UniCredit Bank Austria Purchasing Manager Index in November:

The downturn in Austrian industry slows towards the end of the year

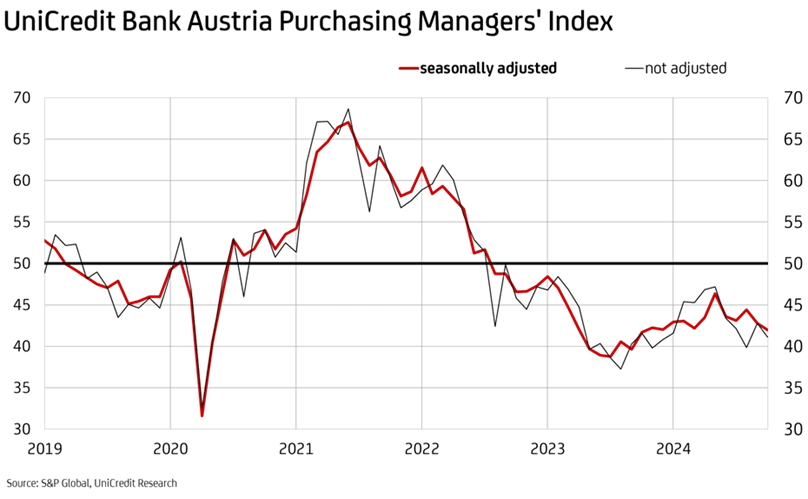

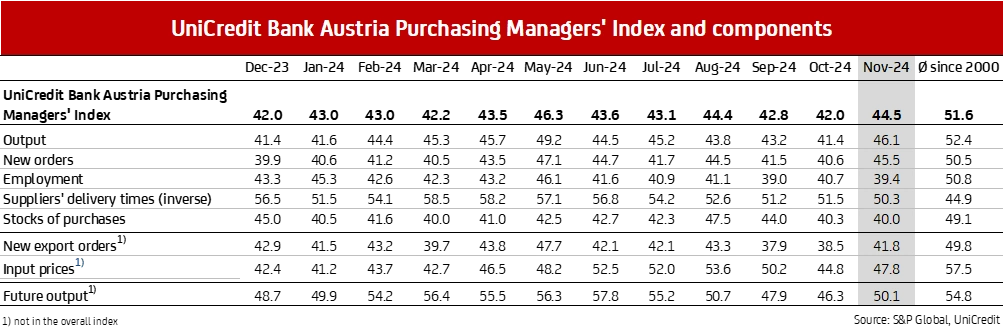

- The UniCredit Bank Austria Purchasing Managers’ Index rose to 44.5 points in November, signalling a slight easing of the economic weakness in the middle of the third year of recession

- Slightly fewer declines in orders resulted in fewer production restrictions than in the previous month

- However, job losses in domestic industrial companies picked up speed again in November

- The accelerated reduction in purchasing volumes led to a further significant decrease in stocks of purchases

- The output price reductions as a result of weak demand were greater than the cost savings from falling raw material prices

- The outlook for Austrian industry stabilised at a low level: the index of production expectations within a year rose to 50.1 points in November, just above the neutrality threshold

In November, there were cautious signs of stabilisation in the industrial economy for the first time in months. “The UniCredit Bank Austria Purchasing Managers’ Index rose by 2.5 points to 44.5 points in November compared to the previous month. However, the indicator was still well below the 50-point mark that signals growth in domestic industry and thus pointed to a continuation of the recession in domestic industry, albeit to a lesser extent,” says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: “This is because the downward trend in production and orders slowed down. On the other hand, the reduction in employment accelerated and weak demand further increased caution in stockpiling. In addition, there was even greater pressure to grant price reductions in sales.”

Fewer declines in orders, fewer production restrictions

The biggest contribution to the rise in the UniCredit Bank Austria Purchasing Manager Index in November came from the noticeable slowdown in the decline in new orders. New domestic business developed more favourably than export business, which remained more subdued due to weak demand from Europe, particularly from the important German market. In addition to restrained demand, increasing geopolitical uncertainty and the current financing conditions, however, new business continues to be held back by customers’ high inventory levels in some cases. Despite the increase to 45.5 points, the index for new orders has been below the production index for three months. Domestic companies therefore continued to focus on working off order backlogs, which consequently fell sharply again in November. However, the negative trend slowed here too. Due to the reduction in order backlogs, average delivery times also fell in November, but only at a very slow pace.

