Safety first for online banking

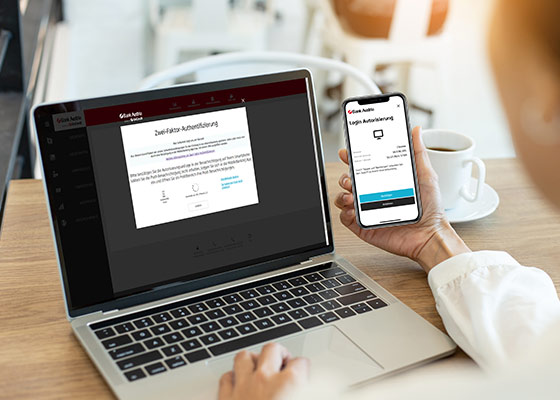

The two-factor-authentication procedure assures a safe online banking environment whenever a user logs into 24You or BusinessNet. This prevents unauthorized access to your account data and enhances security.

If you log in via your browser, you are asked to type in a TAN additionally to your PIN. When using the mobileTAN push method, you confirm the two-factor-authentication simply by clicking on the push message on your smartphone.

Banking made simple with the push message

The mobileTAN push procedure saves you time. By clicking the confirmation button in the MobileBanking app or BusinessNet app you save yourself the trouble of typing in the TAN code when logging into 24You or BusinessNet, enabling you to manage your financial transactions much more quickly.

Moreover, your TANs are sent directly to the app via an encrypted push message. The push messages can only be decrypted by the banking app. This makes it impossible for unauthorized persons to read or forward your MobileTAN push message.

Questions & answers

Two-factor-authentication is the combination of two different factors from the categories

- "knowledge" (something known only to the user, e.g. PIN),

- "possession" (something only the user has, e.g. TAN),

- "inherence" (something the user is, e.g. biometric data such as a fingerprint),

whereby a user authenticates himself/herself.

A login into online banking (24You or BusinessNet) has to be confirmed with a combination of two different security factors. The first is your PIN, the second is the received mobileTAN on a mobile device such as your smartphone, via the app.

Two-factor authentication offers greater security than single-factor-authentication. In addition, two-factor-authentication is a legal requirement of the European Commission, as set forth in the second Payment Services Directive (PSD2).

Login security can only be enhanced if two-factor-authentication is used for every online banking login and not just every 90 days.

When logging in for the first time and activating the MobileBanking app or BusinessNet app, the smartphone is linked to your user code. The second factor, for the subsequent login, is either your PIN or your biometric data.

- Logging into 24You or BusinessNet is simpler: one click, instead of typing in the TAN.

- Encrypted mobileTAN push messages are delivered to the app.

- MobileTAN push messages cannot be read by third-party apps.

- No dependence on a mobile network, e.g. when on holiday. WiFi is sufficient.

To install, open the official App Store, Play Store or AppGallery on your smartphone and enter Bank Austria MobileBanking app or Bank Austria BusinessNet app in the search bar. Alternatively, you can find the direct links to the relevant stores on the following pages: