UniCredit Bank Austria Business Indicator:

Pace of Austrian economic downturn stabilising and probability of recession declining

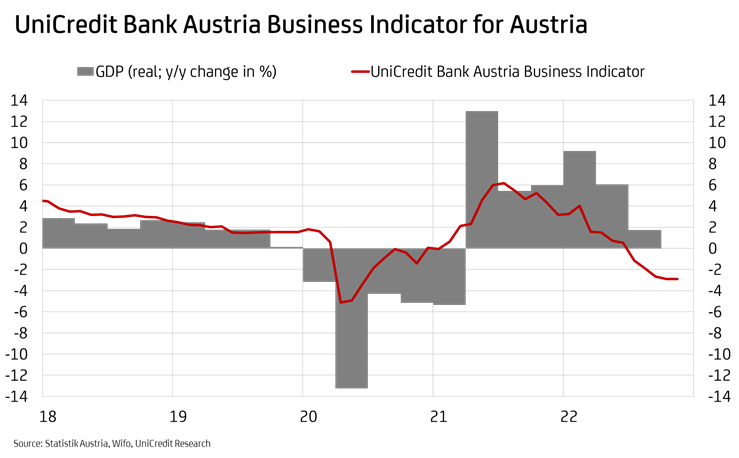

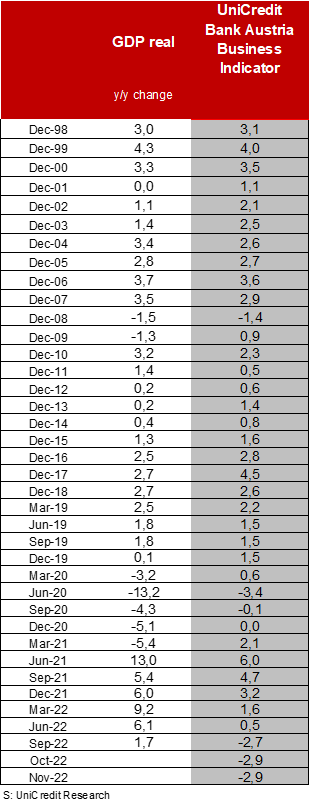

- UniCredit Bank Austria Business Indicator at minus 2.9 points in November, as in previous month

- Stabilising economic sentiment reduces likelihood of recession over winter months

- Recovery starting in spring set to be moderate until 2024, dampened by weak global environment and impact of changing financing conditions

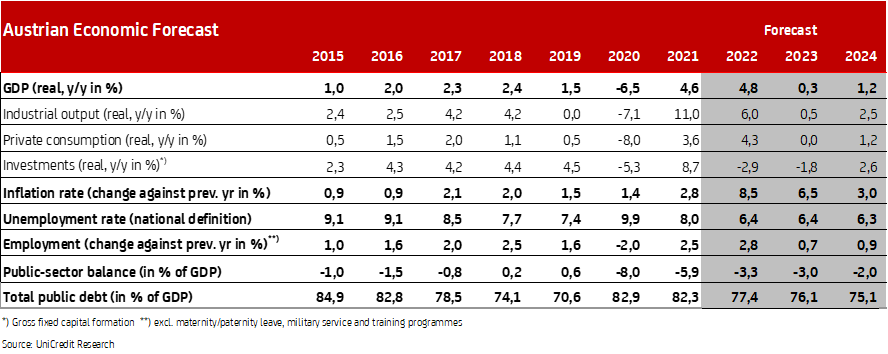

- Following GDP increase of almost 5% in 2022, stagnation expected in 2023, with GDP rising by 0.3%. Moderate recovery expected in 2024 with economic growth of 1.2%

- Labour market showing resilience: Unemployment rate likely to average 6.4% in 2022 and 2023 and fall to 6.3% in 2024

- Second-round effects and wage dynamics slowing inflation reductions: Average inflation to fall to 6.5% for 2023 and 3% for 2024.

- ECB to raise refinancing rate to 3.25% until spring 2023. Turnaround in monetary policy expected for 2024.

The deterioration in economic sentiment in Austria, which began with the outbreak of war in Ukraine, has now come to an end just before the end of the year. "At minus 2.9 points, the UniCredit Bank Austria Business Indicator reached the same level in November as in the previous month. The pace of the Austrian economic downturn has not increased any further. However, the indicator suggests a slight decline in GDP in the final quarter of 2022. At 0.2%, economic growth in the third quarter was already low compared to the previous quarter", says UniCredit Bank Austria Chief Economist Stefan Bruckbauer. This means that the Austrian economy is likely to have entered a minor recession. "The global environment has weakened significantly and is causing signs of a slowdown in the domestic industrial sector. After some delay, growth in the construction industry and the service sector is also likely to come to an end and they will follow the industrial sector into a recession", says Bruckbauer, adding: "We are expecting economic development to decline over the winter—albeit only slightly—and the latest data even raises our hopes that Austria could just escape a recession."

Weakness in industrial sector, but services holding up

The differing trends across individual sectors of the economy continued in November, and the global export environment deteriorated. While there were signs of improvement in Asia, the continuing decline in sentiment in the industrial sectors of Eastern Europe and some Western European countries weighted on the economic expectations for the domestic industrial sector. After sharp slumps in orders and increasing concerns about high energy prices and rising labour costs, sentiment among industrial businesses in Austria deteriorated once again and is now clearly in the pessimistic range. By contrast, despite a slight decline, the mood in construction remains good given the full order books.

