UniCredit Bank Austria Purchasing Manager Index in August:

Lack of new orders prolongs recession for Austria's industry

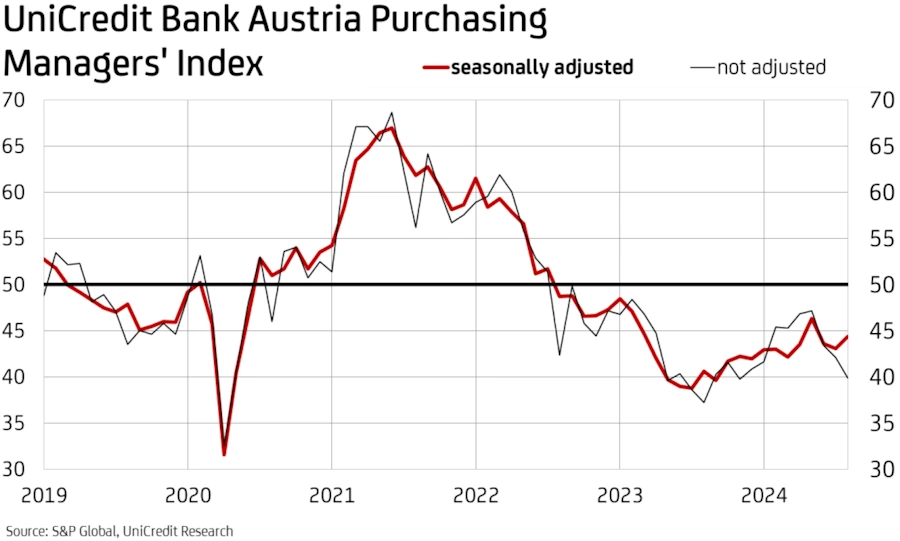

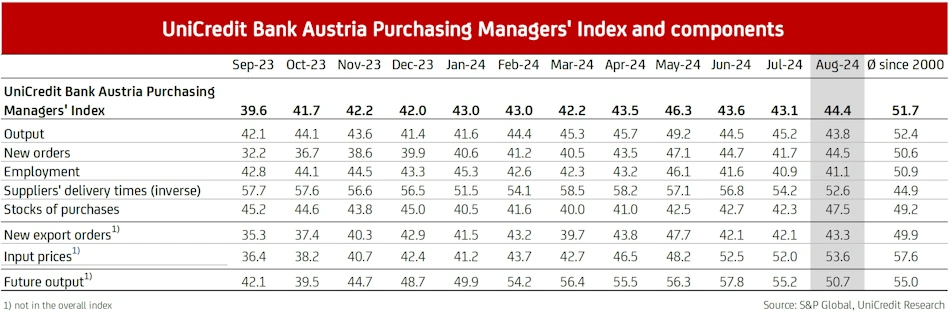

- Despite a slight increase in the UniCredit Bank Austria Purchasing Managers' Index in August to 44.4 points, the industry has now been in recession for exactly two years

- Deterioration in the economic outlook: Expectations index for industrial production for the next twelve months fell to just 50.7 points, the lowest value since the beginning of the year

- Despite a slightly lower drop in new orders, industrial companies cut back output at a faster pace in August

- Continued strong job losses increased unemployment rate in manufacturing to highest level in three years

- Increasing burden on the earnings situation, as weak demand necessitated discounts in output prices despite rising costs

- The significant reduction in purchasing volumes led to a further reduction in inventories of raw materials and input materials

Domestic industry is not emerging from the economic slump. "The UniCredit Bank Austria Purchasing Managers' Index rose to 44.4 points in August. The downward trend has thus slowed somewhat compared to the previous month, but the industry is still in a deep recession. For exactly two years now, the indicator has been below the 50-point mark, above which growth would be signaled," says UniCredit Bank Austria Chief Economist Stefan Bruckbauer.

