UniCredit Bank Austria Analysis

Austria‘s competitiveness challenged

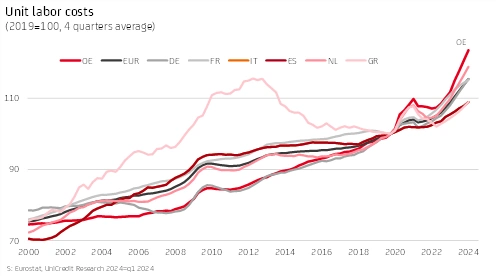

- Triggered by high inflation in Austria, unit labour costs also rose at an above-average rate of 23 %, five percentage points more than in the eurozone

- Despite an above-average increase in labour costs, sales prices rose only on average, and even below average in exports

- Austria very successful in exporting goods and services since 2019

- Austria with strongest difference between rise in labour costs and export prices

- Export success at the expense of earnings, real decline in profits for Austria’s economy as a whole, despite growth on average in the eurozone

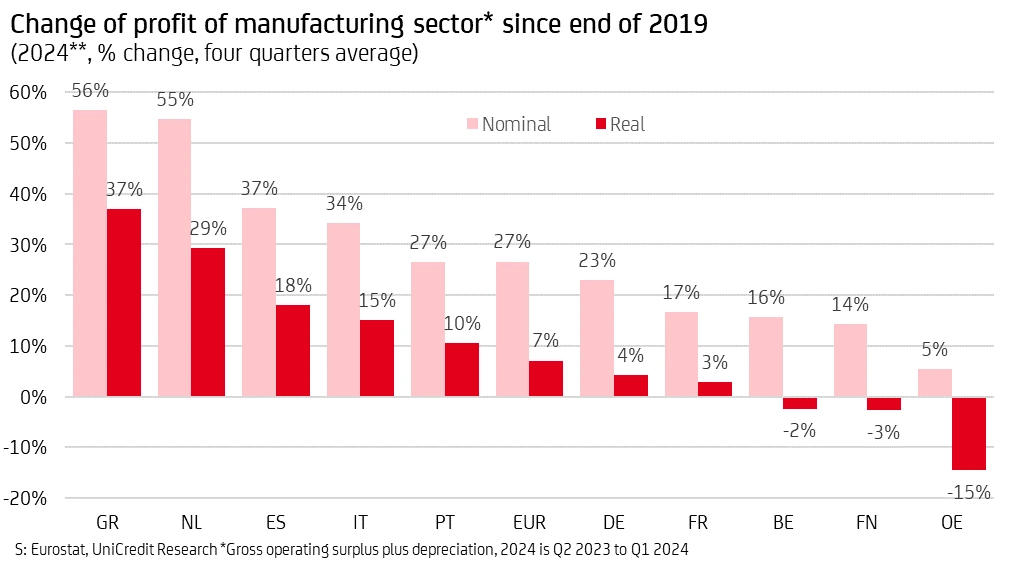

- Sharp real decline in profits for Austrian industry of around 15 %, despite increase of 7 % in the eurozone

Since the start of the pandemic, Austria has seen the sharpest rise in unit labour costs among the top ten eurozone countries1 with an increase of 23.4 per cent (2024Q1 compared to the end of 2019), almost ten percentage points more than the eurozone average or Germany (15.4%) and almost 15 percentage points more than Italy, for example. The main reason for the stronger increase in unit labour costs in Austria was higher inflation, which at 23% (Q2 2023 to Q1 2024 compared to 2019) has been five percentage points higher in Austria than in the eurozone since the start of the pandemic.

The smaller decline in real wages of two percent compared to the eurozone, where it was four percent, also made a small contribution, with Italy in particular experiencing significant real wage losses, while Germany’s development was similar to Austria at two percent. The increase in productivity, which at three percent was somewhat stronger in Austria than in the eurozone (one percent), was unable to compensate for the large difference due to inflation.

Strongest increase in unit labour costs within the eurozone for Austria since 2019

“Among the top eurozone countries, Austria suffered the sharpest rise in unit labour costs since 2019, mainly due to higher inflation in Austria,” says Stefan Bruckbauer, Chief Economist at UniCredit Bank Austria. “Despite the sharper rise in costs in Austria, export prices for goods and services from Austria in particular did not rise more sharply, meaning that export market shares could even be gained, albeit at the expense of earnings, with the manufacturing sector in particular suffering a sharp drop in real profits,” says Bruckbauer, summarising the results of a UniCredit Bank Austria analysis.

Despite sharp rise in costs, below-average increase in export prices

Despite the highest increase in unit labour costs in Austria compared to the major eurozone countries, producer prices (industrial sales prices) rose significantly less in Austria than in most other eurozone countries, both domestically and, above all, abroad. Domestic producer prices in Austria have risen by 35% since 2019, an increase that was four percentage points below the eurozone average and even six percentage points below the increase in Germany. At 18%, producer prices of Austrian goods abroad even showed the lowest price increase, but overall the price increase abroad was significantly lower than at home.

