UniCredit Bank Austria analysis:

Housing prices in Austria rose much more sharply than incomes in 2021

- The coronavirus crisis has provided an additional impetus to the sharp rise in residential property prices in Austria. After an average increase of 7 percent in 2020, property prices are likely to have risen by more than 10 percent in 2021

- This property price increase, the highest since 2012, was fuelled by sustained high demand. This in turn was the result of a rise in demand for homes and an increased desire, brought about by the pandemic, for a change in the housing situation, as well as increased investment in tangible assets

- Because of this, residential property prices rose particularly sharply relative to incomes in 2021: on average, the value of an annual net income measured against property prices has decreased by 13 percent in real terms since the start of the pandemic

- Rents have also increased markedly. Rents have risen by a total of 60 percent since 2008, but property prices have doubled, meaning that the cost of renting has risen by less than the cost of buying

- The housing price surge is expected to continue at a slower pace in 2022. Prices will continue to rise relative to income in 2022, but not as much as in the first two years of the pandemic

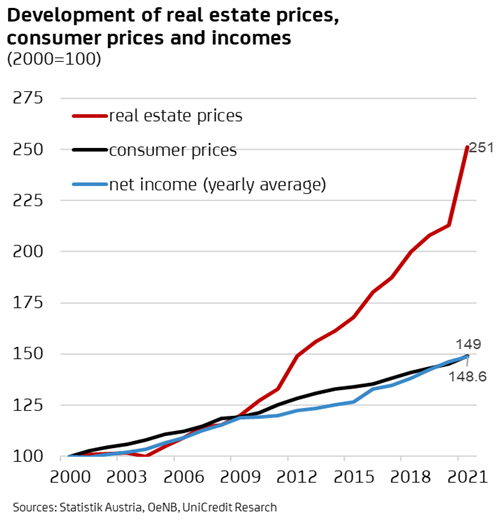

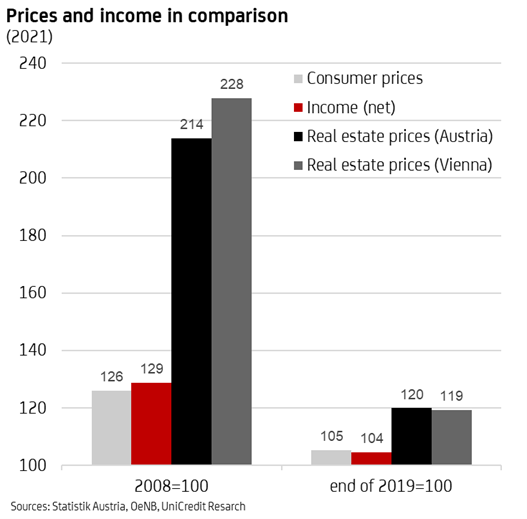

Residential property prices in Austria have been rising very sharply for more than a decade. "Since the 2008 financial crisis, property prices have more than doubled. The upward trend has accelerated even more during the pandemic. Incomes are not rising as fast as prices, so housing in Austria is becoming more expensive relative to incomes," says UniCredit Bank Austria Chief Economist Stefan Bruckbauer. He continues: "In real terms, the value of an average Austrian net income relative to the property price index has decreased by more than 40 percent since the financial crisis and by around 13 percent since the start of the pandemic alone. Although lower interest rates for housing loans have helped Austrian house builders in recent years, they have only been able to offset a small portion of these losses."

Accelerated increase in housing prices during the pandemic

The sustained high demand for housing, the increased attractiveness of investing in tangible assets and the shift in focus during the pandemic to properties with open spaces or to having a "house in the country" gave a further impetus to property prices in Austria in 2021. Having risen sharply by an average of 7 percent in the first year of coronavirus, 2020, the Austrian National Bank (OeNB) property price index indicates that, on average, residential property prices are likely to have increased by more than 10 percent over the second year of the pandemic. "The property price boom has reached a new peak during the pandemic. Property prices in Austria are currently almost 20 percent higher than they were at the start of the pandemic. In contrast, the general price level measured against consumer prices and average incomes only rose by around 5 percent over the same period," says UniCredit Bank Austria economist Walter Pudschedl.

This means that, on average, the value of an annual net income measured against property prices has decreased by 13 percent in real terms in just two years since the start of the pandemic. In purely arithmetic terms, in 2021 an employee would have needed to work for around 15 years to buy a 100 m² condominium, and around 7.5 years for a 100 m² house. Before the pandemic, it was one to 1.5 years less.

The significant divergence of the prices of residential properties and general consumer prices began around the time of the 2008/2009 financial crisis. As incomes have largely followed the rise in consumer prices, residential properties have become much more expensive relative to incomes since that time. The average net income has increased by around 28 percent since 2008, slightly more than the general price increase of 26 percent. However, residential property prices have more than doubled during the same period. Since the beginning of the financial crisis, the value of the average net income of an employee working in Austria has fallen in real terms by 40 percent relative to the property price index. In 2008, an annual income could buy around 14 m² of housing space (weighted average of houses and condominiums); in 2021 it was only enough for 8 m².

Compensation effect of lower interest rates

The sharp decline in interest rates in recent years has led to a reduction in the costs of loans to finance property purchases. According to OeNB statistics, the interest rate for a residential construction loan with a fixed interest rate for 10 years and more has fallen from an average of 5.6 percent in 2008 to 1.55 percent before the pandemic and stood at only 1.33 percent at the end of 2021. As a result, the monthly charge for a 20-year loan of 100,000 euros has fallen from around 700 euros to only 475 euros today, which means that it is around 30 percent lower. A monthly instalment amount of 700 euros was enough to take out a loan of 142,800 euros just before the pandemic; now it would be enough to borrow 145,650 euros.

"More affordable financing conditions have dampened the rise in property prices by around 45 percent relative to incomes since 2008. However, the slowdown in the trend of interest rate cuts has reduced this effect over the past few years. Since the start of the pandemic, it has been just over one percent. The falling cost of debt financing, which is how most owner-occupied properties are financed, has therefore at least partially absorbed the increase in property prices. The price increase since 2008 is decreasing, but is still around 70 percent. Since the start of the pandemic it is 12 percent," says Pudschedl.

Rents have also increased significantly, but less sharply than purchase prices

Rents have risen by around 60 percent since 2008. This is equivalent to an annual increase of 3.7 percent. This is not only well above the general inflation rate of 1.8 percent, but also higher than the nominal income growth during this period, which is almost 2 percent per year on average. Property prices have risen by an average of 6.2 percent per year since the financial crisis.

"Rents have also increased markedly relative to incomes since the financial crisis. The value of an average Austrian net income relative to the rental price index has decreased in real terms by over 20 percent since the financial crisis. By comparison, property prices have more than doubled during this period, so the cost of renting has risen less sharply than the cost of buying," says Pudschedl.

Price dynamics are expected to slow

The increase in the price of housing relative to incomes, the upcoming turnaround in interest rates and the decline in demand for housing all point to a slowdown in the price surge on the Austrian residential property market. "The peak in the price rise seems to be behind us, but the existing investment pressure continues to support the domestic residential property market. The classic investor motivation to hedge against inflation by escaping to tangible assets continues to take centre stage. This, along with the desire for security, will continue to drive demand for residential property, push up prices and lead to a further increase in housing costs for now, but at least less so than in 2021," Bruckbauer concludes.

Further information can be found at: Housing became significantly more expensive in 2021 relative to incomes, UniCredit Bank Austria, January 2022

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957

Email: walter.pudschedl@unicreditgroup.at