The production index rose to 46.1 points, the second-highest value in a year and a half. “Domestic companies reduced production less sharply than in the previous month because the decline in new business also slowed. The pace of the decline in domestic orders in particular slowed noticeably,” says UniCredit Bank Austria economist Walter Pudschedl.

Job cuts

Despite the slowdown in the decline in production, job losses in Austrian industry accelerated again in November. The employment index fell to 39.4 points, the lowest value of the current recession apart from September.

In the course of the ongoing adjustment of production to declining new business, employment in the domestic industry began to fall exactly one and a half years ago. Since then, almost 14,000 jobs have been lost in the sector. “In view of the ongoing recession, more and more domestic companies have had to refrain from retaining qualified employees in order to be well equipped for a coming economic recovery. The sharp drop in capacity utilisation to well below the long-term average has accelerated the necessary adjustment of personnel capacities to the lower production requirements in recent months, especially as the shortage of skilled workers has also eased noticeably in the meantime. In November, the seasonally adjusted unemployment rate in manufacturing rose to 4.1 per cent, the highest level in three and a half years,” says Pudschedl.

In the weak demand environment, job losses are expected to continue in the coming months and the unemployment rate in industry is expected to rise further. If expectations of a recovery in the course of 2025 are fulfilled, a turnaround in the labour market can be expected around the turn of the year 2025/2026. “We expect the annual average unemployment rate to rise to 3.8 per cent in 2024 after just 3.2 per cent in the previous year. Despite higher momentum, the unemployment rate in the sector will remain significantly lower than in the economy as a whole at 7.0 per cent,” expects Pudschedl. An above-average deterioration is expected in the industrial strongholds of Upper Austria and Styria.

Output prices fell more sharply than costs

Due to the lower demand for raw materials and primary products, domestic companies once again reduced their purchasing volumes in November, which was not only reflected in a further reduction in inventories of primary materials, but also led to a continuation of the decline in purchasing costs. “Weak demand has now supported a decline in input prices for exactly one year. However, the companies’ costs for preliminary products and raw materials have fallen more slowly recently,” says Pudschedl, adding: “The decline in costs had to be passed on to customers due to the strong competition in a weak demand environment. Output prices fell even more sharply than costs due to discounts, particularly in the capital goods industry. On average, the earnings situation of domestic companies is likely to have deteriorated somewhat as a result of the price trends.”

Risks increased, recovery still not in sight

The slowdown in the downward trend in domestic industry, which was reflected in lower declines in new orders and output than in the previous month, was accompanied by a decline in pessimism among companies in November. The rise in the production expectations index to over 50 points for the first time in three months signals a stabilisation of the economy in the medium term, albeit at the current low level. The balance between new orders and stocks of finished goods for the first time since May also supports hopes of a foreseeable end to the recession in Austrian industry.

However, the cautious stabilisation trends are on rather shaky ground, which is underlined not only by the increased risks for global trade but also by the impending political changes in the USA and the persistently challenging European environment. The preliminary Purchasing Managers’ Index for the manufacturing industry in the eurozone fell to 45.2 points in November. The weakness of German industry is also weighing heavily on other markets besides Austria, including France.

“Despite a slight stabilisation trend, there is no end in sight to the recession in domestic industry for the time being. While the starting position for Austria’s industry is particularly challenging due to the sharp rise in unit labour costs and the resulting reduction in price competitiveness, the further easing of monetary policy and the rising real purchasing power of domestic consumers for 2025 are also delicate signs of a return to a moderate growth trajectory over the course of the year," says Bruckbauer, adding: "However, in view of increased risks due to further intensifying political uncertainties and increasing protectionism in global trade, our expectations are very limited. Following the decline in industrial production by almost 4 per cent in real terms in 2024, we only expect production of goods in Austria to stabilise in 2025 with an increase of less than one per cent.”

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

E-mail: walter.pudschedl@unicreditgroup.at