If one takes the overall price development of exports, i.e. goods and services, together, the average price increase of 18 % in business with foreign countries in Austria was lower than in almost any other of the larger euro countries, similar to exports from Germany or Italy, and less than exports from Spain or the Netherlands.

Austria’s export success at the expense of earnings

Accordingly, Austria has also been able to maintain or even expand its position in exports, at least in comparison to other eurozone countries, since the end of 20192. “Austria’s exports of goods and services have risen by 8.2% in real terms since 2019, more than exports from Germany (1.4%) or France (3.7%), for example; only Italy and Portugal had a stronger increase in exports of goods and services among the larger eurozone countries,” says Bruckbauer.

As the increase in unit labour costs for Austria's export industry (goods and services) was one of the strongest, and at the same time both producer prices abroad and overall prices for goods and services in exports rose by around 18%, which is similar to other eurozone countries, the margin is likely to have fallen significantly. The difference between the increase in unit labour costs and export prices amounted to -5.3 percentage points during this period.

“Each of the top 10 countries in the eurozone, with the exception of Austria, was able to increase its export prices more strongly than unit labour costs, which rose by an average of 8.3 percentage points more in the eurozone, 2.7 percentage points in Germany and 8.9 percentage points in Italy. Export success and the maintenance of competitiveness in Austria are therefore likely to have come at the expense of profitability”, according to the economists at UniCredit Bank Austria.

Profits in Austria declining in real terms, especially for the manufacturing sector

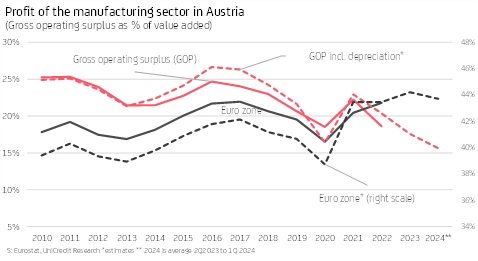

This is confirmed by the development of gross operating surpluses. While these increased by 23% in nominal terms and 3.8% in real terms on average in the eurozone between 2019 and 2023, growth in Austria was lower at 19% in nominal terms and even fell by 3.7% in real terms.

If we look at the manufacturing sector alone, it is clear that price competitiveness in the face of sharply higher unit labour costs has resulted in a significant decline in profits and margins. “An estimate of the gross operating surplus3 for the manufacturing sector in Austria shows an increase of just 5% in nominal terms compared to 2019, which means a drop of 15% in real terms. This was by far the weakest development among the larger eurozone countries”, Bruckbauer quotes from the UniCredit Bank Austria study.

For example, the gross operating surplus (including depreciation) of industrial companies in Greece rose by 56% (37% in real terms) between 2019 and the fourth quarter of 2023, while in the Netherlands it still rose by 29% in real terms and the eurozone average by 7% in real terms. Industrial companies in Germany have also been able to increase their surplus by 4% in real terms so far.

Economic policy required to improve framework conditions for cost efficiency

Even if both price competitiveness and profit development depend on very different factors, not least the mix of products and sales markets, and Austria's industry was very successful in the past4 and was able to achieve a higher “margin” (share of gross operating surplus in value added), the situation is likely to have deteriorated significantly recently.

A look at the development up to 2022 (data is only available for this at industry level) shows that the earnings trend was particularly challenging in the machinery industry, the automotive industry and the furniture industry. The earnings situation in the energy sector and the construction industry was significantly better up to 2022. The retail and transport industries are also likely to have been under strong pressure on earnings, while the catering and accommodation sector is likely to have maintained its margin, at least until 2022.

Shifts in shares of value added between wages and profits were nothing unusual in the past, but the sharp difference in inflation recently and the Austrian tradition of setting wages based on the inflation rate have now led to a major challenge for the location.

While the manufacturing sector will be able to absorb this to some extent by increasing productivity, not least by relocating parts of production abroad, it poses a greater challenge for parts of the service sector, such as tourism. “Increasing efficiency and other measures to reduce the cost burden, especially on labour, are now particularly necessary and represent an important task for the next government in Austria”, says Bruckbauer.

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Stefan Bruckbauer, Tel.: +43 (0) 5 05 05-41952;

E-mail: stefan.bruckbauer@unicreditgroup.at

| Fußnoten: | |

| 1 | The top 10 eurozone countries by GDP are Germany (DE), France (FR), Italy (IT), Spain (ES), the Netherlands (NL), Belgium (BE), Austria (OE), Finland (FN), Portugal (PT) and Greece (GR). These countries account for over 90 per cent of the eurozone's GDP. Ireland, no. 7, was not included in the analysis due to the high volatility of its GDP. |

| 2 | See also: Pudschedl, Walter: “Fighting against windmills”, UniCredit Bank Austria Brief Analysis, July 2024 |

| 3 | No data is yet available for operating surpluses for 2023 at the level of the individual sectors, so the difference between value added and employee compensation is used here as an estimate for the development of operating surpluses, i.e. depreciation is still included here. |

| 4 | See also: Bruckbauer, Stefan (2021). Austria's industry in the last 20 years - a success story, UniCredit Bank Austria Analysis, September 2021 |