No economic recovery in sight

The results of the latest survey of Austrian purchasing managers, conducted by S&P Global on behalf of UniCredit Bank Austria, offer no rays of hope to suggest an imminent economic improvement in the manufacturing sector. "Production output was reduced even more sharply in August than in the previous month, as new business continued to decline. Once again, many jobs were cut and price trends point to a deterioration in the earnings situation," says Bruckbauer, adding: "In view of the ongoing economic slowdown, companies' hopes of an improvement in the situation have been dashed. The index for production expectations over the next twelve months has fallen to 50.7 points, the lowest value since the beginning of the year and below the long-term average for the first time. Domestic industry is therefore hardly expecting any growth in the medium term either."

The international environment also currently offers no prospects for domestic industrial companies. "Apart from the increasing challenges in the export business due to the unfavourable development of price competitiveness and the general rise in protectionism, the global industrial recovery has stalled," says Bruckbauer, adding: "The ongoing recession in European industry is now being compounded by a noticeable slowdown in US industry. The preliminary Purchasing Managers' Index for the manufacturing industry in the US fell to 48.0 points in August, falling below the growth threshold for the second month in a row." In the eurozone, the preliminary purchasing managers' index for industry fell to 45.6 points, weighed down by significant declines in the major industrialised nations of Germany and France.

Accelerated decline in production

While all other components of the UniCredit Bank Austria Purchasing Managers' Index showed at least a slight slowdown in the downward trend, the decline in production accelerated in August compared to the previous month. "The output index fell to 43.8 points. This means that the pace of the decline in production in the domestic industry was only stronger at the beginning of the year than in August. This is due to the continuing slump in new business, even if the drop in new orders has decreased somewhat recently. Increased concerns about the economy and geopolitical uncertainties are continuing to make people reluctant to invest. In addition, increased destocking and weakness in the construction sector are likely to dampen demand in industry," says UniCredit Bank Austria economist Walter Pudschedl. Demand from abroad and domestically declined at a slower pace in August, although the significantly lower improvement in the index for new export orders to 43.3 points tends to indicate greater challenges in international business. At 44.5 points, the index for new orders noticeably exceeded the output index for the first time since mid-2021. However, this single positive signal does not yet indicate a possible recovery in the industry.

Continuing strong job losses

In view of the reduction in production due to a lack of orders, domestic industrial companies have once again significantly reduced their workforce. "The pace of job cuts has hardly changed since the previous month and remained consistently high in August. The number of employees in manufacturing fell by around 7,000 compared to the previous year. At the same time, the seasonally adjusted unemployment rate rose to 3.9 per cent, its highest level since June 2021," says Pudschedl.

In the first eight months of the year, the unemployment rate in Austrian industry averaged 3.7 per cent. As the deterioration in the labour market is likely to continue, the economists at UniCredit Bank Austria expect the unemployment rate in the sector to average at least 3.8 percent in 2024, compared to just 3.2 percent in the previous year. The deterioration in the labour market situation in the industrial sector will therefore also have a significant impact on the upward trend at a macroeconomic level, but will remain significantly more favourable. In the economy as a whole, the unemployment rate is likely to rise to 7 per cent in 2024.

Rising costs, but slightly falling output prices

Input prices for domestic industry rose for the third month in a row, and at an increasing pace in August. "Higher raw material and transport prices were responsible for the recent rise in costs in the domestic industry. Although the cost dynamics in August were below the long-term average, the earnings situation of companies is likely to have deteriorated on average, as output prices were reduced again at the same time. However, the price reductions due to weakening demand were very small," says Pudschedl. The output price index rose to 48.6 points in August.

Purchasing and inventories reduced

In view of the weak economic environment, domestic industrial companies once again reduced their purchasing activities at a rapid pace in August. The index for purchasing volume only reached 40.2 points and was therefore only marginally higher than in the previous month. The low index indicates that the decline in purchasing volume in companies was greater than that in production output, which points to continued strong efforts to reduce inventories. "In view of lower production requirements and rising costs, as well as to increase the liquidity of companies, inventories of raw materials and input materials were reduced for the seventeenth consecutive month in August, albeit at a noticeably slower pace than in previous months. By contrast, inventories of finished goods remained largely unchanged, as cost-driven efforts to reduce them in the face of unexpectedly low sales volumes and excessively high production capacities were thwarted," says Pudschedl.

Queries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Phone: +43 (0)5 05 05-41957;

E-mail: walter.pudschedl@unicreditgroup.at