around EUR 25 is attributable to interest rate increases since 2009."

The monthly cost of financing a property is now more than 19% of average net income, which is significantly more than the figure of 12% in 2009 for a property of a similar size. If property prices had developed in step with general inflation, loan costs as a proportion of net earnings would now be almost as high as in 2009 and affordability almost unchanged. Only when taking a short-term view of recent months does it become clear that the increase in interest rates following the tightening of monetary policy by the ECB has also pushed up the cost of financing a property loan, and property prices have now actually begun to decline slightly.

Further information can be found on:

https://www.bankaustria.at/boersen-und-research-analysen-und-research.jsp

Analysis: "Price is the problem, not interest rates — housing affordability in European comparison", UniCredit Bank Austria, August 2023

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at