"The UniCredit Bank Austria Business Indicator stabilised in November, but is lower than it has been for more than two years. The renewed deterioration in sentiment among industrial businesses owing to the unfavourable global environment was aggravated by the onset of economic slowdown in construction, but the slight easing of the situation in the services sector compensated for the downturn in the production sectors", says UniCredit Bank Austria Economist Walter Pudschedl, adding: "The economic forecast for all sectors of the economy in Austria, however, is worse than the eurozone average for the first time since 2005. Sentiment in Austria appears to be significantly worse than the actual situation, especially among consumers."

Weak start to 2023

Although the global economic slowdown and high inflation will continue to have a negative impact on development at the beginning of 2023, the cyclical consequences for the Austrian economy should remain manageable. The loss of purchasing power for domestic consumers will be limited by government measures to curb inflation, such as the electricity price cap, value adjustments to social benefits and changes in the tax on wages and income. Some service industries, such as tourism, could continue to benefit from pandemic-related catch-up effects. The outlook for the industrial sector, however, is much less favourable due to the high energy costs. In the difficult global environment, there will be considerable investor restraint. As a result, the slump in investment is therefore expected to weigh much more heavily on the Austrian economy in the first few months of 2023 than the development of consumer demand, which could produce a positive surprise and is likely to mitigate the recession.

Moderate recovery from the spring only gaining momentum slowly

"With inflation slowing, a recovery in the domestic economy should begin in spring, buoyed by the development in the eurozone. The pace of recovery will remain low, however, slowed by ongoing geopolitical uncertainties and inflation only falling gradually.

"Following economic growth of almost 5% in 2022, stagnation is all that can be expected for 2023 with a GDP increase of 0.3%, due to the weak start to the year. The rate of expansion will remain below average until 2024. The weak global recovery, the declining resilience of the labour market and the change in financing conditions, especially in residential construction, are slowing down. We are expecting economic growth of just 1.2% in 2024", says Pudschedl. Two consecutive years of below-trend growth will help rebalance aggregate demand and supply following the shocks caused by the pandemic and the conflict in Ukraine.

Labour market crisis-proof

The economic slowdown over the second half of the year has led to a slight increase in Austria's unemployment rate. The seasonally adjusted unemployment rate was 6.4% in November, having reached 6.2% over the summer. However, any further increase during the winter recession is likely to be manageable. This optimistic view is driven by the current tightness of the domestic labour market. The number of vacancies has remained consistent since the beginning of the year, at over 120,000. The number of unemployed people for every vacancy has fallen to a record low. On average, there are only two jobseekers for each vacant position.

Despite the mild recession over the winter and only a moderate pace of recovery until 2024, the Austrian labour market is expected to prove very resilient. Performance is being boosted by an abating increase in the labour supply, the trend towards a continuing decline in working hours and the labour hoarding of skilled workers by employers in order to have sufficient staffing for the upcoming recovery in times of labour shortages. "Following the drop in the unemployment rate to an average of 6.4% in 2022, we expect it to stabilise at 6.4% in 2023 and to decline slightly to 6.3% in 2024", says Pudschedl.

Inflation to slow only gradually in 2023

The upwards trend in inflation, which has been ongoing since the beginning of 2021, was interrupted for the first time in November with a slight drop to 10.6% due to easing crude oil prices. The electricity price cap should further curb inflation in December. Nevertheless, average annual inflation of 8.5% is to be expected in Austria for 2022. Following double-digit inflation at the start of the year, the continued easing of prices for energy resources should allow for a sustained slowdown in inflation, although this slowdown will only be gradual. Relatively high wage agreements, fiscal measures to support purchasing power and second-round effects of increased energy costs will also keep inflation high during the course of 2023.

"The situation is not expected to ease to any noticeable degree until the final third of 2023, when the prices of (energy) resources, decreasing supply disruptions and lower demand will have a dampening effect. That said, inflation is still expected to rise by up to 4% year on year by the end of 2023. Only by the second half of 2024 should inflation be at around 2%, putting it back within the central banks' target range", says Pudschedl. Average annual inflation in Austria is set to be 6.5% in 2023 and 3% in 2024.

Further tightening of monetary policy until spring 2023, but trend reversal expected in 2024

Following the rapid tightening of monetary policy in the second half of the year, which continued in December with a further rate hike, the European Central Bank is expected to tighten the reins of monetary policy even further next year. "We expect the refinancing rate in the eurozone and the deposit rate to peak in spring 2023, at 3.25% and 2.75% respectively. In addition, the ECB will continue its quantitative tightening over the next year by reducing the securities portfolio from the purchasing programmes", says Bruckbauer, adding: "However, a shift in European monetary policy is emerging for 2024, with the ECB changing course to an easing of the policy, due to lower inflation and weak economic conditions. We expect interest rates to fall by around 75 basis points over the course of 2024."

Enquiries

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Tel.: +43 (0)5 05 05-41957;

Email: walter.pudschedl@unicreditgroup.at